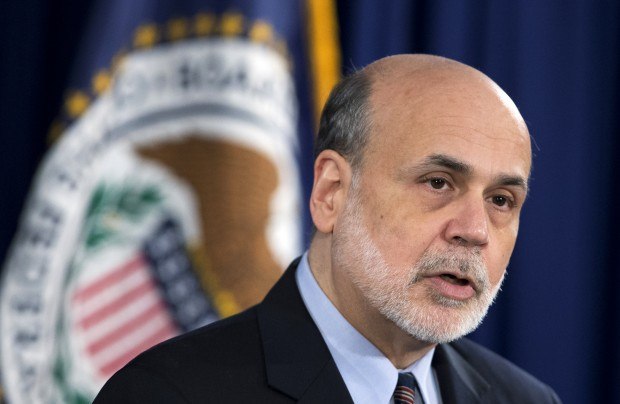

Intellectually, Ben S. Bernanke was prepared to tackle the gravest economic crisis since the 1930s as chairman of the Federal Reserve. A Princeton University economics professor, he was an expert on the causes of the Great Depression. He was a practitioner as well as economic historian, serving on the Fed’s Board of Governors and as chairman of President George W. Bush’s Council of Economic Advisers. Yet in other ways, from dealings with reporters to bankers and members of Congress, there was little that could have prepared Bernanke for the challenges to come. Here are some highlights of his eight-year term, which ends tomorrow:

***

KEEP SWINGING: Known for his love of baseball, Bernanke’s attitude as the crisis intensified was to “keep swinging” with unconventional policies, recalled four-decade Fed veteran Donald Kohn, who retired as vice chairman in 2010.

Bernanke would say that, while he didn’t agree with all of President Franklin D. Roosevelt’s policies to fight the Depression, he admired his willingness to try new approaches.

The chairman didn’t want to be afraid to “swing and miss for a strike” because the welfare of the U.S. was at stake, Kohn said. “That general idea, that you’ve got to keep innovating, that was really important, and that you’re willing to try these unconventional policies.”

***

A RARE OUTBURST: Kohn also was impressed by how Bernanke remained “amazingly calm” during the crisis. The rescue of American International Group Inc. provoked a rare outburst of anger.

“If there is a single episode in this entire 18 months that has made me more angry, I can’t think of one other than AIG,” Bernanke told lawmakers on March 3, 2009. AIG “exploited a huge gap in the regulatory system, there was no oversight of the financial-products division, this was a hedge fund basically that was attached to a large and stable insurance company.”

In a March 2009 interview on the CBS Corp.’s “60 Minutes” program, Bernanke said he “slammed the phone more than a few times on discussing AIG.”

***

WORK ETHIC: On weekends, Washington’s streets empty of government workers, politicians and lobbyists, who are replaced by tourists taking in the monuments and museums. Bernanke was never one to boast about his work ethic, but during the crisis the staff knew where he would be on any given Sunday — in his office on the second floor of the Fed’s Marriner S. Eccles Building.

***

MEDIA MISHAPS: Bernanke got off to a rocky start with the media. At the April 29, 2006, White House Correspondents’ Association dinner, he told Maria Bartiromo, then an anchor for CNBC, that investors had misinterpreted remarks to Congress that seemed to suggest the Fed was finished raising interest rates. Bonds tumbled when CNBC reported the conversation, which Bernanke later called a “lapse in judgment.”

***

EXPLAINING QE: Bernanke sometimes struggled to explain the Fed’s large-scale asset purchases, or quantitative easing, to the public.

In the March 2009 interview on “60 Minutes,” asked if the Fed’s programs were spending tax dollars, Bernanke replied: “It’s much more akin to printing money than it is to borrowing.”

In December of 2010, Bernanke again appeared on “60 Minutes” to explain Fed policies, which by then included a second round of bond purchases.

“One myth that’s out there is that what we’re doing is printing money,” Bernanke said. “We’re not printing money.”

***

ASSESSING RISKS: Appearing before the Joint Economic Committee of Congress in March 2007, Bernanke said that, while he expected moderate growth, economic risks were multiplying. Housing was one of those risks.

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained,” he said.

Five days after the hearing, subprime mortgage lender New Century Financial Corp. went bankrupt. Two months later, Bear Stearns Cos. suspended redemptions from two subprime hedge funds. A year after the hearing, Bear Stearns failed.

When Bernanke testified to the Financial Crisis Inquiry Commission in 2009, he said he considered subprime contained because it was “a pretty small asset class.” What he hadn’t foreseen was the degree of interconnectedness, and how risky home loans “entangled in these huge securitized pools” could spur contagion like an old-fashioned bank run.

***

RELATIONS WITH CONGRESS: No lawmaker sparred as frequently with Bernanke as Texas Republican Ron Paul, author of the book “End the Fed.” Paul unleashed a barrage of questions at a Feb. 24, 2010, hearing, with two unusual assertions:

First, he said it was reported that during the 1980s, “the Fed actually facilitated a $5.5 billion loan to Saddam Hussein and he then bought weapons from our military-industrial complex and also that is when he invested in a nuclear reactor.”

Second, he cited reports that “the cash used in the Watergate scandal came through the Federal Reserve, and when investigators back in those years tried to find out they were always stonewalled and we couldn’t get the information.”

Bernanke responded:

“Well, congressman, these specific allegations you’ve made I think are absolutely bizarre, and I have absolutely no knowledge of anything remotely like what you just described.”

A 34-page report from the Fed’s Office of Inspector General “did not find any evidence” supporting Paul’s allegations.

***

OPENING GAMBIT: As part of his effort to improve transparency, Bernanke started holding regular press conferences in April 2011.

He fielded questions about the Fed’s decision to keep borrowing costs low for “an extended period,” the outlook for the labor market and an increase in gasoline prices. The final question, about a book on the history of financial crises by Carmen Reinhart and Kenneth Rogoff, jogged a memory about Rogoff, a fellow graduate student at the Massachusetts Institute of Technology in the late 1970s.

“I’ve known him for a long time,” Bernanke said. “I even played chess against him, which was a big mistake.”

Rogoff, in an interview later, declined to comment on the chess game, except to say Bernanke played as black using an opening strategy known as Petrov’s Defense.

As for the press conference, “I thought he gave, speaking of chess, a masterful performance,” Rogoff said.

***

DIMON CONFRONTATION: Bernanke was subjected to an unusual grilling at a June 2011 banking conference in Atlanta. His adversary was none other than Jamie Dimon, chief executive officer of JPMorgan Chase & Co.

Dimon spoke for more than two minutes, asking whether tightened financial regulation, intended to reduce risk, might instead end up hurting the economy. He listed tougher capital requirements, risk oversight, and mortgage underwriting standards as well as stress tests and hundreds of new rules.

“Has anyone bothered to study the cumulative effect of all these things?” Dimon asked. “And do you have a fear, like I do, that when we look back and look at them all that they will be a reason that it took so long that our banks, our credit, our businesses, and most importantly, job creation started going again? Is this holding us back at this point?”

Bernanke smiled. “Well, Jamie, that list you gave me made me feel pretty good there for a while,” he said. “It sounds like we’re getting a lot done.”

“To answer your question, nobody’s looked at it” in detail because the impact is too complicated to quantify, Bernanke said. “I can’t pretend that anybody really has.”

***

ADVICE FOR STUDENTS: Bernanke returned to Princeton University last June and offered advice to graduating seniors in a speech that quoted Saint Luke, Lily Tomlin and Forrest Gump.

He urged graduates not to be overly focused on money, which is “a means, not an end.” He endorsed public service as a “worthy and challenging pursuit” and said most politicians mean well. And he said choosing the right spouse was crucial, advising his audience to look beyond “beauty, romance and sexual attraction.”

Bernanke, an economics professor at Princeton from 1985 until 2002, also offered a blunt assessment of his profession.

“Economics is a highly sophisticated field of thought that is superb at explaining to policy makers precisely why the choices they made in the past were wrong,” he said. “About the future, not so much.”

–With assistance from Caroline Salas Gage in New York, Steve Matthews in Atlanta and Craig Torres and Joshua Zumbrun in Washington. Editors: Chris Wellisz, Mark Rohner

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits