Ongoing rate increases and reductions in capacity are taking shape in most property/casualty lines—and for some, will continue into the new year, according to a recently released report from USI Insurance Services.

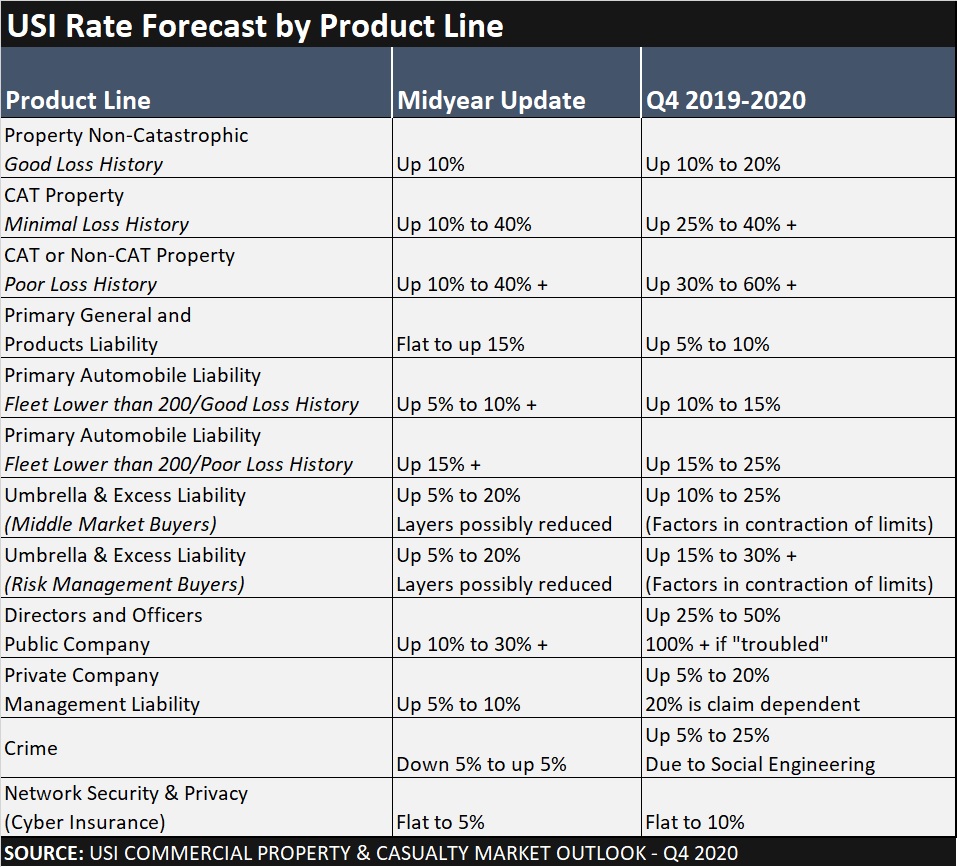

The Q4 2019-2020 P&C Insurance Market Outlook Report lists 28 different product lines along with forecasts from a prior midyear update compared to observations of fourth-quarter pricing. Only one line—loss sensitive workers comp accounts—showed lower rate forecasts for the fourth quarter vs. midyear, and just seven others stayed the same.

The other 20 lines, including all the property lines, general liability, umbrella and cyber, had higher rate change indications for the fourth quarter than at midyear. Below, we reveal a dozen of those.

Along with the rate comparisons, the report provides added information from USI practice leaders for individual lines. Among the insights are these:

- In property insurance lines, wildfire is no longer a throw in.

- Three market leaders, AIG, FM Global and Lloyd’s of London are highly scrutinizing their North American property business impacting capacity, rates, and coverage.

- In casualty insurance, the firming of the insurance market for the majority of coverage lines is not being driven by capacity constraints but rather because capital is being deployed much more conservatively and selectively.

- Unlike commercial automobile liability, for which the market has been firming over a three or four-year time frame, for primary general/products liability and umbrella/excess liability, the market firmed rapidly beginning in fourth-quarter 2018. Prior attempts to raise rates in prior years were short-lived but the current environment of more restrictive risk selection, tighter underwriting standards and reduced competition is turning out to be much more uniform, prolonged and severe than anticipated.

- USI is increasingly seeing markets unwilling to write primary liability lines on a standalone basis without workers compensation, especially for larger accounts.

- Deteriorating casualty loss trends characterized by increased frequency of severity losses has caused markets to exit certain lines, reduce capacity and raise rates considerably. These activities cut across all industries and classifications regardless of tenure with markets or past loss history.

- The demand for casualty rate increases is not expected to slow dramatically for the duration of 2019 and into the third- or fourth-quarter of 2020.

- USI has seen a reduction in average lead umbrella capacity of $25 million fall down to $15 million or less, with no corresponding decrease in rates and the reallocation of capacity higher up in towers.

- Excess markets are walking away from what they view as below-market pricing; new market capacity is not entering.

- In public D&O, there has been more upward rate movement in the first three-quarters of 2019 than USI has witnessed in the past 16 years. “We have clearly now transitioned into a carrier-dictated market.”

- In cyber, the flat-to-10 percent rate change indications shown on the chart above, aren’t the rule for large companies or prime targets. For those over $1 billion in revenue and for insureds in “challenging classes” like retail, hospitality, health care and financial institutions, USI has seen increases in premium of up to 20 percent and SIR increases of up to 50 percent—and this is expected to continue for the balance of this year and through the first half of 2020.

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers