U.S. and Bermuda reinsurers reported strong operating performance for the first six months of 2022, supported by continued pricing increases in most reinsurance and specialty lines of business as well as tighter terms and conditions and low catastrophe losses, according to a report published by Moody’s Investors Service.

Gross premiums written for the group increased more than 10 percent during the first half of the year compared to the same period last year, reflecting primarily higher premium rates and rising exposures in certain business segments, said the Moody’s report, titled “Rising prices, low catastrophes boost operating returns for first half of 2022.”

Despite improved rates and strong demand for property-catastrophe reinsurance, some reinsurers continued to reduce their natural catastrophe exposures during the second quarter “as management teams focus on improving bottom-line results and reducing earnings volatility,” the report said, noting that they are choosing instead to increase their writings in casualty, specialty and other (non-catastrophe) property lines.

“The Florida market saw a particularly difficult June 1 renewal season, with reinsurers generally holding the line on increased exposures while improving underlying margins based on strong pricing conditions. Smaller domestic Florida cedents had the most difficulty in securing reinsurance coverage,” according to Moody’s.

Reinsurers’ management teams took different approaches to property-catastrophe writings during the quarter, with companies such as Arch and PartnerRe reporting healthy growth in property lines, while others such as Everest Re and Alleghany chose to reduce their property-catastrophe exposures, Moody’s explained.

In June 2022, AXIS announced it planned to exit the property-catastrophe market and focus its reinsurance business on specialty lines. In July, French insurer Covéa completed its acquisition of PartnerRe, which Moody’s said will likely benefit from being part of a larger insurance organization. Covéa has substantial capital resources that could help “alleviate capital strain in the event of large catastrophe losses or to help finance profitable growth opportunities.”

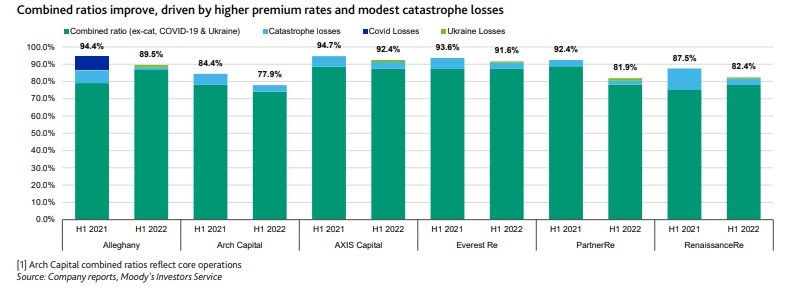

The cohort of U.S. and Bermuda reinsurers analyzed by Moody’s—Alleghany, Arch, AXIS, Everest Re, PartnerRe and RenaissanceRe—all saw strong underwriting results during the first six months of 2022. Arch reported the lowest combined ratio for the first half of 2022, at 78, driven by strong performance in the company’s mortgage book. (A combined ratio below 100 indicates an underwriting profit).

A relatively low level of catastrophe losses during the first half of 2022 also helped reinsurers’ earnings, with catastrophes contributing less than four percentage points to the six-month loss ratio for the cohort of companies analyzed by Moody’s. This reflected reduced worldwide insured natural catastrophe losses of $35 billion during the first half of 2022, according to Swiss Re, compared to $46 billion during the same period in 2021.

Pricing to Stay Favorable

Until the 2022 Atlantic hurricane season runs its course, Moody’s said, it is too soon to determine whether reinsurers will post strong profits for the full year 2022.

“Given inflationary pressures, particularly in rebuilding costs as well as higher frequency and severity of catastrophes, we expect pricing momentum to continue through the January 2023 renewal season,” the report continued.

“Despite the favorable pricing conditions, the sector remains exposed to potentially large catastrophe events, rising loss costs as a result of economic and social inflationary trends, and uncertainty with regard to exposures related to the ongoing military conflict in Ukraine.”

War in Ukraine

The military conflict in Ukraine contributed to modest losses to the cohort during the first half of 2022, representing $50 million in losses for PartnerRe, $45 million for Everest, $44 million for Alleghany, $30 million for AXIS and $25 million for RenRe, Moody’s said.

Arch reported 2.1 points in current-year catastrophe losses in its insurance segment during the first six months of 2022, mostly from the military conflict in Ukraine and natural catastrophes. It also reported 7.0 points of current year catastrophe losses in its reinsurance segment during the same period, a portion of which were Ukraine-related losses.

Investment Losses

Rising interest rates combined with equity market volatility during the first half led most companies to report significant realized and unrealized losses on investments, Moody’s said.

The reinsurance cohort analyzed by Moody’s reported a 12.6 percent decline in shareholders’ equity driven by volatile investment valuations.

“Although investment portfolios are likely to experience valuation volatility in coming months, with the exception of an outsized catastrophe loss event(s) requiring very large claims payouts, we expect U.S. and Bermuda reinsurers to recover most of their unrealized fixed income investment losses over time, given the relatively short duration of their portfolios and their ability to hold bonds to maturity,” the ratings agency said.

Depending on the type of coverage, reinsurers’ claims payouts may take 12-18 months and sometimes longer, which “helps cushion the sector from an accelerated drawdown on their fixed income portfolios.”

The strong underwriting performance during the first half of 2022 led to improved operating returns on equity, which ranged from 11 percent to 16 percent for the cohort, said the ratings agency.

Source: Moody’s Investors Service

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes