Though insurers do a good job attracting new customers shopping for policies via their digital channels, they fall short when it comes to servicing existing customers, a new industry report shows.

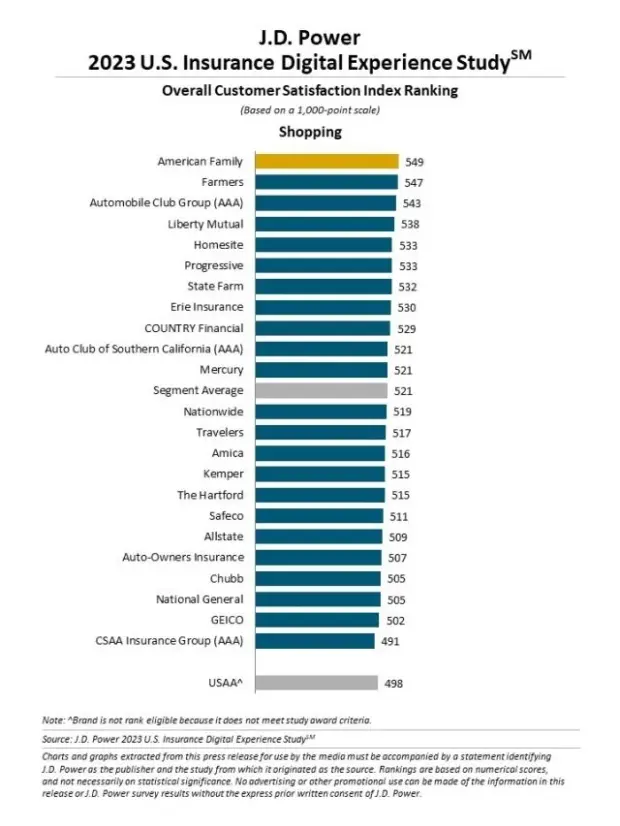

Overall satisfaction with the P/C shopping experience is up 22 points — to just 521 (based on a 1,000-point scale).

Relative to customer satisfaction scores with digital shopping tools in other industries, such as banking and airlines, the insurance industry still has a long way to go, the 2023 U.S. Insurance Digital Experience Study by JD Power and Corporate Insight found.

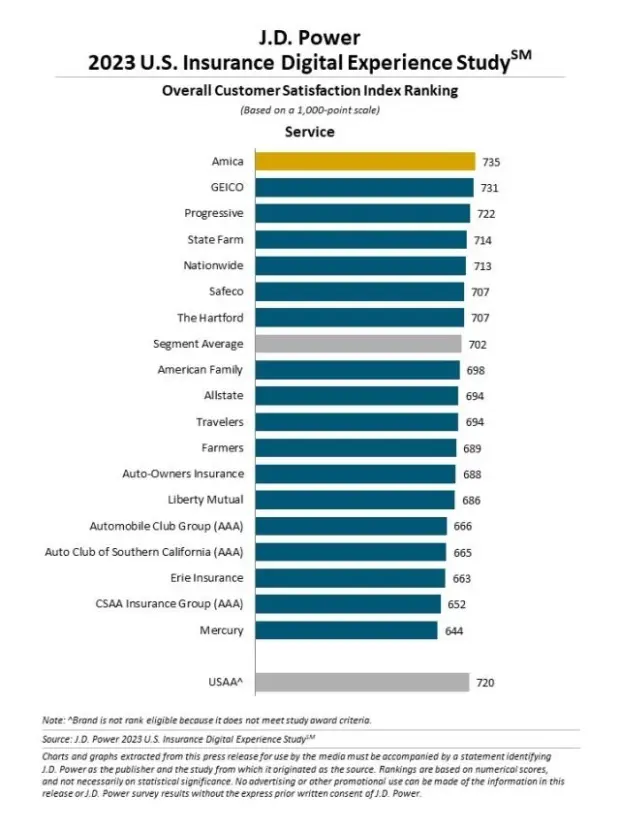

Overall satisfaction with the digital service experience is higher at 702 — down 3 points from last year — with customers being unable to find the information they need being the biggest complaint. Satisfaction scores are lowest (698) when customers must call the insurer because they could not find information on an insurer’s website or app, which happens 42 percent of the time.

In account servicing, the study finds significant gaps in mobile app performance. The average satisfaction score among the top-performing 25 percent of customers using a mobile app is 872 — substantially higher than any other channel. Satisfaction among the bottom 25 percent of customers using a mobile app declines 305 points to 567.

The results reveal big gaps in mobile apple performance and that traditional carriers are still beating out InsurTechs on digital advice and shopping.

Though InsurTechs outperform on the research policy information metric, traditional carriers perform as well or better on all other key factors. Traditional insurers perform particularly well on ability to make digital payments, ability to locate contact information and ability to make profile updates.

The annual report evaluates the digital consumer experiences of both P/C insurance shoppers seeking quotes and existing customers conducting typical policy-servicing activities and examines desktop, mobile web, and mobile apps functionality based on ease of navigation, speed, visual appeal and information/content.

The study was conducted in collaboration with Corporate Insight, a provider of competitive intelligence and user experience research to the financial services and healthcare industries.

The customer churn seen right now is at a historic level, according to Stephen Crewdson, senior director, insurance business intelligence at J.D. Power.

“This puts a spotlight on the critical role insurer digital channels play in not just attracting new customers but also onboarding them, and in retaining existing customers,” he added. “When it comes to shopping, insurers are starting to get the formula right, but they are still lagging far behind the best-in-class offerings in other industries like banking and airlines when it comes to servicing existing customers. That needs to become a focal point if insurers really want to build lifetime customer value.”

Insurer Rankings

Amica ranked highest in the service segment with a score of 735, followed by GEICO (731) and Progressive (722).

American Family ranked highest in the shopping segment with a score of 549, followed by Farmers (547) and Automobile Club Group (AAA) (543).

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford