It seems like InsurTech has become the term du jour over the last nine months. It is often used to imply destruction, disintermediation, disruption and disaster (the four Ds) for the insurance industry.

Executive Summary

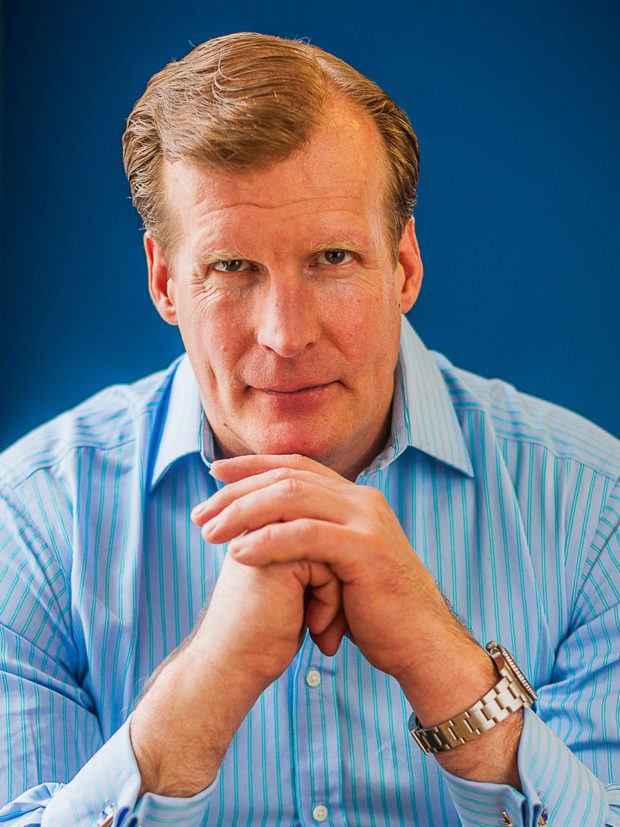

"Do your customers really care about underwriting and product differences, or is this something you think they should care about?" Insureon CEO Ted Devine invites carriers to rethink their priorities regarding product and customer experiences. He also urges them to understand the benefits of putting marketing and distribution functions together and the power of machine learning applications in insurance and other businesses.I don’t believe any of this to be true. The agents aren’t dead, the brokers aren’t going away, and the carriers will be the primary source of capital for decades to come.

At the same time, technology, data and machine learning are changing the insurance industry in fundamental ways. This change is happening at an ever-increasing rate, which I expect to continue. It will not slow down, and it won’t go away. Those carriers that don’t intelligently embrace and leverage these ideas will put their companies at a significant disadvantage. More simply put: There will be winners and losers, and the firms that best leverage these new tools and technologies will be the winners.