Many business leaders feel unprepared for growing geopolitical risks and inflation, according to a report published by Beazley.

“Across the UK and U.S., fewer business leaders feel well prepared to manage geopolitical risks. Concerns about the possible consequences of war—notably, war and terrorism risks and economic unrest—are off the scale compared with the prior year, and inflation is a dominating concern,” said the report titled Spotlight on Geopolitical Risks.

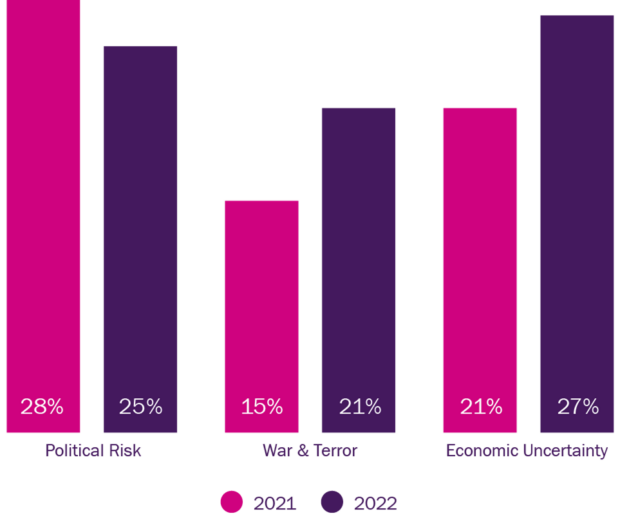

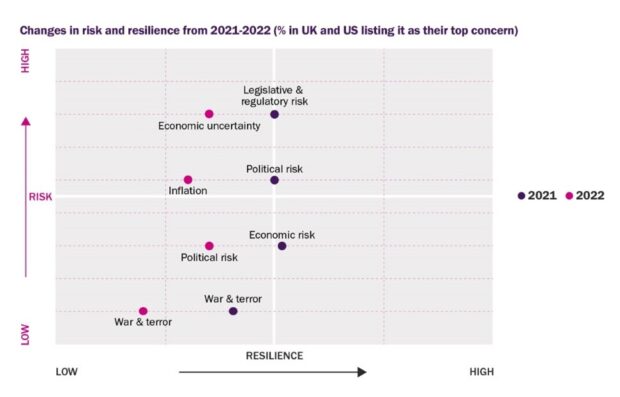

A little over 21 percent of businesses in the UK and U.S. listed war and terror as their No. 1 concern compared with nearly 15 percent in 2021, an increase of around 46 percent, said the report. In addition, the number of businesses that cited economic uncertainty as their primary concern increased from 21 percent to over 27 percent from 2021 to 2022, a 31 percent increase. Meanwhile, 27 percent of UK and U.S. business leaders put inflation at the top of their risk list.

At the same time, perceived resilience has fallen back markedly, with 10 percent fewer businesses feeling “very prepared” for war and terror, and 8 percent fewer for economic risks, the report said.

As businesses struggle to adjust to this new reality, preparedness and mitigation strategies are becoming a key focus, said Beazley. Indeed, the report said, building business resilience in the face of geopolitical turmoil is now urgent.

“Against a challenging backdrop, business strategies are now at a point of inflection. Even those territories far removed from the theater of war in Eastern Europe are feeling the impact of global sanctions and commodity shortages on risks across the board from supply chain to cyber to political risk and trade credit,” commented Roddy Barnett, Beazley’s head of Political Risks & Trade Credit, in an introduction to the report, which he authored.

“Businesses need to know that as we face a moment of geopolitical change, which is fraught with unpredictability, they can protect overseas physical assets and their human capital, both at home and abroad, by actively investing in a mixture of risk management and effective insurance cover,” he continued.

Risk Mitigation Is Key

The report emphasized that business leaders need to better understand their geopolitical risks and prepare for and seek to mitigate them where possible. Specialist political risk, trade credit and terrorism insurers have a role to play in providing appropriate cover that provides the risk mitigation that they need, it explained.

Further, businesses will need to consider the likely heightened need for additional insurance cover such as D&O and trade credit.

Barnett noted that insurance buyers will need to make choices. “Should cover to protect overseas assets be cancellable or not? And will an investment in insurance help reduce the threat from or mitigate the impact of a deadly weapons event?”

U.S. Domestic Threat Environment

Commenting on the scourge of deadly weapons attacks in the U.S., the report said, the U.S. domestic threat environment “is almost as challenging as overseas.”

The report indicated that it is vital that U.S. risk managers are not complacent about this risk. They need to actively prepare “to help prevent and mitigate the impact of these horrendous incidents,” according to Chris Parker, head of Terrorism and Kidnap & Ransom, who was quoted in the report.

“The past two years have been the deadliest on record for gun violence, with more than 1,300 mass shootings across the United States, statistics that have been brought into sharp relief by the recent tragic incidents in Texas and New York State,” the report said.

Key findings from the report include:

- Inflation is a dominant threat, with 55 percent of business leaders believing they lack the necessary resilience to deal with it, which rises to 65 percent in the United States.

- Economic uncertainty is up 31 percent on the year before.

- Rising prices and an unpredictable economic environment are driving instability and civil unrest – a factor causing recent rioting in Sri Lanka. Countries such as Egypt and Turkey, which are highly dependent on energy and food imports from Russia and Ukraine, are also vulnerable to the secondary effects of the war. “Experience suggests that the resulting economic pressure from severe economic hardship is likely to drive up political tensions.”

- S. business must confront the double threat of unpredictability at home from rising gun violence, while, as a world superpower, it is facing up to a watershed in geopolitics as its relationship with Russia and China shifts.

Survey Methodology

During January 2022 Beazley commissioned research company Opinion Matters to survey the opinions of over 1,000 business leaders and insurance buyers of businesses based in the UK and U.S. with international operations. With a minimum of 40 respondents per country per industry sector, respondents represented businesses operating in: healthcare and life sciences; financial institutions and professional services; manufacturing; energy and utilities (including mining); retail, wholesale, food and beverage; public sector and education; real estate and construction; tech, media and telecoms; hospitality, entertainment and leisure; and marine and warehousing.

Of the firms surveyed in both the U.S. and the UK, there was an equal split of respondents across company sizes of: $250,000 – $1 million, $1,000,001 – $10 million, $10,000,001 – $100 million, $100,000,001 – $1 billion, more than $1 billion. Similar research undertaken in 2021, covered 1,000 participants from the U.S. and UK, from which the previous years’ figures are derived.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec