In a report published Monday, global reinsurance broker Gallagher Re concluded that while attritional loss ratios and overall combined ratios came down across the Lloyd’s market in 2021, inflation could stop the positive performance momentum of recent years.

According to the first annual “Lloyd’s of London Market Report” from Gallagher Re, the need to develop and implement ESG strategies, as well as efforts to modernize and digitize the market, are internal factors that could also halt performance progress.

“Inflation is a key area of focus. Syndicates will need to ensure that inflation is carefully considered and factored into planning activities which will be monitored by Lloyd’s,” the report says, highlighting a major challenge facing the Lloyd’s market and the industry.

Related article: Lloyds’ CFO Keese Sees Inflation as Biggest Challenge for Insurers in 2022

Describing the progress so far, Gallagher Re reports that not only did the majority individual syndicates achieve a sub-100 combined ratios in 2021, but also that the general spread of underwriting performance across the market—viewed over a decade—has narrowed and shifted toward profitability.

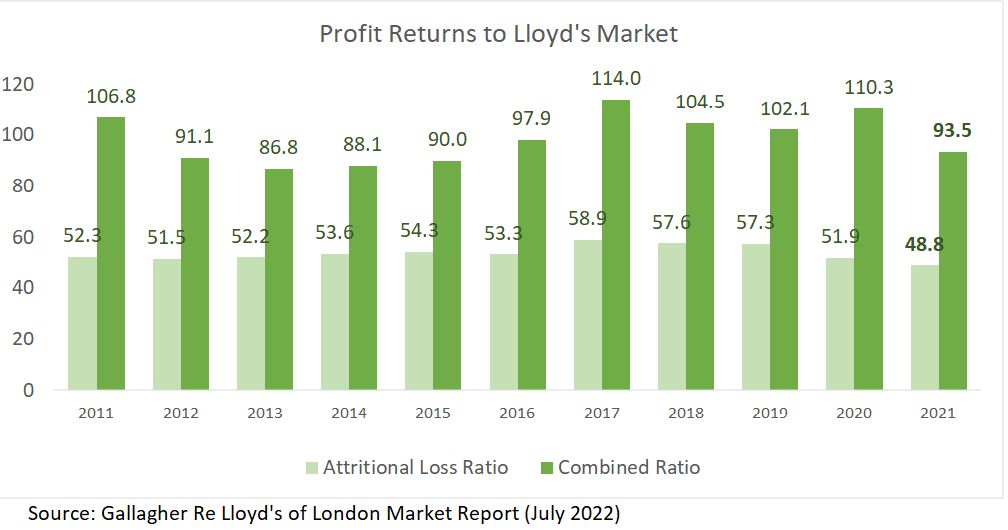

Overall, during the four years prior to 2021, Lloyd’s combined ratios were above 100—ranging from 102.1 in 2019 to more than 110 in both 2017 and 2020.

The 2021 calendar year combined ratio of 93.5 is the lowest reported since 2015.

The 93.5 combined ratio for 2021 was accompanied by gross written premium growth of 11 percent and a 6.6 percent return on net average assets, Gallagher Re said.

Attritional (non-catastrophe) loss ratios showed a five-year decline—falling to 48.8 in 2021—reflecting continuing rate momentum across Lloyd’s, the report said, noting the impacts of 16 consecutive quarters of positive rate movement and of remedial work undertaken.

Still, external challenges including uncertain natural catastrophes remain potential spoilers to a picture of underwriting profit. Even in 2021, the reduced attritional loss ratio offset a significant amount of natural catastrophe activity, with Hurricane Ida, winter storm Uri and European Floods made

notable contributions to major claims figures (11.2 percent).

The report, which set out to dig into numbers, also presents trends in expense ratios, prio- year loss reserve changes, and investment returns over time, as well as comparisons of underwriting ratios and returns-on-equity with market peers, and Lloyd’s segment results for property, casualty, marine, aviation and transport and reinsurance segments.

Before going on to list out the challenges of inflation and ESG initiatives that loom ahead, Gallagher Re unearths a data insight from its analysis of syndicate performance—a moderate correlation between the mean and standard deviation of each syndicate’s combined ratio over the period 2012 to 2021.

“While that suggests more volatile syndicates have tended to outperform, it demonstrated that consistent profitability was also achieved with lower volatility,” explained Shireen Gammoh, Gallagher Re’s Head of Strategic and Financial Analytics, one of the report’s authors in a media statement.

Source: Gallagher Re

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation