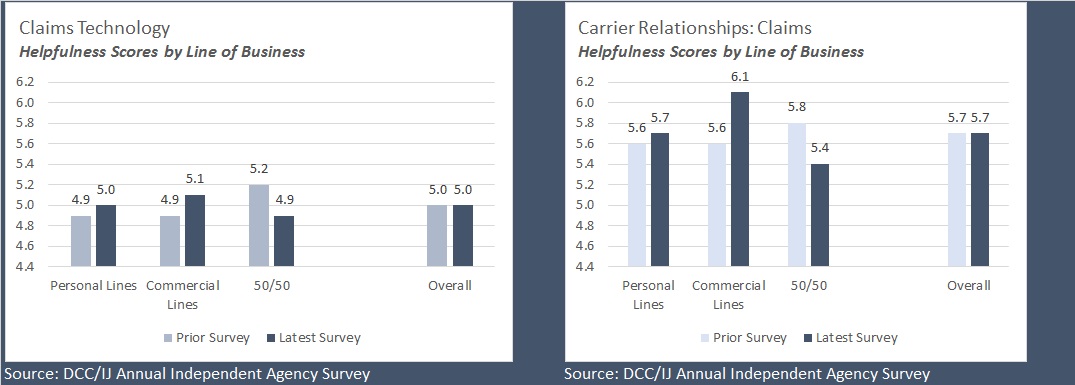

While the overriding theme of the DCC report was the fact that the latest survey results generally corroborate a collection of mediocre scores for carrier technology from agents and just slightly better views on relationships, in the area that reflected the worst scores two years running, there were some noticeable pockets of improvement.

With just about nowhere to go but up, the absolute lowest scores from the prior survey for claims technology each improved:

- A 4.5 score from agents under the age of 40 jumped to 5.2.

- Average scores of 4.9 from agents working in the smallest firms (1-20 employees), those working in agencies specializing in personal lines and those who described themselves as agency principals all rose to 5.0.

- Another 4.9 prior-survey score—for claims technology from agents working in commercial lines agencies—rose to 5.1.

Commercial Lines Scores Advance

Commercial lines agencies also accounted for one of the biggest upward movements in scores recorded in the survey—not for technology but instead for the help they get from day-to-day interactions with carrier personnel on claims matters. Their average relationship “helpfulness” score advanced from 5.6 in the prior survey to 6.1 in the latest one.

The 0.2-point increase in the average score related to claims technology and the 0.5-point increase on relationships appear to be part of a general trend upward in the year-over-year changes in scores from commercial lines agents, with three of the four technology scores and three out of four relationship scores all higher than those recorded by DCC for the prior year’s survey. (The two scores that didn’t advance—related to technology for writing policies and relationship guidance in servicing policies—remained unchanged for commercial lines agents.)

The commercial lines group, in fact, was the only cut of the data—by line of business segment, by size, by age group or agency role—for which more than four scores out of the eight total technology and relationship scores went up in the latest survey and no score declined.

While the under-40 age group also showed some strong upward movement in three scores (the average technology score for claims help rose to 0.7 points from 4.5 to 5.2, and the relationship scores for servicing and claims moved at least 0.5 points or more to 6.2), a drop of 0.4 points in the young agents’ score for technology to help with prospecting brought that average down from 5.3 in the prior survey to under 5.0 in the latest (4.9).

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers