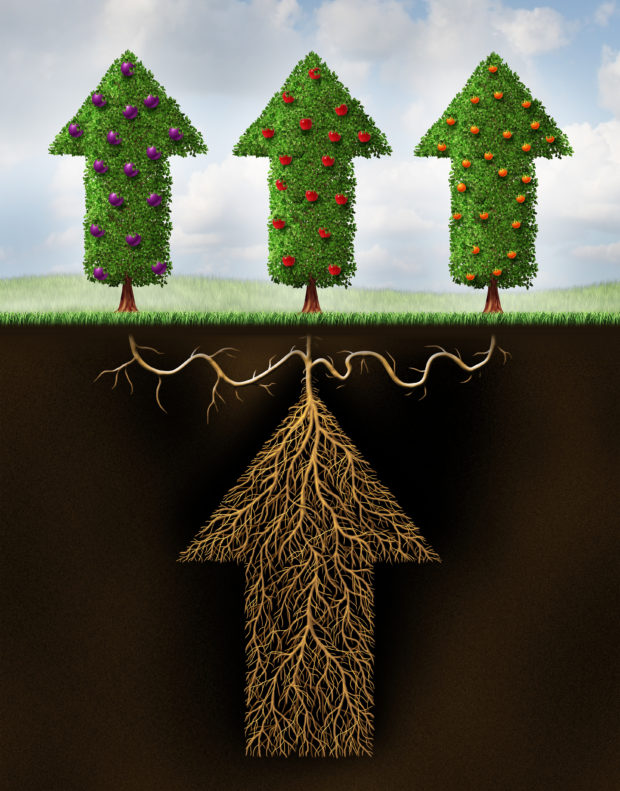

Looking at the second-quarter earnings reports of leading insurers, the argument for product diversification has never been stronger. Results are in from this COVID-impacted quarter, and they indicate that the historically high multiples that primary lines-centric carriers paid to break into specialty had some merit. That’s because not all corners of insurance have been impacted in the same way by the pandemic, and the top-line growth in the newly acquired specialty lines has softened the blows felt elsewhere for the insurers that had the foresight to diversify.

Executive Summary

Opinion. Anuj Jain, the Carriers Practice Leader at ReSource Pro, makes the case that product diversification can boost top-line growth even in a pandemic-impacted quarter. He examines the second-quarter 2020 results of three multiline carriers that recently acquired commercial and specialty insurance competitors to support his view.Additionally, this quarter is showing historic rate-taking by carriers. A closer examination of where insurers are suffering and where they’re thriving shows resiliency, though not for all players.

On the struggling side, we have small commercial, personal auto and workers compensation. While personal auto has declined due to rebates and policy discounts, workers compensation—which was showing signs of emerging out of a rate reduction environment—saw a slip in payroll as unemployment rates shot up to nearly 15 percent in April. Small commercial is taking a hit as a whole because of these two lines and businesses shrinking or even shuttering in record numbers.

On the recovering side, property excess layers and the wholesale market are continuing their march toward significant rate increases and protecting the top line. Brokers continue to face pressures to go the extra mile on behalf of insureds as limits drop and prices go up. COVID-19 will likely prolong this trend as pandemic-related losses, and more importantly loss expenses, start piling up.

Let’s take a closer look at those who diversified. Three large multiline carriers that created a diversified platform through mergers and acquisitions have been able to weather the impacts and uncertainty around COVID-19:

- ACE acquired Chubb in 2016.

- Liberty Mutual acquired Ironshore in 2017.

- Hartford acquired Navigators in 2019.

Large commercial, specialty and wholesale are either providing growth or mitigating the effects of personal lines and the slowdown in middle and small commercial accounts.

Chubb

For Chubb, total North America P/C insurance net written premium increased 3.8 percent in second-quarter 2020 from the year prior, growing to $5.5 billion from $5.3 billion. Commercial segments (formerly ACE) grew 5.3 percent, while personal segments (formerly Chubb platform) went up 1.4 percent. The premium changes by major segment in North America were as follows:

- Major Accounts Retail and Excess and Surplus (E&S) wholesale, 7.5 percent

- Middle Market and Small Commercial, 1.6 percent

- Personal P/C, 1.4 percent

- Agriculture, -1.1 percent

We can see that E&S and large commercial accounts primarily drove Chubb’s growth.

Liberty Mutual

Liberty Mutual’s net written premium declined 2.9 percent to $9.8 billion from $10.0 billion for three months ending June 30, 2020 vs. June 30, 2019. Mitigating the impact of auto, small commercial and workers compensation were Global Risk Solutions Specialty (including Ironshore platform) and large commercial property. Premium changes by major lines for the same quarter include:

- Private Auto, -6.4 percent

- Homeowners, +4.3 percent

- Global Risk Solutions Specialty, +4.5 percent

- Global Risk Solutions Reinsurance, +2.6 percent

- Commercial Multiple Peril, -10.6 percent

- Commercial Automobile, -20.3 percent

- Workers Compensation, -18.3 percent

- Global Risk Solutions Casualty, -1.8 percent

- Commercial Property, +25.6 percent

Here, growth emerged from specialty and large property accounts.

The Hartford

Second-quarter 2020 results show The Hartford as 4 percent up on written premium to $2.2 billion from $2.1 billion, which the insurer attributes to the 2019 acquisition of Navigators Group.

The earnings report notes that, “excluding Navigators, second-quarter 2020 written premium declined 11 percent due to lower new business across most lines, lower premium retention in middle market, reduction in estimated audit premiums receivable, and endorsements reducing premium in workers compensation due to a declining exposure base.”

And besides the performance bump from Navigators, The Hartford also enjoyed $28 million of new business in the second quarter thanks to the 2018 Foremost renewal rights agreement. If you leave this bright spot out, small commercial new business was down 24 percent.

Once again, we are seeing second-quarter growth for a carrier driven by mergers and a movement into specialty lines.

Analysis

While aggregate results are still being compiled, at this point it is fair to assume that COVID-19’s impact on commercial insurers from a top-line perspective has been limited to a handful of sizable lines. The industry, led by E&S and large accounts space, is showing a strong resiliency to a downturn.

Where we’re headed in third-quarter 2020 is hard to predict. Some signs point to a positive momentum in the economy, including unemployment dropping from 14.7 percent in April to 10 percent in July and hard-hit sectors, such as airlines and hospitality, starting to revive, albeit slowly. The U.S. government has made attempts at replacing lost income with the CARES Act to mitigate adverse effects on spending, at least temporarily, and a second stimulus bill may soon pass.

A few considerations that may further deteriorate the situation include a second wave of COVID-19 cases, a crash in the indices if current record levels turn out to be fueled by over-optimism and the geopolitical situation, especially as foreign relations rhetoric picks up in an election year.

For the commercial insurance industry, while the bottom line may well suffer, the top line should be on a flat to upward trajectory. In third-quarter 2020, we’ll likely see auto exposures increase as the economy opens, as well as an uptick in workers compensation exposures with employment numbers going back up. The E&S market continues to expand through rate hikes, and this could even accelerate expansion as COVID-related losses hit the balance sheets.

Where each diversified versus non-diversified carrier ends up is a different question that CEOs should ask themselves.

10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage