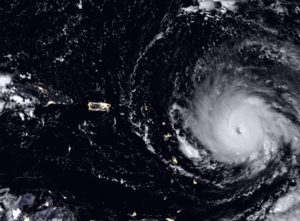

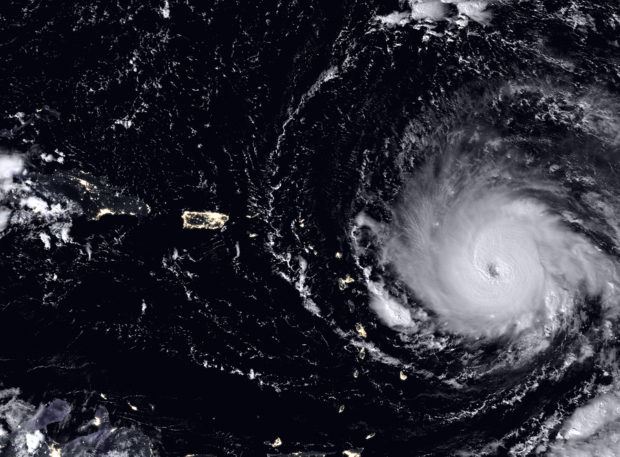

Estimated insured losses for the insurance industry for Hurricane Irma range from $25 to $50 billion based on a number of estimates, according to a report from Fitch Ratings.

Fitch’s calculation comes close on the high-end to RMS, which estimated Irma will leave behind $35 billion to $55 billion in insured losses in the U.S. and Caribbean combined.

The ratings agency said these losses will represent a substantial near-term earnings reduction for companies with exposure to the Florida (re)insurance market. However, Irma related losses are not anticipated to adversely affect capital adequacy to a degree that weakens ratings in the near term for insurers in Fitch’s coverage universe.

According to the report, reinsurers and some larger diversified insurers do face a risk that continued near-term catastrophic losses in the 2017 hurricane season may add to already large losses from Hurricanes Irma and Harvey to create net losses that adversely affect capital and exceed ratings sensitives.

“Re-insurers will bear a large portion of losses from Irma, but the reinsurance market is well equipped to handle substantial hurricane losses in part due to a lack of major hurricane landfalls in the 11 years before Irma,” said Chris Grimes, director at Fitch.

Florida property specialists hold approximately 64 percent of the Florida homeowners insurance market share by Fitch’s estimate as of year-end 2016, growing in recent years by writing business previously covered by state sponsored insurer Citizens Property Insurance Corp. Irma represents the first major hurricane landfall in most of these organizations’ histories. As Irma losses will be less than previously feared, the majority are unlikely to have losses from the event that exceed catastrophe reinsurance program limits.

The report also found that capital market investors are also exposed. Florida property risk is often transferred to the insurance-linked securities (ILS) market through multiple vehicles including catastrophe (cat) bonds, collateralized reinsurance, sidecars, industry loss warranties (ILW), and hedge fund-supported reinsurers. Swiss Re Capital Markets estimates about 45 percent of outstanding cat bonds are exposed to Florida wind events and over 60% are exposed to broader U.S. wind.

Source: Fitch Ratings

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®  What Berkshire’s CEO Abel Said About Insurance

What Berkshire’s CEO Abel Said About Insurance