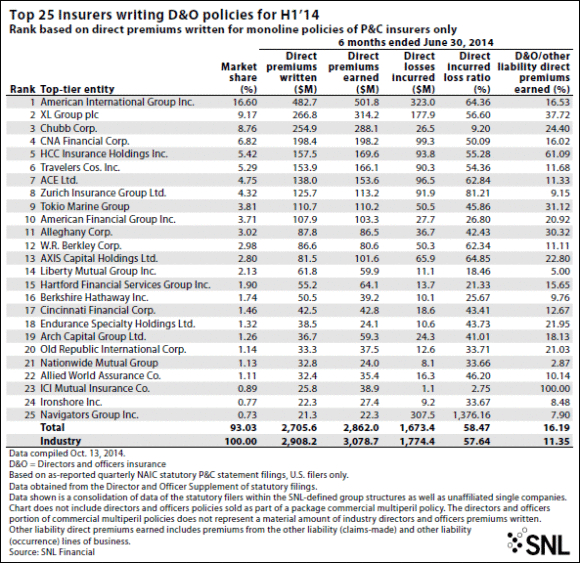

Direct premiums written for the directors and officers liability insurance industry grew 7.35 percent year over year in the first half of 2014, rising to $2.91 billion, according to an SNL Financial analysis of monoline D&O policies.

Growth in written premiums was assisted by rate increases in D&O liability lines in both 2013 and 2014. Average total D&O liability program rate hikes previously amounted to 3.6 percent year over year in 2013, according to Marsh’s annual report on the U.S. insurance market released in February 2014. Rates increased steadily on a month-to-month basis throughout the first half of 2014, according to MarketScout, ranging from 1 percent in June to 3 percent in March. The median month-to-month rate increase was 2 percent, which occurred in January, April and May.

American International Group Inc. remained strongly positioned as the D&O market leader in the first half of 2014, with 16.60 percent market share. It posted 15.37 percent year-over-year growth in direct premiums written for the first half.

In an August interview with SNL, Grant Merrill, commercial D&O and crime manager for the EMEA region at AIG, elaborated on how the insurer looks for ways to innovate and differentiate itself in the professional liability marketplace. In June, AIG announced a new D&O policy endorsement that ensures primary D&O policy funds are immediately available to clients named as defendants in securities lawsuits for the preparation of “event studies.” Additional premiums were not required for this endorsement.

CNA Financial Corp., which ranked fourth by market share as of June 30, was the fastest-growing D&O insurer in the top 25, with a year-over-year growth rate of 62.43 percent in the first half of 2014.

Although rate increases have occurred, the industry’s underwriting profitability may still be deteriorating. The direct incurred loss ratio increased to 57.64 percent in the first half from 50.35 percent a year ago, having remained at or below 50 percent in the last three years.

Favorable loss reserve development contributed to a few companies avoiding the upward loss trend experienced by the industry. Chubb Corp. and Liberty Mutual (with 8.76 percent and 2.13 percent market share, respectively) outperformed peers by posting loss ratios of 9.20 percent and 18.46 percent as of June 30—the second- and third-lowest loss ratios during the period. ICI Mutual Insurance Co. a RRG, however, nabbed the top spot during the first half of the year by reporting a 2.75 percent loss ratio. Chubb disclosed that much of its $80 million favorable loss reserve development in professional liability lines during the second quarter of 2014 occurred in D&O policies on accident years prior to 2010. ICI Mutual also cited $12.2 million in favorable loss reserve development during 2013 as the main factor in a declining loss ratio. In its case, however, $10.2 million worth of development occurred on claims originating from 2012.

Source: SNL Financial

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation