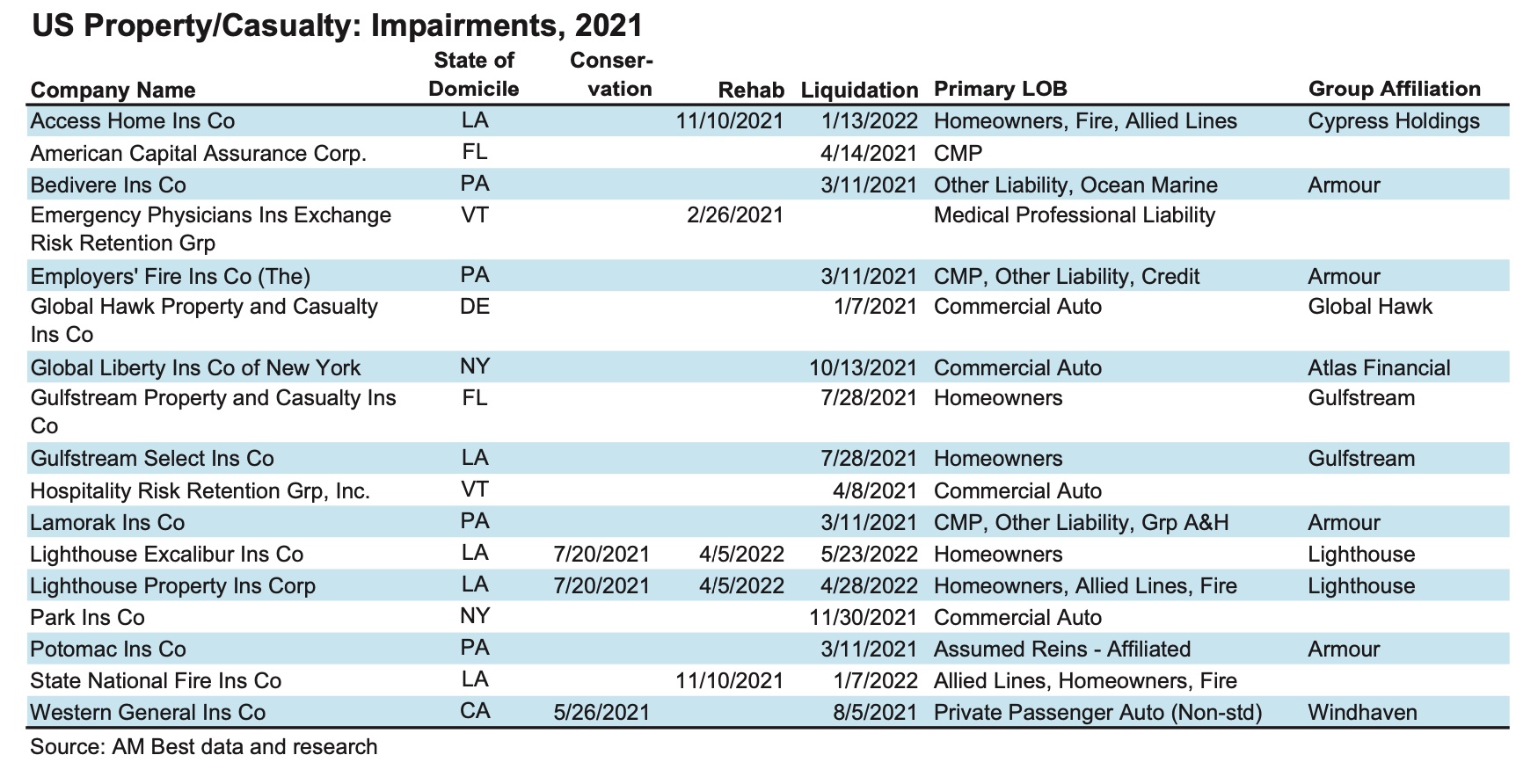

Seventeen U.S. property/casualty insurance companies became impaired in 2021, with seven of the impairments driven by catastrophe losses from hurricanes, primarily in Louisiana and Florida, according to an AM Best report.

In addition to the five Louisiana-domiciled companies and two Florida-domiciled insurers, impairments identified in 2021 included four commercial auto insurers and a pair of Vermont-domiciled risk retention groups, said the Best’s Special Report, titled “2021 US Property/Casualty Impairments Update.”

“Specific causes have been identified for some of the impairments, with most falling into the category of general business failure, arising out of some combination of poor strategic direction, weak operations, internal control weaknesses, or underpricing and underreserving of the business. The most relevant aspect of these impairments may be the products these companies offered and the products’ potential risks,” AM Best explained.

Impairments in 2021

Diving into highlights of the 2021 impairments, AM Best said two Vermont-domiciled risk retention groups (RRG) were among those impaired companies. One RRG had provided medical professional liability insurance to emergency physicians in 25 states that experienced a surge in high severity claims. A second RRG provided commercial automobile insurance to franchisees of Domino’s Pizza and was declared insolvent when it became apparent there was a sufficiently high degree of uncertainty that the company would be able to continue with a solvent runoff, the ratings agency said.

In addition, two New York commercial auto insurers became impaired in 2021. One of these insurers experienced volatile results following a change in ownership in 2015. A second auto insurer had been monitored by regulators, which had been seeking an order to place it into liquidation in 2017, but the regulatory action took years because the company attempted to conceal its insolvency, AM Best revealed.

Another impaired commercial auto insurer was affiliated with an impaired RRG in 2020 (caused by alleged fraud), said AM Best, noting that the regulator in March 2020 uncovered several areas of considerable concern about the company’s operations and financial viability because management’s conduct had placed the company in a condition that rendered further insurance transactions hazardous to its policyholders.

AM Best also cited the case of an impaired non-standard automobile insurer that had settled two large claims for amounts well in excess of policy limits, which resulted in significant adverse reserve development. “Following continued deterioration and efforts to seek a buyer for the company or its book of business with no acceptable proposal received, the regulator deemed the company to be operating in a hazardous financial condition,” the ratings agency said.

Of the 17 impaired insurers in 2021, 16 were placed into insolvent liquidation, the AM Best report said.

Impairment Trends 2000-2021

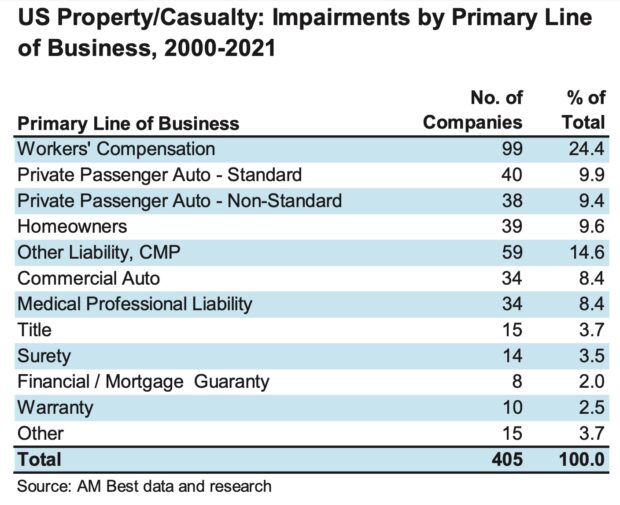

In addition to identifying impairments that occurred in 2021, this report also provides data for the period 2000 to 2021.

From 2000 to 2021, 413 property/casualty insurers became impaired. The leading line of business was workers compensation, which accounted for 24 percent of the impairments, said AM Best, adding that personal lines insurers accounted for 29 percent—split between private passenger auto (19 percent) and homeowners (10 percent).

Private passenger auto can be further broken down between standard (10 percent) and non-standard auto insurers (9 percent).

Commercial lines insurers accounted for 23 percent of impairments, split between other liability/commercial multi-peril (15 percent) and commercial auto (8 percent). The remaining 24 percent was split among specialty lines, AM Best noted.

“We identified specific causes for 104 of the impairments. Catastrophe losses were the leading cause of 28 impairments, while 25 were related primarily to fraud or alleged fraud,” the ratings agency said.

“Affiliate problems caused 22 impairments, while 16 companies became impaired after experiencing rapid growth. Investment losses were a significant factor in 11 impairments. One insurer became impaired because of reinsurance failure; another company was placed into liquidation after marketing warranty insurance products without a license.”

Source: AM Best

Photograph: Lyndell Scott walks past the debris of his gutted home in the aftermath of Hurricane Ida in LaPlace, La., Sept. 10, 2021. (AP Photo/Gerald Herbert)

Six Forces That Will Reshape Insurance in 2026

Six Forces That Will Reshape Insurance in 2026  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Preparing for an AI Native Future

Preparing for an AI Native Future