Less than two months after one of RenaissanceRe’s shareholders urged the Bermuda-based reinsurer to consider putting itself up for sale, the company announced it will buy another reinsurer instead—Tokio Millenium Re—as part of a $1.5 billion deal.

On Tuesday, RenaissanceRe Holdings Ltd. (RenRe) announced that it entered into a definitive agreement with Tokio Marine Holdings, Inc. under which an affiliate of RenRe will acquire Tokio Marine’s reinsurance platform. The platform includes Tokio Millennium Re AG and Tokio Millennium Re (UK) Limited, collectively known as “TMR” in the reinsurance industry.

Under the terms of the deal, Tokio Marine is to receive 1.02-times the tangible book value of TMR at closing. If closing tangible book value is unchanged from June 30, 2018, Tokio Marine will receive roughly $1.5 billion in total consideration, consisting of $1.22 billion in cash and $250 million of RenaissanceRe common shares.

A provision of the deal calls for Tokio Marine to provide a $500 million adverse development cover to RenRe, protecting TMR’s stated reserves at closing (including unearned premium reserves).

According to RenRe’s press statement, no shareholder approval of the deal is required. RenRe said that the transaction has been unanimously approved by the boards of directors of both RenRe and Tokio Marine and is expected to close in the first half of 2019 and is subject to customary closing conditions and regulatory approvals.

Still the deal seems to be at odds with the advice of one shareholder, TimeSquare Capital Management, an institutional management firm, which has been RenRe investor since 2008. On Sept. 7, 2018, Ian Anthony Rosenthal, TimesSquare senior founding partner and portfolio manager, and Seth Bienstock, partner and director, sent a letter to RenRe’s Chief Executive Officer Kevin O’Donnell, imploring that he and RenRe’s board consider strategic options, including a potential sale.

The partners made that letter public on Oct. 2. They argued the company’s position as a standalone reinsurer hasn’t led to any value creation for shareholders, while acquisitions of peer companies have been done at “escalating valuation multiples over the past two years,” listing deals for hybrid companies XL Catlin and Validus (writing both insurance and reinsurance) among those consummated at high multiples.

Both RenRe and Tokio Millenium Re write only reinsurance business (although Tokio Marine has many operations globally that write primary insurance).

“Over the period of our ownership, we have witnessed a structural transformation of RenRe’s core property catastrophe reinsurance business, driven by the growing participation of alternative capital. In our view, this has had an adverse impact on the long-term risk-adjusted returns achievable in this business. Importantly, the degree of pricing response following large loss events over the past decade has been dampened relative to history and the duration of pricing gains has been ephemeral,” the TimesSquare partners argued.

RenRe responded with an Oct. 2 public statement welcoming “open and constructive communications with all shareholders.”

“We have considered fully TimesSquare’s views and have shared them with our board. Our board understands, and is committed to, its fiduciary duties to act in the best interests of all shareholders. Our board and management team continuously focus on enhancing shareholder value through execution of the Company’s strategic plan,” the statement said.

Offering a vote of confidence in RenRe’s strategy, State Farm Mutual Automobile Insurance Company has agreed to invest $250 million in RenaissanceRe through the purchase of RenaissanceRe’s common shares in a private placement.

As a result of the investment, State Farm will own about 4.8 percent of RenRe’s total common shares outstanding, RenRe announced, noting the existing relationship between the companies that includes State Farm’s investments in RenRe-managed vehicles Top Layer Reinsurance Ltd. and DaVinciRe Holdings Ltd.

The shares purchased by State Farm will be valued at yesterday’s closing price of $128.37 per common share.

Commenting on the deal to acquire Tokio Millennium Re, O’Donnell said, “This transaction will increase our scale, broaden our reach and extend our ability to apply our core strengths to a deeper customer base. Our unique ability to capitalize on large, one-of-a-kind opportunities underscores our global reinsurance leadership, including in casualty and specialty lines, and our ability to execute on our successful, highly differentiated strategy.”

In a separate announcement, Tokio Marine said, “Our core strategy is focused on expanding profitable and stable primary insurance business, and as a result we have taken the strategic decision to divest TMR and TMR(UK) as dedicated reinsurance companies.”

The Tokio Marine announcement further explains that the group set up TMR as a subsidiary to write overseas reinsurance risks in 2000. While contributing to the overall profits of Tokio Marine Group over time as the reinsurance operations expanded into non-catastrophe exposed classes, a soft reinsurance market has impacted returns on reinsurance business, the Japanese parent company said. At the same time, Tokio Marine Group has been actively acquiring specialty insurance businesses around the globe—Kiln, Philadelphia, Delphi and HCC—shrinking the contribution of the reinsurance business to overall profit even further. In fact, the contribution of reinsurance business fell from roughly 50 percent to less than 10 percent in a decade, Tokio Marine said.

According to TMR’s 2017 annual report, natural and manmade catastrophe losses last year resulted in the biggest bottom-line net loss in TMR’s history—$158.9 million. TMR also strengthened reserves and adjusted its underwriting approach on auto and excess casualty business, reporting a combined ratio of 116.2 on $1.3 billion of net premiums.

RenRe’s 2017 results also took a hit from last year’s record-breaking insured catastrophe losses for the industry, recording a net loss of $244.8 million for the year.

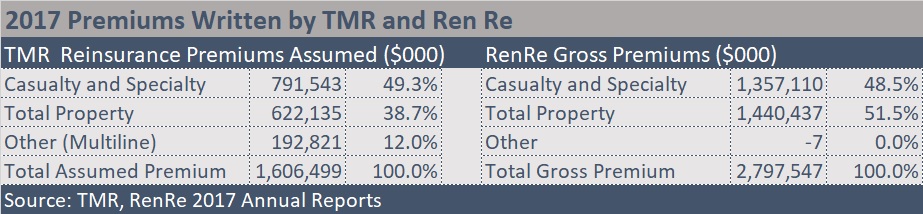

The annual statements reveal other similarities between the TMR and RenRe books.

Both companies reported just about half their premiums in casualty and specialty lines last year, but RenRe has a higher proportion of property reinsurance business, and property-catastrophe business, in particular.

Property-cat premiums of $1.1 billion represented 39.5 percent of RenRe’s $2.8 billion of total premiums written last year, and more than three-quarter of the total property reinsurance book. For TMR, property-cat premiums of $390 million represented on 24.3 percent of total assumed premiums of $1.6 billion and just over 60 percent of the total TMR property reinsurance book.

Overall, property premiums made up 51.5 percent of RenRe’s book but only about 39 percent of TMR’s book. Besides casualty, specialty and property business, TMR reported some multiline business, representing 12 percent of total premiums.

Geographically, most of TMR’s business—$1.1 billion of the $1.6 billion total, or 68 percent—comes from North America, according to the 2017 annual report. At RenRe, North American business was roughly one-third of the 2017 property book and just over 20 percent of the casualty and specialty segment.

Like RenRe, TMR was established as a Bermuda prop-cat reinsurer—TMR in 2000 and RenRe in 1993. TMR expanded to non-cat lines in 2010, setting up operations in Zurich, then Sydney in 2011, the U.S. in 2014 and the UK in 2015. In October 2013, TMR redomiciled to Switzerland converting the Bermuda operation into a branch.

Yesterday, RenRe also reported earnings for the third-quarter and first nine months of 2019. With preannounced cat losses of over $150 million, net income was $32.7 million for the quarter, compared with a net loss of $504.8 million in last year’s third quarter.

Through nine months, net income is $281.2 million for 2018, compared to a loss of $241.3 million for the comparable period in 2017.

BofA Merrill Lynch is acting as financial advisor to RenaissanceRe in connection with the TMR transaction and Willkie Farr & Gallagher LLP as legal counsel. Wachtell, Lipton, Rosen & Katz is acting as legal counsel to RenaissanceRe’s board of directors in connection with the transaction.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers