The current property-catastrophe reinsurance market is one of the hardest in decades—and very different from previous ones, a new AM Best report notes, also predicting that underwriting discipline will last longer than in prior cycles.

Past hard cycles, triggered when a major catastrophic event would erode a significant amount of industry capital, led to a rapid spikes in rates and new startup formations.

In the current hard market, the path to adequate prices has taken longer than expected, said the report, explaining that “the last six years have seen a slow, protracted process of reinsurers realigning their risk profiles, reallocating capital, reunderwriting and repricing,” AM Best said.

“After several years of disappointing financial results, reinsurers have become much more cautious about deploying their capital. A prudent approach is likely to preserve underwriting discipline for a longer period than in previous cycles,” the report said.

Profits Return

Despite extremely challenging conditions, with persistent and elevated claims activity, the global reinsurance segment returned an underwriting profit in 2022, according to the AM Best report.

“Reinsurers generally have realigned their risk profiles and are in a strong position to generate the underwriting profits that had been elusive for a number of years,” said the report titled “Global Reinsurers Face Challenges Even as Conditions Improve.”

These positive financial trends are continuing for 2023, with the four main European reinsurers, Hannover Re, Munich Re, SCOR and Swiss Re, all reporting very strong results with returns on capital significantly surpassing their cost of capital, said a separate report published by Fitch Ratings. “Price increases above claims inflation and better terms and conditions for property & casualty (P/C) have led to better underwriting margins on average.”

Profits improved significantly during the first half of 2023, “thanks to better pricing, lower claims, more favorable terms and conditions and a rise in investment yields,” said Robert Mazzuoli, Director, Fitch Ratings, in the report, titled “European Reinsurers: 1H23 Results.”

Recovery Underway

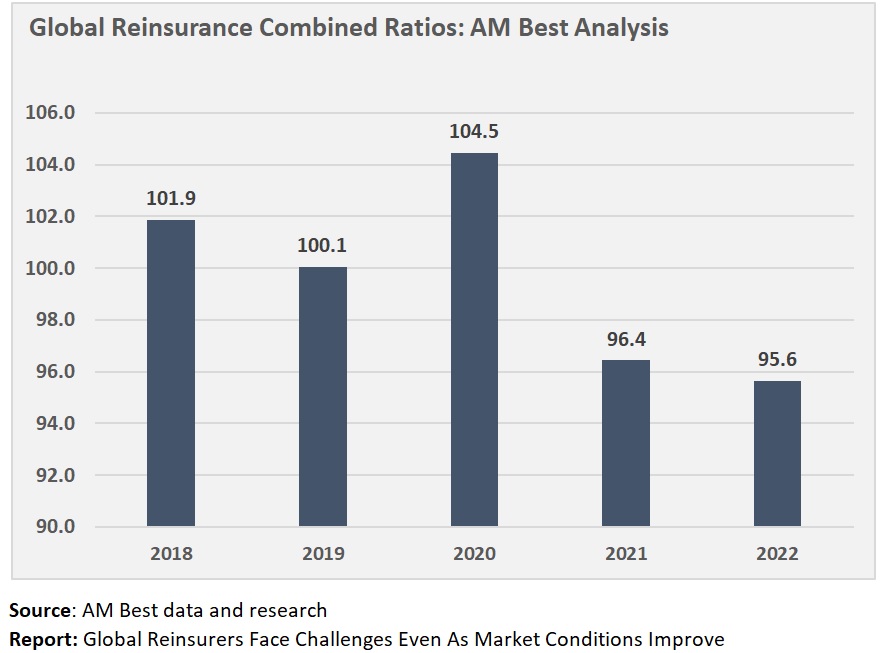

Reinsurers’ profitability started to improve and stabilize in 2021, the year that marked the start of the recovery, said AM Best. In 2022, however, higher natural catastrophe claims and concerns about inflation triggered sizable reserve strengthening by some key reinsurers. Nevertheless, AM Best’s global reinsurance composite posted a combined ratio of 95.6 in 2022, a 0.8 percentage point improvement over 2021. (Combined ratios below 100 indicate an underwriting profit).

At the same time, investment results in 2022 were severely affected by unrealized losses on fixed-income securities, which led the sector to post a return on equity of 0.8 percent in 2022, down significantly from a 9.0 percent ROE reported during 2021.

“Despite a much more cautious approach to underwriting, 2022 technical results, albeit mostly positive, were under pressure due to the unexpected severity and geographical spread of major weather events—Hurricane Ian, European winter storms, and other secondary perils such as severe convective storms in the U.S., hailstorms in France, and floods in Australia,” AM Best added.

Sharp Rise in Profits in 2023

Reinsurers’ profits continued their upward trajectory during the first half of 2023 as better underwriting results in P/C and life as well as significantly higher investment results have led “to a sharp rise in profits…,” according to Fitch, referring to the H1 2023 results of the four main European reinsurers.

The reported ROE in H1 2023 rose by 12.4 percentage points from H1 2022, Fitch continued. “The return on capital surpassed the cost of capital, which is 8-10 percent at all four major reinsurers.”

All four reinsurers reported stable or higher returns on investments in H1 2023 compared to H1 2022, “as (un)realized investment losses weighed less on results and recurring investment income improved thanks to higher interest rates,” Fitch said.

Fitch noted that premium rate increases and rising investment income will continue to support earnings growth during the second half into 2024, “as investment returns increasingly benefit from higher reinvestment yields.”

Following the much harder market conditions seen since the start of 2023, AM Best affirmed that interest in property-catastrophe risks has renewed cautiously, albeit with much tighter terms and conditions.

Shifting Capital

Best noted that after several years of disappointing results, reinsurers have been under pressure to generate returns that cover their cost of capital, leading companies to shift their capital from property-catastrophe risks.

AM Best said this shift has been accomplished by either moving up in the protection tower from the lower and medium layers property catastrophe risks, by tightening terms and conditions, or diversifying into lines seen to be more stable or profitable such as casualty and specialty lines and excess and surplus primary segments. The ratings agency noted that reinsurers’ work to realign their risk profiles “have largely transferred the burden of a heavy cat loss to primary writers.”

Fitch concurred that cedents have had to substantially increase their retentions and accept both reduced limits and increased attachment points. “Reinsurers largely reduced the offering of aggregate covers for high frequency natural catastrophe claims, returning to largely providing capital protection, with earnings volatility moving back to primary insurers.”

AM Best Senior Director Carlos Wong-Fupuy highlighted the distinction between “available” and “deployed” capital. “Available capital is not under pressure; however, the well-established global reinsurers have become much more cautious allocating their capital, which pressures the deployment of capacity,” he said in a statement.

Speaking on a video presentation accompanying the report, Wong-Fupuy noted that reinsurers are under very strong pressure to improve ROEs to meet their cost of capital. “When we think of the situation between 2017 and 2021, we’ve estimated ROE’s around 4.5 or 5 percent at a time of low interest rates when the cost of capital was being estimated almost twice as much.” Combined ratios and returns have improved but the cost of capital has increased as well, he noted. “It’s not rare to see companies actually targeting ROEs in excess of 15 percent to try to meet their cost of capital because risk-free interest rates have gone up, the risk premium that investors attribute to the reinsurance segment is going up given the volatility” of results.

“Inflation expectations are also an important factor to put into the equation,” he said.

AM Best is maintaining its stable outlook for the global reinsurance sector, reflecting a balance of positive and negative factors impacting reinsurers. “Results have been improving. The market, despite the unrealized investment losses that we saw last year, we think remains well capitalized. But there are a number of challenges as well [and] many companies are still playing catch up,” said Wong-Dupuy.

“You are producing good results after four or five years of sustained losses. Companies are still very cautious on how they deploy the capital,” he said.

A version of this article was published by Insurance Journal under the title, “Conditions Are Challenging, Claims Are Elevated, but Reinsurers’ Profits Return: Reports.” Reporter L.S. Howard is the Reinsurance and International Editor of Insurance Journal.

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  The Future of HR Is AI

The Future of HR Is AI  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits