If Republican President Donald Trump wins re-election, the property/casualty insurance industry is not likely to see much change from the status quo in Washington.

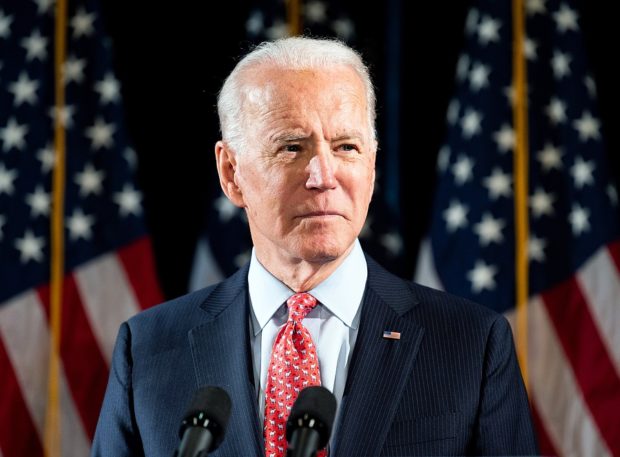

If Democrat Joe Biden wins the presidency, however, the P/C insurance industry can expect a flurry of legislative activity around taxes, climate-energy-and-infrastructure, social justice and risk-based insurance pricing, and other issues.

That’s the outlook from one veteran Capitol Hill lobbyist, Glenn Westrick, senior vice president for Government Relations at Travelers. Westrick offered his pre-election perspective during a recent Travelers Institute virtual forum on the evolving political scene in Washington. He was joined by David Sampson, president and chief executive officer of the American Property Casualty Insurance Association (APCIA).

Westrick won’t predict a winner but does predict the November election will result in one of two scenarios: either a status quo election with Trump re-elected and Republicans retaining control of the Senate and Democrats of the House; or a sweep election with Biden and the Democrats in control of the White House and both houses of Congress.

The industry could be facing a very different Washington landscape depending on which scenario is in place on inauguration day, Jan. 20, 2021.

“If we do have a status quo election, then there’s going to be less action going on, at least at the federal level for legislation. A Trump win would bring a very limited federal agenda,” Westrick said. “Most second term presidents do not have the coattails or the energy of the first term to have an aggressive legislative agenda. And Trump does not have good relationships with the Congress and we wouldn’t expect a bold agenda going into the second term.”

That would not necessarily be a bad result for the industry. “Business, in general, doesn’t dislike gridlock in Washington because it tends to allow certainty and you don’t have big legislative changes,” he said.

On the other hand, a sweep by Biden and his fellow Democrats is likely to mean Westrick and his colleagues will be very busy next year.

“Now, that will bring a huge legislative activity to Washington. One party control normally does, and certainly one party Democratic control will do that,” he said, recalling the first two years of President Obama’s administration when the Recovery Act, the Affordable Care Act, and Dodd-Frank were all passed. “We think we will see that type of activity if the Democrats do have a sweep in November.”

Sampson had no election crystal ball either but did agree with Westrick insofar as he thinks if Biden wins, the Senate majority “will be decisively Democratic.”

The APCIA leader offered a further observation on the election and today’s political climate:

“I am deeply concerned that the underlying fissures in society could lead to political unrest on top of the social unrest that we’ve already been experiencing this year. And I think it’s very important, as does our board and our executive committee, for the industry to have a voice of reason and concern and call us to our better angels to trust the system of checks and balances that are embedded in American society and our government.”

Biden Issues

Westrick said the 2017 Trump tax bill was a “big win” for domestic insurers because it lowered their taxes and helped the industry be more competitive with foreign insurers. He does not see another business tax cut if Biden wins.

Biden is expected to raise taxes on corporations. “The big thing will be who pays, who pays what, what industries end up on the losing side. There’s always winners and losers in a tax fight,” Westrick said.

A Biden Administration would seek to tackle climate change with a package that is likely to include measures on mitigation, energy and infrastructure. “There’s a lot of passion on these issues, especially on the progressive side of the Democratic Party that wants to get at climate through energy policy,” Westrick said.

He said the questions for the insurance industry will center on what mitigation efforts are going to be included in any climate package. He said the industry would welcome help from Washington in coordinating with states on storm and wildfire mitigation efforts. Also, the industry will be watching to see how any climate package affects certain industries and investment portfolios.

“Will it limit or change our underwriting appetite?” he continued. “And again, in Washington, it’s always who pays the bills for that. It’ll be a big debate, and we think that will happen soon, in the next Congress.”

A third issue is risk-based insurance pricing, which has drawn attention as part of the debate over social justice.

“There’s going to be questions about pricing, and we’re going to have to be prepared to answer that and to discuss that in a rational manner so that the market discipline that risk-based pricing brings, can continue, and we can continue getting our products to the consumers at the best possible price,” he said.

Westrick said the industry’s efforts around risk-based pricing will have to be largely educational, explaining what risk-based pricing is and why it is so important to the industry.

“We’re a very heavily regulated industry, so we are regulated for our forms and our prices and how we do business at the state level very closely,” he said. “We need to explain that to a new set of legislators and potentially regulators in Washington, about how we do our business, how it’s important to price to risks, the benefits that come to consumers for that.”

Sampson shares Westrick’s expectation that 2021 will require the industry to educate policymakers about risk-based pricing, not only in Washington but also in the states. “State insurance regulators have committed to an aggressive agenda that includes a reassessment of insurance rating and underwriting factors, insurers’ use of big data and artificial intelligence, all within the context of social equity and inclusion,” he said.

He said at least 29 states are gearing up to do something on risk-based pricing next year.

‘War Footing’ on Pandemic

Sampson said the P/C insurance industry had intended to address lawsuit abuse and legal reforms when 2020 began. But once the pandemic erupted in March, the industry’s priority changed to countering attempts to have insurers pay for business interruption losses stemming from coronavirus lockdowns, losses that were not anticipated in policies.

He said APCIA and the industry went on a “war footing” as the “pandemic crisis very quickly became a business of insurance crisis, with a wave of threats to retroactively impose insurance coverage and opportunistic trial lawyers leveraging the pandemic to expand coverage and for personal gain.”

The “war footing” meant that the APCIA board, which typically meets once a quarter, has met nine times since March 13, and the group’s executive committee, scheduled to meet eight times in all of 2020, thus far this year has met 21 times.

Also, the APCIA board set aside a $3 million legal reserve bond that enabled the association to retain top constitutional and insurance coverage firms to help in the fight against state efforts to impose retroactive business insurance coverage.

Sampson said APCIA shifted its focus and its legal, public affairs and communications resources to fighting the business interruption legislation to avoid what he said would be a “devastating impact” if the industry had to pay these unexpected claims.

The “war” effort appears to have paid off. “[W]e feel reasonably optimistic that we have it contained this year,” Sampson said, although he added he is not yet waving a victory flag.

Regardless of whether Democrats or Republicans are in charge, the pandemic challenge will continue next year as the industry seeks to garner support for its federal policy proposal for managing future pandemic risks, a plan built on the premise that pandemics are essentially uninsurable. The Business Continuity Protection Program would establish a system for businesses to be able to purchase basic pandemic coverage from the federal government, while also allowing for private insurance markets to develop excess, surplus and] reinsurance backup coverages.

*This story ran previously in our sister publication Insurance Journal.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies