A new Verisk analysis finds the national average motor vehicle report (MVR) fee now stands at $10.65 and has increased by more than 25% over the past decade.

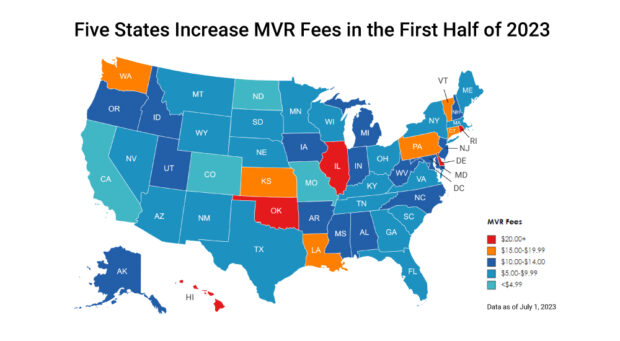

In the first half of 2023 alone, five states increased MVR fees:

- Effective January 1, Kentucky adjusted its rate from $5.50 per record to $6.00

- Effective July 1:

- Idaho moved from $9.00 per record to $10.00

- Illinois jumped from $12.00 per record to $20.00

- Pennsylvania increased fees from $14.00 per record to $16.00, and

- Oregon lifted the price from $13.17 per record to $13.99.

These changes bring the number of states that charge $20 or more for MVRs to five, with 11 charging $15 or more.

Verisk Expands Violation Risk Capabilities

Verisk’s LightSpeed auto suite helps deliver the information needed for insurers to develop an accurate, bindable auto quote as early as the first rate call. MVRs are traditionally used to evaluate violation risk, but they are one of the most expensive components of auto insurance underwriting. Verisk’s full complement of driving history tools helps insurers, employers, and transportation companies manage risk and optimize these expenses. These tools leverage cost-efficient driving risk indicators to improve underwriting efficiency, boost conversion rates, and improve the consumer experience.

Additional enhancements:

- Verisk recently harnessed court records to add New Mexico to the growing list of states where a new business indicator of activity is available.

- Verisk now provides capabilities for ongoing tracking of driver violations in nearly every state.

- New driver monitoring capabilities, informed by court record data, have expanded into three new states: Kentucky, Massachusetts, and Mississippi.

Growing Public Records Capabilities

Verisk’s new Public Records Intelligence solution delivers court and other public record data for valuable insurer use cases. Gain insights from more than 1.8 billion court records and 100 million crash records obtained from more than 30,000 public data sources. With Verisk’s deep domain expertise in compliance and scalable technologies, this information can be streamlined into insurance-ready analytics, such as standardized violation codes, and used in automated workflows to improve efficiency and return on investment.

Learn more about Verisk’s Driving History Solutions.

By Lacy Berthold, Danyel Hickling, and Mark Vilbrandt

Lacy Berthold, underwriting product manager at Verisk, is responsible for product development and innovation related to identifying driver risk. She has been with Verisk for more than a decade, with experience in insurance compliance, specifically auto liability insurance reporting and lienholder notifications, and product management of driving history solutions.

Danyel Hickling, underwriting product manager at Verisk, is responsible for product development and innovation in identifying driver risk for commercial auto insurance. She joined Verisk in 2022 and has more than 20 years of experience in the insurance industry at both carrier and MGA/MGU offices, specializing in commercial transportation. Her resume includes working as a production underwriter and team lead. Throughout her career, she has focused on supporting profitable growth and ensuring the success of her customers.

Mark Vilbrandt, underwriting product manager at Verisk, is responsible for product development and innovation related to identifying driver risk. He has 18 years of experience working at a top-10 personal lines carrier with specializations in underwriting, product management, telematics, and product development, across both auto and property lines of business. Throughout his career, Mark has maintained an unwavering focus on building innovative new products that drive profitable growth.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality