Rating upgrades in the U.S. property/casualty insurance segment bounced back to pre-pandemic levels in 2021, increasing to 7.7 percent of all rating actions compared with 5.3 percent in 2020, according to a new AM Best special report.

According to report, “P/C Rating Upgrades Increase for 2021 as Insurers Adjust to Pandemic,” the total number of rating upgrades increased to 54 in 2021, up from 38 the previous year, even though insurers continued to face ongoing COVID-19 implications, inflation, and higher loss costs.

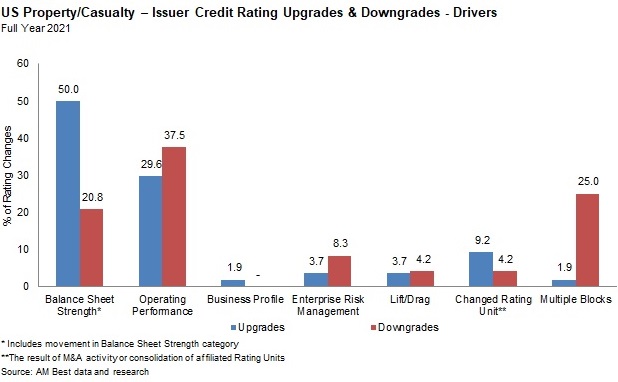

The report said that half of the 54 P/C upgrades came as a result of enhanced capitalization, which improved AM Best’s balance sheet strength assessments for the rated entities.

While another 30 percent of the upgrades resulted from improvements in underwriting and profitability metrics—driving positive movements in the operating performance assessment portion of the rating analysis—worsening operating performance assessments were also the main drivers of downgrades.

Breaking down results by segment, the report noted that the personal lines segment had 32 upgrades and 11 downgrades in 2021, compared to 20 upgrades and 14 downgrades in 2020.

Rebounding surplus levels in late 2020 helped to explain the high level of upgrades for personal lines insurers in 2021.

“The higher surplus levels and favorable risk-adjusted capitalization at the start of 2021 positioned the segment to manage various challenges in 2021, including above average catastrophe activity, elevated reinsurance costs, and a return to pre-pandemic frequency trends, as well as increased loss severity,” AM Best said.

The personal lines segment also maintained its stable outlook, according to AM Best, but negative outlooks for insurers continue to outnumber positive outlooks due to the frequency of catastrophe events, higher reinsurance costs, and market uncertainty.

On the commercial lines side, there were 21 upgrades and 13 downgrades in 2021, compared to 17 upgrades and 11 downgrades in 2020. For the most part insurers here maintained solid risk-adjusted capitalization and have experienced strong pricing momentum as well as favorable court rulings on many pandemic-related business interruption claims disputes.

AM Best said downgrades in commercial “were primarily driven by deteriorating underwriting results stemming from severe weather events and adverse reserve development in the commercial auto line, which led to unfavorable operating results.”

In commercial, negative outlooks declined in 2021 compared to 2020 and AM Best revised its outlook from negative to stable for the segment thanks to the “modest impact” of COVID-19 and other factors. Looking ahead, concerns for the commercial lines segment include inflation, economic recovery, loss costs, and the regulatory issues related workers compensation.

For all P/C insurers, the report also notes longer-term impacts of the COVID-19, including the challenges related to hybrid work environments, finding talent and the need for increased spending on technology platforms. “Uncertainty abounds, but change is essential,” the report concludes, adding that that AM Best will continue to monitor the impacts and take any necessary actions if warranted.

Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict

Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict  Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud

Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End  How Modern Is ‘Modern Enough’ for Insurance Applications?

How Modern Is ‘Modern Enough’ for Insurance Applications?