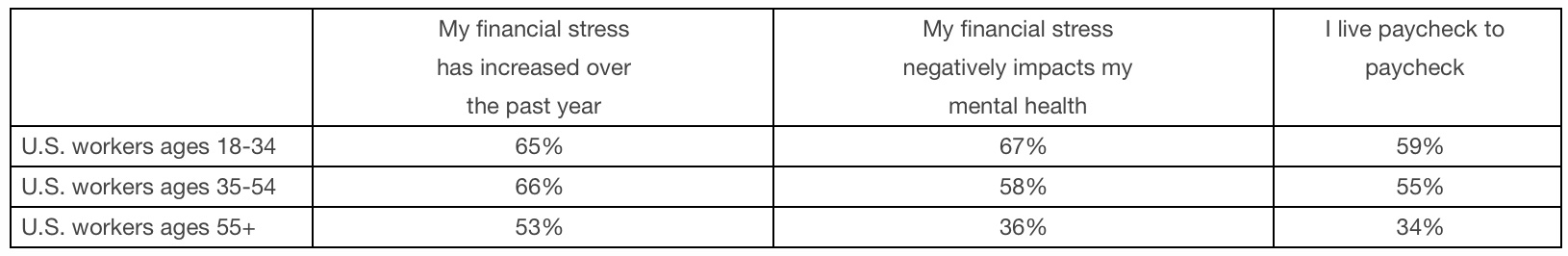

New research by The Hartford finds 63 percent of U.S. workers feel their financial stress has increased over the past year, and 56 percent say their financial stress negatively impacts their mental health.

Younger workers, who are more likely to live paycheck to paycheck, are also more likely to be impacted by financial stress, The Hartford’s latest Future of Benefits Pulse Survey found.

Source: The Hartford’s Future of Benefits Pulse Survey

“The rising rate of financial stress along with its negative effect on employee mental health is a warning for employers of all sizes,” said Laura Marzi, benefits expert and head of marketing for Group Benefits at The Hartford, in a statement. “We know many employers offer benefits and tools to help address the physical, financial and mental health of their workforce. Employers who take notice of this trend and make these benefits easier to understand and more accessible will benefit from employees who are healthier, happier and more productive.”

Key findings:

- More than half of workers ages 18-34 (53 percent) say they wish their employer could help with financial coaching, compared with 38 percent of those ages 35-54 and 14 percent of those ages 55+.

- Many U.S. workers are not prepared financially for an emergency, with 39 percent of respondents reporting they have less than $1,000 in savings or no savings at all. Among those with little or no savings, women are more likely than men to have no savings or less than $500 (42 percent vs. 20 percent).

- Despite lack of emergency funds, 49 percent of respondents said savings is the No. 1 resource they will rely on to make ends meet if they experience an injury or illness that prevents them from working for 12 weeks or more, followed by short-term disability insurance (31 percent). Fourteen percent of workers would not be able to make ends meet if they were out of work for 12 weeks or more.

- Most U.S. workers (81 percent) are taking steps to prepare for a possible recession: cutting back on day-to-day expenses (40 percent); paying off debt (30 percent); increasing contributions to savings and/or investment accounts (23 percent); looking for a higher-paying job (19 percent); getting a second job to increase their household income (17 percent).

Methodology: A national omnibus online survey was conducted in the U.S. among approximately 900 full-time and part-time employed adults aged 18+. The research was conducted Nov. 14-15, 2022. The margin of error is +/- 3 percent at a 95 percent confidence level.

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers