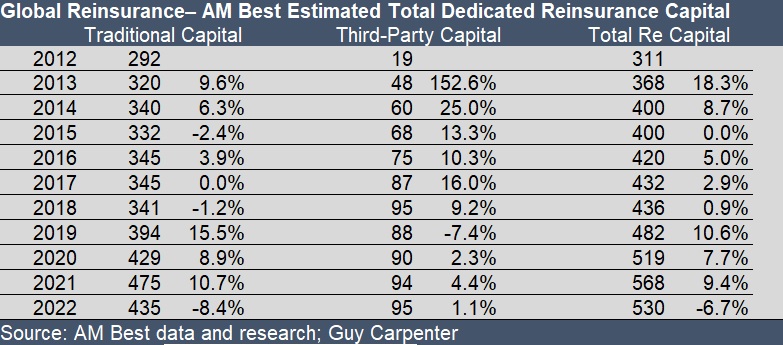

AM Best estimates that traditional reinsurance capital will drop by roughly $40 billion to $435 billion at year-end 2022, after hefty jumps recorded in each of the prior three years.

The projected 8.4 percent decline to $435 billion for 2022 from $475 billion in 2021, following increases of 15.5 percent for 2019, 8.9 percent for 2020 and 10.7 percent in 2021, takes into account both the tailwinds of the underwriting market and the headwinds of the capital and investment markets.

To come up with the 2022 forecast, AM Best is also considering continued geopolitical turmoil and a potential decline in global GDP, the rating agency said in a report published on Monday morning, “Dedicated Reinsurance Capital Growth of 2021 May Not Continue.”

“With interest rates on the rise and equity markets declining, we do anticipate a rather substantial mark-to-market loss in traditional reinsurance capital levels,” Dan Hofmeister, senior financial analyst, AM Best, said in a video accompanying the report on the AM Best website. Working in the opposite direction, reinsurance capital has been boosted by underwriting results in spite of heightened cat loss activity in the first half of the year, he said.

As hurricane season plays out, however, “if we do see a reversal in these underwriting trends, it could prove to be very problematic for the industry’s capital levels,” Hofmeister said.

While the report notes that many reinsurers substantially decreased property exposure through the last renewal cycle, some are still exposed to material amounts of multiyear reinsurance contracts. Those reinsurers that did not manage risk exposures prudently could be exposed to material capital deterioration, AM Best said, referring to a double-whammy of underwriting losses and adverse investment market returns in 2022.

Overall, elevated catastrophe losses have been characterized as “earnings events” rather than capital depleting ones in recent years, the report says, noting that many reinsurers’ underwriting returns have been close to breakeven but that capital grew through investment gains and the ability to access affordable debt financing.

The AM Best report also includes a decade-long record of third-party reinsurance capital levels and a projection that third-party capital overall will stay steady at about $95 billion for 2022 compared to $94 billion in 2021.

Even though the downturn in the U.S. equity market has presented capital supply challenges for some insurance-linked securities funds, AM Best says the pullback of traditional reinsurance in catastrophe-exposed markets such as Florida may be creating opportunities for ILS funds. Where traditional capacity is lacking, ILS funds can take advantage of significant price increases and tighter terms and conditions, the report says.

In addition, Best is seeing signs of a growing market for non-catastrophe ILS deals even though casualty-focused ILS investments carry the prospect of greater correlation with broader financial markets—a drawback for investors seeking diversification. One factor helping to attract investors is relatively lower volatility of casualty ILS when compared to natural catastrophe deals, the report says, also noting that AM Best is aware of casualty deals that have addressed investor concerns about the “liquidity lockup of longer-tail business” (although the report does not say specifically how these concerns have been mitigated).

Putting traditional and third-party capital together, AM Best is estimating a 6.7 percent drop in reinsurance capital from both sources—the first drop in a decade of figures compiled by the rating agency.

Estimating Dedicated Reinsurance Capital

AM Best works in conjunction with Guy Carpenter to estimate the total amount of capital supporting the reinsurance industry. AM Best determines traditional reinsurance capital; Guy Carpenter determines third-party capital.

The report notes that pure reinsurers with a global reach are rare, necessitating an “incisive analysis” on AM Best’s part to present an accurate picture of capital backing the reinsurance market. Global reinsurers are typically also engaged in businesses such as specialty insurance and large commercial, for example.

AM Best’s estimate of traditional reinsurance capacity takes into account the allocations by business classification. “Since year-end 2018, our estimate has been less than 60 percent of total shareholders’ equity of the consolidated figures for groups identifying as reinsurance writers,” The report says.

The 2022 estimates incorporates the assumption the more capital will be directed toward primary insurance operations of larger groups than had proportionally been allocated in prior years.

A Bit of History

The report explained the 10.7 percent jump in traditional reinsurance capital in 2021 highlighting substantially improved underwriting returns and strong equity market growth fueling the increase in shareholders equity of reinsurance market participants. In fact, AM Best’s Global Reinsurance Composite reported its lowest combined ratio in five years in 2021—96.4—and equity values soared 17 percent for the group.

The biggest year-over-year jump in capital recorded in the AM Best report was a 15.5 percent increase in 2019. AM Best’s 2020 report on capital levels explained that even though most reinsurers were underwriting at, or just above, breakeven in 2019, the vast majority of companies had been adversely impacted by mark-to-market unrealized losses from both fixed-income securities and equity holdings toward the end of 2018, which reversed in 2019.

“Notably, National Indemnity—given the scale of its balance sheet—was a key driver in these movements, with unrealized losses of $11.4 billion in 2018 and unrealized gains of $47.7 billion in 2019,” the 2020 report explained.

In a final section of the report, AM Best provides an analysis of estimated traditional reinsurance capital vs. risk-adjusted capital requirements, noting that the sharp rise in dedicated capital in the last two years has not translated into substantially improved risk-adjusted capital positions for reinsurers.

Hofmeister explained that required capital has risen at similar rate as dedicated capital.

Best approximates required risk-adjusted capital with a measure of capital utilization—basically, how much capital is needed to maintain the strongest Best Capital Adequacy Ratio (25 percent at 99.6 percent VaR).

Capital utilization remained flat at 82 percent for 2020 and 2021, and is projected at 87 percent for 2022. “We expect that the rise in required capital and the deterioration of available capital throughout 2022 will result in the highest capital utilization levels in recent history,” says the report, which also shows capital utilization at 75-80 percent for 2017-2019.

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers