As insurers embrace InsurTech in multiple ways, The Hanover Insurance Group’s Richard Lavey offers some advice: Not everything works as initially envisioned, and that’s OK.

“‘If you build it, they will come’ is not necessarily how this plays out,” explains Lavey, The Hanover Insurance Group executive vice president and president of Hanover Agency Markets. “I can’t say everything is working perfectly, but we are quite pleased and optimistic. The learnings along the way are often worth more than any economic value that comes with them, the way we can pivot and adjust and make our value proposition stronger.”

Lavey has helped shape the insurer’s ongoing digital strategy since it was put into play a little over two years ago. The Hanover has invested “several million dollars” to date in this process, he said, with newly announced plans to pursue a multiyear digital investment strategy designed to improve its independent agent and customer experience throughout the various insurance buying processes.

A ‘Digital Assist’ Digital Model

Lavey said during a Carrier Management interview and in a follow-up email that The Hanover’s innovation agenda is intertwined with its digital agenda, which he describes as investing in improving customer and agency experiences through multiple parts of its value chain.

“We’re trying to accomplish something that we know is really hard and that is helping agents help clients experience insurance better,” he said. “We are taking the next step to enable our agents to provide a better experience for their clients. It’s an ambitious agenda to change the perception that clients experience with insurance.”

Lavey explained that the digital strategy is both formed by and developed on behalf of independent agents. The Hanover seeks agent advice through focus groups but also relies on external research and surveys to determine the most important and relevant digital priorities.

All of those elements help inform development of what Lavey describes as a “digital assist” digital model, where digital technology serves as a tool but not the main focus.

“Digital can be a proxy for efficiency and the way to engage, but it’s not a proxy for eliminating the agency from the equation all together,” Lavey said. “A digital assist digital model starts with some digital engagement—it helps the customer get educated, understand coverages at their convenience [through an] upfront education process.”

At this point, there is an assumption that customers need some assistance so they can then interact with an agent to help them make sure they’re buying the right kind of insurance. Then, the digital model resumes with elements including self-serve payment options and the ability for customers to electronically look up policy information and submit claims.

How to Make It Work

To help implement this strategy, The Hanover focuses on partnerships “where it makes sense,” Lavey said.

“We think hard about taking advantage of other platforms already in existence and leasing those platforms as opposed to building them in-house,” Lavey explained. “Particularly in a fast-paced innovation world, if you build your own approach to all these capabilities, the speed to market is slower than desired.”

Partnerships are also more cost-effective than doing everything in-house, Lavey noted.

“In the innovation world, where [you’re] testing and learning that not everything is going to be wildly successful, to spend time and resources to build something internally—we don’t believe that to be the wisest model,” he added.

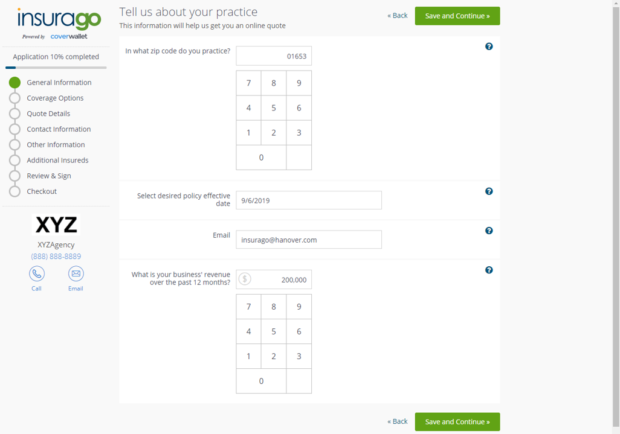

The Hanover’s partnership with CoverWallet is one example of this strategy—an agreement to use the InsurTech’s technology for a customer-facing digital platform that helps independent agents acquire new business customers, such as freelancers, contractors and others. Dubbed Insurago, Lavey explained that CoverWallet built out the whole user interface and consumer end-to-end experience, while The Hanover built out its products on the platform.

“That is a match made in heaven, frankly, [and it] allowed us to stand that up in a short period of time,” Lavey said. All in all, The Hanover was able to debut Insurago in April after a six-month process. Developing it in-house would have taken twice as long, he added.

Other partnerships, Lavey pointed out, are focused on areas such as underwriting and analytics, and facilitating more efficient workflows between the customer, agent and carrier.

Working Out the Bugs

Of course, not every technological investment works well right out of the gate, something Lavey freely acknowledges. He said, however, that even blips provide longer-term learning experiences that benefit the company as it pursues greater use of technology.

One learning curve is this: the realization that sourcing third-party data to help with the efficiency of underwriting isn’t always 100 percent accurate.

“As an example, if you are eyeing data about a restaurant and whether or not they provide delivery service, the data that comes back is not necessarily always correct, [with] things like [online food delivery service] Grubhub and other features that bring back false positives or false negatives” Lavey said. Data has to be verified and validated before using it in the decision-making process.”

In the end, Lavey said that The Hanover’s push to update its digital strategy was imperative in today’s market.

“We obviously recognize the dynamic and changing nature of the industry, the need to be more relevant to customer expectations,” Lavey pointed out. “We were experiencing an increase in the demand for digital engagement.”

Lavey added that the increase in InsurTech investments in general offers an added motivating factor for all insurers to modernize how they engage with customers.

“The InsurTech [startups] funded by venture capital recognize that there is friction in the insurance buying process and insurance servicing process, and [they are] attempting to [solve problems] for those issues,” Lavey said. “The Hanover and other carriers in the industry recognized that we need to solve them ourselves [or] InsurTechs and others around them will solve them for us.”

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly