SUMMARY

-

Personal auto insurance application fraud has increased 18 percent since 2019.

-

Artificial intelligence (AI) is powering advances in search-and-match algorithms that improve hit rates, reduce false positives, and help identify attempted evasion.

-

Insurers can leverage 65+ fraud-detection triggers in real-time via a “stoplight” approach that directs quote workflow to help automate and fast-track low-risk quotes, investigate those with potential for soft fraud, and mitigate risks with hard-fraud signals.

-

In an unparalleled hard market, application fraud analytics offer a more precise path to sustainable, profitable growth without extreme non-rate actions that slow new business in underpriced markets.

How is fraud affecting the insurance industry? What types of fraud are most common? Can new technologies and tools help personal auto leaders detect application fraud and confront premium leakage at the point of quote?

Hard times lead to hard (and soft) fraud

Fraud adds up to more than $300 billion per year for the U.S. insurance industry, a cost borne in part by consumers. Hard economic times and the challenges of the past few years may tempt individuals to commit fraud. While claims fraud is most prevalent, auto insurance application fraud is also on the rise.

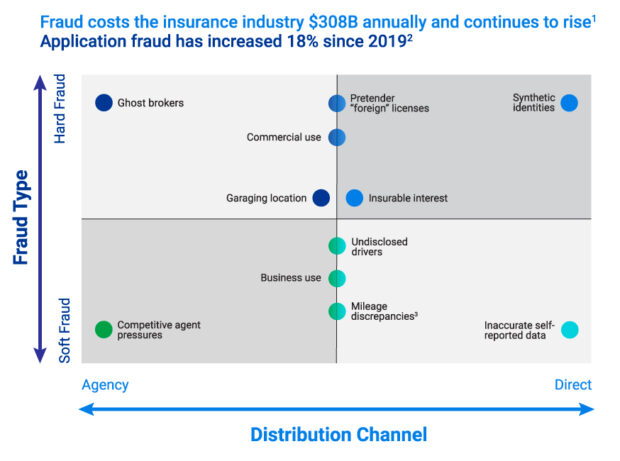

Application fraud can be “hard” or “soft” based on the level of criminal intent, and applicants and agents alike can be the direct culprits. Here are some common types of application fraud auto insurers face.

Premium leakage for personal auto is estimated at $35.1 billion annually,4 and application fraud—as defined by Verisk’s average RISK:check® score—is 18% higher in 2023 compared with a 2019 baseline.

In the case of hard fraud, individuals with criminal intent may be plotting future claims schemes or attempts at identity theft. During pandemic lockdowns, identity theft schemes targeted unemployment insurance. More recently, application fraud schemes have emerged, such as “ghost brokers” who trick applicants by collecting money upfront for nonexistent insurance, and synthetic identities that blend pieces of several identities.

Personal auto insurance leaders can leverage new tools to help detect application fraud and confront premium leakage.

Direct traffic with the RISK:check® stoplight

Verisk’s RISK:check Point of Sale offers an innovative solution to tackle application fraud. Insurers can leverage more than 65 fraud-detection triggers in real-time via a “stoplight” approach that directs quote workflow to help:

- automate and fast-track quotes for green-light, truthful applications,

- investigate yellow-light applications with the potential for soft fraud, and

- mitigate red-light risks that have hard fraud signals.

About two-thirds of applications show no triggers for potential application fraud, so why not fast-track quotes for these individuals who appear to be truthful? Only about 3 to 5 percent of applications fall into the red-light category, and these are likely risks you should examine further before putting them on your book of business. Segmenting applications in this way can help you focus resources on additional underwriting review to fight premium leakage and capture the right premium for the right risk.

The RISK:check triggers flag potential fraud in several categories: Identity, address/garaging exceptions, discovered drivers in the household, commercial vehicle usage, branded titles, and more. These reason codes along with RISK:check scoring analytics can be harnessed for the stoplight approach to inform underwriting workflows and additional vetting of risks as warranted.

Another feature of the solution is that artificial intelligence (AI) powers new advances in search-and-match algorithms to improve hit rates, reduce false positives, and help identify attempted evasion.5 In addition, these fraud-detection elements are accessible through Verisk’s LightSpeed for Personal Auto to move data forward in the quote flow and modernize the insurance buying experience.

A nuanced approach to non-rate actions

In an unparalleled hard market, application fraud analytics offer a more precise alternative to help foster sustainable, profitable growth. This approach stands in contrast to more extreme and blunt non-rate actions that some insurers are implementing to slow new business in markets that suffer from inadequate rates and other regulatory hurdles.

Consider the following broad non-rate actions some insurers are implementing for new and renewal business:

| New Business | Renewal Business |

| • Automated underwriting holds | • Increased renewal surveys |

| • Requiring documentation pre-bind | • Strict annual mileage verification |

| • Pausing new business in some states | • Increased nonrenewals |

Even if you are slightly underpriced in certain markets, would you want to fast-track truthful applicants for a quote while you work to address longer-term rate adequacy and grow market share among good risks? These precision tools offer flexibility and nuance to customize your approach by geography and a variety of other factors. Last, explore why some clients of Verisk’s RISK:check suite achieve an impressive 22:1 return on investment over the policy life cycle: RISK:check Renewal enables insurers to employ non-rate actions at renewal as one of the fastest ways to address short-term profitability challenges.

Ask your Verisk account executive about a 30-day free trial of RISK:check Point of Sale, available for a limited time.

Brad Magick, CPCU, leads the management of Verisk products for auto underwriting fraud, application and rate integrity, and book health. These products include Verisk’s RISK:check suite to help insurers mitigate fraud and confront premium leakage—a $35.1 billion annual problem for the industry. He oversees point-of-sale and renewal solutions, as well as advanced analytics that enable prioritized pursuit of premium recovery and policyholder outreach programs.

- The Impact of Insurance Fraud on the US Economy, The Coalition Against Insurance Fraud, 2022.

- Verisk client analysis of 9.1M transactions from 2019 to August 2023, based on the average RISK:check score.

- Mileage is not tracked at the point of sale via RISK:check Point of Sales, but it can be obtained with Verisk’s MileageConfirm or at renewal with optional policyholder contact for premium recapture via Verisk’s complete RISK:check suite.

- The Impact of Insurance Fraud on the US Economy, The Coalition Against Insurance Fraud, 2022,; Additional Verisk research can be found in the report: The Challenge of Auto Insurance Premium Leakage, 2017.

- Artificial intelligence is used to improve search-and-match algorithms only and is not used in calculating potential application fraud triggers or for the RISK:check Point of Sale scoring analytics.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs