Munich Re still holds the top spot on AM Best’s annual ranking of global reinsurance groups but Hannover Re took the No. 2 position in a ranking based solely on non-life reinsurance premium volume.

To take the second-place ranking, Hannover Re pushed Swiss Re down to the No. 3 spot, with Hannover Re’s growth in non-life gross premiums coming in at nearly 19 percent.

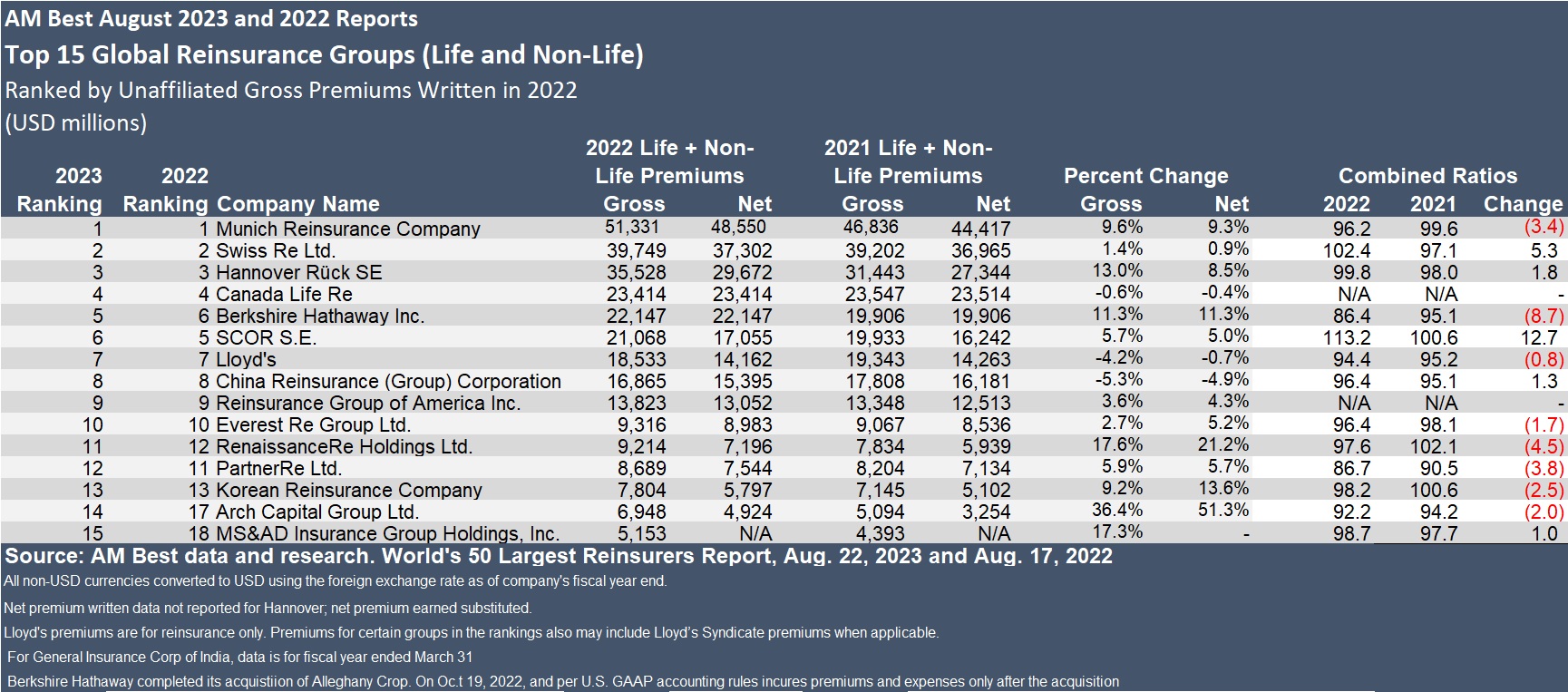

AM Best annually publishes a list of the top 50 global reinsurers based on prior-year premiums for life and non-life reinsurance, and a separate list of the 15 biggest based on prior-year non-life reinsurance premiums alone.

Munich Re held onto the top spot on both lists, with Swiss Re still coming in as the second-largest global writer of both life and non-life reinsurance premiums. The Munich Re-Swiss Re duo has held those same positions for three years in a row. (AM Best’s 2020 report, based on 2019 premiums, showed the positions of Munich Re and Swiss Re reversed.)

Focusing on trends in global non-life reinsurance groups, AM Best noted that beyond Hannover Re’s upward move, most of the other changes in non-life rankings were seen in companies now ranked between No. 11 and No. 15 on the non-life list. For example, Arch Capital rose from No. 15 to No. 11, displacing Korean Re, which fell slightly from No. 11 to No. 12.

“Two companies included in last year’s top 15 fell off the list this year: AXA XL, which pulled back from property-catastrophe reinsurance, and Transatlantic Holdings Inc., which was consolidated into Berkshire Hathaway,” according to the ratings agency.

New entrants to the top 15 non-life list include Odyssey Group, ranked at No. 15, and Sompo International, ranked at No. 14.

Overall Ranking: Non-Life and Life Combined

Overall, combining non-life and life reinsurance premiums, total gross reinsurance premiums written by the top 50 groups increased by 2.6 percent to $363.6 billion in 2022, from $354.4 billion in 2021. AM Best explained that premium growth for many reinsurers was primarily driven by strong rate increases, rather than exposure growth.

“Nevertheless, global investment market turmoil and more frequent and severe global catastrophe losses, compounded by severe secondary peril losses, resulted in many reinsurers failing to meet their cost of capital in recent years,” according to the report titled “World’s 50 Largest Reinsurers.”

Related: Not Your Grandpa’s Hard Reinsurance Market; Profits Return, Discipline Stays

Munich Re and Swiss Re accounted for one-quarter of the top 50 reinsurance gross premiums written in 2022, up from 24.3 percent in 2021, which AM Best said is particularly notable given the euro’s depreciation. An excerpt of AM Best’s full ranking, showing the top 15 of the 50 groups, based on non-life and life premiums combined, is presented below.

The No. 3 and 4 spots in the ranking—Hannover Re and Canada Life Re, respectively—were unchanged from their positions from 2021, while Berkshire Hathaway moved up one spot to fifth place—driven partially by its acquisition of Alleghany Corp.—which pushed SCOR down to sixth place. The four largest reinsurers at year-end 2022 were ranked the same as in 2021.

Ranked at No. 7 on the list, Lloyd’s saw a small premium decline, although it was mainly driven by the 10.1 percent depreciation of the pound against the US dollar. At constant exchange rates for the current and prior year, GPW grew approximately 7.2 percent, AM Best explained. (Lloyd’s is No. 4 on the list of non-life reinsurance groups.)

“The 10 largest reinsurers on the list accounted for 69.4 percent of total reinsurance GPW, up from 67.9 percent at year-end 2021, and slightly higher than the 68.5 percent at year-end 2020,” the report continued. “Despite this concentration, the global reinsurance market remains highly competitive.”

Rankings Below Top 10

AM Best noted that there was significant movement in the rankings below the top 10, which was “driven primarily by shifts in reinsurance portfolios’ mix, as companies sought to reduce operating performance volatility and balance sheet vulnerability or increase their exposures to certain lines as rates became increasingly attractive.”

The companies with two of the biggest ranking improvements—Odyssey Group Holdings and Allied World Assurance Co. Holdings—have the same parent company: Fairfax Financial Holdings. Odyssey rose from No. 27 at year-end 2021 to No. 20 in 2022, while Allied World rose from No. 44 to No. 39.

“Odyssey’s GPW grew 30.9 percent, driven largely by its P/C lines of business in the U.S., which benefited from new business, expanded relationships with existing clients, and improved pricing,” AM Best continued. Between year-end 2021 and year-end 2022, Allied World’s GPW grew 24.3 percent, “benefiting from the hard reinsurance market and improved terms and conditions.”

Multiple reinsurers had smaller but still notable movements in the rankings. For example, Tokio Marine rose from No. 38 to No. 34, with GPW increasing 11.6 percent—a number that was dampened by the 8.0 percent depreciation of the Japanese yen against the U.S. dollar. However, when using foreign exchange rates consistent with year-end 2021, AM Best said, Tokio Marine’s non-life GPW rose 21.5 percent year-on-year.

AM Best said five companies moved up three positions.

- Arch rose from No. 17 to No. 14, driven by 36.4 percent growth in non-life GPW.

- MS&AD moved from No. 18 to No. 15, driven by 17.3 percent growth in non-life GPW (despite being dampened by the 8.0% depreciation of the yen).

- Sompo International Holdings moved from No. 20 to No. 17, driven by 6.9 percent GPW growth.

- MAPFRE Re moved from No. 21 to No. 18 on 3.5 percent premium growth.

- Finally, Assicurazioni Generali rose from No. 22 to No. 19 on 4.1 percent premium growth.

Currency exchange rate fluctuations have a meaningful impact on companies’ rankings, said AM Best. Those currencies with the greatest dampening effect on global reinsurers’ premium volume in 2022 were the Japanese yen, which depreciated by 8.1 percent against the U.S. dollar; South Korea’s won, which depreciated by 6.2 percent; the euro (5.7 percent); and the Canadian dollar (5.6 percent).

Cutting Property-Cat Exposure

Bermuda-based Fidelis, which was a new entrant in 2021, dropped out of the top 50 ranking as the company is working to cut its property-catastrophe exposure. “Fidelis had significant property-catastrophe losses in both 2021 and 2022, with a combined ratio over 110 in both years.”

AXA XL, which also has pulled back from property-catastrophe reinsurance as it looks to minimize volatility in its business, has dropped from No. 16 to No. 21 in the rankings, AM Best said.

Notable Changes, New Entries

Looking forward, AM Best expects “Renaissance Re will have a notable ranking change once its acquisition of Validus from AIG is completed.” In combination, the two entities had gross life and non-life premiums written of $12.3 billion at year-end 2022, which would be ranked No. 10.

AM Best said two new reinsurers entered the top 50 list this year— Convex Group and Core Specialty Insurance Holdings, ranked at No. 40 and No. 44, respectively.

Convex, the Bermuda-based specialty insurer and reinsurer, was founded in 2019, while Core Specialty, the newly recapitalized carve-out of StarStone, was launched in December 2020, “following extensive expansion of equity funding and new executive hires.”

A version of this article was published on Insurance Journal. Reporter L.S. Howard is the International and Reinsurance Editor of Carrier Management and Insurance Journal. Susanne Sclafane, Executive Editor, Carrier Management, contributed to the article.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance