More cyber reinsurance rate increases can be expected as reinsurers seek to regain underwriting profits in their cyber portfolios, according to a report published by S&P Global Ratings.

“Reinsurers had a difficult 2022 due to low profitability and even underwriting losses in their cyber portfolios,” said the report titled “Global Cyber Insurance: Reinsurance Remains Key to Growth.”

The gross combined ratio was 107 and the net combined ratio was 101 in 2022 for global reinsurance groups for the cyber business they reinsured, the report added, noting that cyber reinsurers’ gross and net combined (loss and expense) ratios underperformed primary insurers on average.

However, S&P said it’s important that primary cyber insurers can absorb reinsurance rate increases without passing them on to policyholders. “This may be vital in the development of a sustainable cyber insurance market.”

Cyber Re/insurance Market Growth

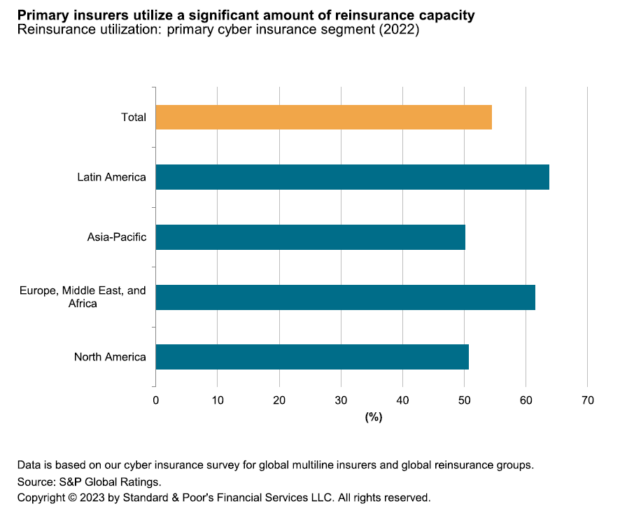

To highlight the importance of reinsurers to the cyber insurance market, S&P pointed to the fact that, in 2022, primary insurers ceded about 50-65 percent of cyber insurance premiums to reinsurers (depending on the region). See related chart.

“As the cyber insurance market develops, the cyber reinsurance market will mature as well. Despite larger reinsurers signaling that they are close to capacity, we see other reinsurers exploring opportunities to increase their exposure to cyber risk. This would help the market expand responsibly, with a diverse range of reinsurers.”

S&P said that cyber insurance is still the fastest-growing subsector of the global insurance market with cyber insurance premiums reaching about $12 billion in 2022. On annual premium growth of 25-30 percent, S&P expects the cyber market to reach about $23 billion by 2025.

About 56 percent of gross premiums written in affirmative cyber insurance — which explicitly covers cyber risk — are generated in North America, while 37 percent are generated in Europe, the Middle East and Africa. Asia-Pacific accounts for 6 percent of the cyber GPW and 1 percent of GPW come from Latin America, S&P said.

Primary cyber insurance rate increases have decelerated recently, with the average increase in cyber insurance premiums falling below 10 percent in the first quarter of this year for the first time in 10 quarters, said S&P, quoting statistics from the Council of Insurance Agents and Brokers. The increase was 15 percent in the fourth quarter of 2022 and just 3.6 percent in the second quarter of 2023 – down from a peak of 34.3 percent in the fourth quarter of 2021, S&P added.

The report attributed the decline in premiums to increased competition as more primary carriers have begun to offer cyber insurance as well as the measures that insurers have taken over the past two years to cut exposures and increase rates, which have helped them improve their risk-return profiles.

“Insurers have also adjusted contract terms and conditions; increased retention levels, meaning policyholders retain more risk; and reduced coverage for specific types of loss, especially in relation to ransomware and business interruption coverage,” the report explained. “Those changes partly stem from the significant number of insurers whose loss ratios increased sharply, mainly due to larger and more frequent ransomware-related claims in 2020 and 2021.”

S&P said these measures have paid off as the global cyber insurance market has recently return to profitability. “In 2022, the gross combined ratios of global insurers in the primary insurance segment improved to 64-87 percent, depending on the region, indicating solid underlying technical profitability,” the report confirmed.

“An unfortunate side effect of the price increases and tightening of terms and conditions over the past two years is the perception of cyber insurance being unaffordable, especially for small-to-midsize enterprises. That, in turn, has led some companies and government entities to eschew cyber coverage altogether. This course of action offers upfront cost savings, but it could also make recovering from a cyber attack more difficult.”

This is why, the report indicated, it’s important in the market’s development for primary cyber insurance underwriters to absorb reinsurance rate increases without passing them on to policyholders.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers