For parts of three decades, one of TV’s most popular shows has been “Whose Line is it Anyway?”, the spinoff of a UK improv show that used a rotating cast of actors, plus a musician and a slew of improv games to get audiences laughing. One of Whose Line’s more popular games is called “Stand, Sit, Lie.” Actors are given a scene that they need to act out, but during the scene, one actor must be sitting, one must be standing, and one must be lying down. If an actor changes position, the other actors must move quickly to fill the empty space. If the standing actor sits down, the sitting actor has to stand up. If the one sitting lies down…you get the picture. Roles and positions change frequently.

SMB companies and Group & Voluntary Benefits insurers, agents, and brokers are also shifting roles, seemingly at random. Roles are not only in flux, but they are also almost improvisational. SMB companies that used to lie down and wait for brokers to feed them benefits are now sitting up and searching for their own through different distribution channels. Insurers are expanding from agents or brokers are now standing up with new products and services and seeking additional partner and channel options.

Data’s role is also in motion. For years, Group & Voluntary insurers have used relatively little “feedback” data to tailor insurance or services. There was very little plan customization. There was almost no employee personalization for most benefits. In many cases, employee data was held simply as a name in a group record. Insurers relied upon year-over-year claims experience and usage data to adapt pricing. Today, however, employees and businesses are willing to share more relevant data, but Group & Voluntary insurers are struggling to figure out how to put it to good use.

What insurers really need is a holistic look at:

a.) giving employees experiences they don’t want to give up when they leave the company,

b.) improving their relationships and connections with value-added services, and

c.) how their technologies grow employer interest and expand product and channel options.

Role-reversals and changes will be needed, but in order to add roles and remain productive, insurers will need to understand how they can use technology to build their businesses. It will require new uses of data, value-added services, and channel options.

To give everyone involved better insights into the Group & Voluntary market and opportunities, Majesco SMB survey data and Insurer survey data from our 2023 reports was used to compare and contrast where each player thinks they are, versus where each player is planning on going. Do these shifts match demand or will overlapping roles diminish everyone’s ROI? For an in-depth look at the results, you can download, Bridging the Customer Expectation Gap for Group and Voluntary Benefits.

The Importance of Data & Analytics for Group & Voluntary Benefits

The importance of capturing, enriching, and using data for identifying opportunities and then delivering a relevant and engaging experience for employees is crucial for Group and Voluntary benefits providers in today’s digital era. Whether the data is structured, unstructured, real-time IoT, or machine-generated, it must be leveraged by advanced analytics to enable the creation of tailored propositions and more compelling customer experiences…aligning employee needs to the appropriate products and services, thereby creating deeper trust, loyalty, and engagement.

There is an opportunity during enrollment to provide guidance on products based on their data. Moving beyond the once-a-year enrollment is also an opportunity to expand products and value. Just consider, the birth of a child, entering college, purchase of a new home, getting a new pet, switching to a Gig worker status, or retirement are all events or instances where the employee’s risk needs change but may be missed opportunities for insurers. Does this need to be the case – especially with the demand for individual and Gig products rising? Could we capture more employee-related data internally and externally to guide them in selecting insurance benefits when needed, not just annually? Yes, if we rethink how we do business. Anything that helps the employee make the right choices at the right times creates customer loyalty and value.

SMB Customer – Insurer Gaps for Data Sources and Technologies

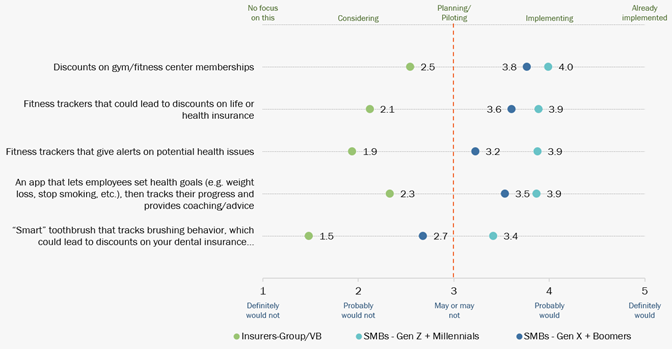

Structured, unstructured, transactional, real-time, and third-party data across the Group and Voluntary benefits spectrum can be used to drive innovative data-led propositions, improved underwriting and claims, and ultimately enhanced customer experiences. SMB customers and their employees, particularly Millennials and Gen Z are more than willing to provide a broader range of data for personalization, as represented in Figure 1. However, insurers are not using this data effectively, creating a large customer expectation gap.

As more employees look for access to worksites or individual products that are easily portable, having them priced based on their personal risk rather than as part of the group will be increasingly demanded. In addition, use of the data and other demographic factors can be used to suggest specific products within the benefit plan that are more aligned with their needs and expectations at enrollment, driving greater product adoption. This is something Majesco Intelligent Core for L&AH and Intelligent Sales and Underwriting Workbench do for our customers. It’s why we call them “intelligent solutions.”

Figure 1: SMB-Insurer gaps in new data sources and technologies for group/voluntary benefits pricing and underwriting

Leading Insurers Navigating the Gaps Using New Methods or Data Sources

Here are some examples of insurance improv in action. All three of these insurers reached outside of their traditional roles to provide a benefit or service connected to trends or innovations from outside the industry.

- Aflac launched dental, vision, and hearing plans for individuals pursuing contract, Gig, or solo entrepreneurial work outside traditional workplaces or entering retirement.[1]

- A leading benefits provider launched a new critical illness product that provides DNA testing to support personalized cancer treatments.

- Beam Insurance launched a new dental product that includes a smart toothbrush to monitor brushing for improved health.[2]

Value-Added Services for Group & Voluntary Benefits

A key strategy for insurers to address customer expectations is to increase the value of the products they offer. To do so, insurers should bundle, or offer for a price, value-added services that extend the value of the risk product/policy, such as earning points for wellness that can be used to buy things, annual financial planning assessment, roadside assistance, claims assistance and more.

Value-added services can create new revenue opportunities while also strengthening the customer relationship, loyalty, trust, and value. Often, these fit into the role of financial wellness. It is where our partnership with Empathy to enhance the claims process adds tremendous value.

MB Customer – Insurer Gaps for Value-Added Services

Across the board, there is a significant customer expectation gap between what customers want – regardless of generational group – and what insurers are delivering, as represented in Figure 2. These value-added services provide tangible value and enhance overall wellness with alerts and more.

In addition, these options could gather more personalized data to enhance their pricing as well as their overall experience. Many are “low hanging fruit” that would not take a lot of effort, but create tremendous value and start insurers down the road to a more holistic, valued offering and experience for customers. Much of the employee health and wellness data needed for value-added services or data-supplemented products is already available today through sources such as Fitbit, Apple, and Strava APIs — insurers can simply take advantage of available data. Employers and employees are growing much more amenable to sharing when they see the value in providing it.

Figure 2: SMB-Insurer gaps in value-added services for group/voluntary benefits

Leading Insurers Navigating the Gaps with Value-Added Services

Here are some examples of companies that are making it happen. They are improving their products as they encourage lifestyle and wellness improvements among employee populations.

- EquiTrust Life Insurance Company partnered with Assured Allies to offer its Bridge fixed indexed annuity with a long-term care rider policyholders access to Assured Allies’ NeverStop data and analytics-based wellness program.[3]

- YuLife in the UK wraps their group protection proposition with their employee well-being app, providing access to well-being tracking and counseling services, and reward partners to build a more engaging proposition for the employee while also providing services to the employer to increase employees’ productivity and loyalty.[4]

- Vitality offers a range of value-added services that are focused on wellness and are partnering with different insurers globally like John Hancock.

Distribution Channels for Group & Voluntary Benefits

In the traditional distribution model, insurers fight for a share of mind and wallet, so customers think of them when they need insurance. Many large insurers spend hundreds of millions of dollars on advertising and others spend significant dollars in the traditional agent/broker channel, to keep them “top of mind” when insurance is needed. With the increasing competitive challenges to attract and retain customers, insurers must develop and utilize a broader distribution ecosystem that engages customers when and how they want…putting the customer first.

Today’s interconnected world requires insurance to play across a broad distribution spectrum of channel options, expanding reach to customers when, where, and with whom they want to buy insurance. These options form a distribution ecosystem that expands reach but requires a partnership approach, particularly for embedded channels.

SMB Customer – Insurer Gaps in the Pursuit of Distribution Channels

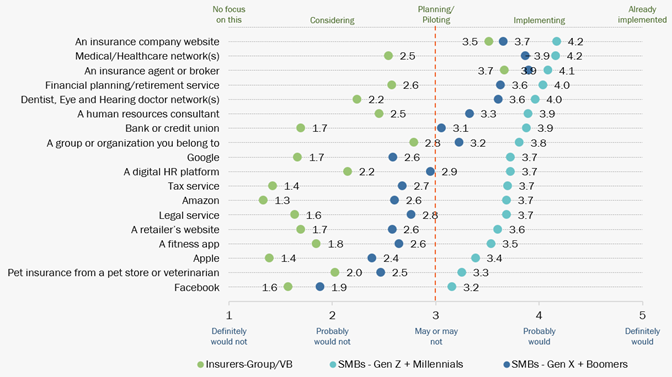

Today’s buyers still look to agents and brokers, but will look to buy insurance through other channels or entities as well, as reflected in Figure 3. SMBs are leveraging other trusted and loyal relationships that make buying insurance through them relevant, particularly for the Millennial and Gen Z SMB owners.

This customer expectation gap reflects how group and voluntary benefit insurers are limiting their market reach to this very large and under-supported market segment.

Figure 3: SMB-Insurer gaps in distribution channels for group/voluntary benefits

Leading Companies Entering the Industry by Taking on New Roles

- Highlighting the GAFA company options, some analysts are predicting Apple will enter the health insurance market in 2024, leveraging rich fitness and health data gathered from millions of Apple Watch users[5] which will directly align with their desire for personalized insurance using data from fitness trackers as noted previously.

- ADP works with some insurers to offer benefit plan options to SMBs, given they have a broader trusted relationship to manage HR and payroll needs.[6]

The Payoff — Taking on New Roles

Instead of continuing the decades-long fight for a share of the same large employer market, we now have an unmet market opportunity with small and medium employers. The growth opportunities are pretty astounding. Over 50% of employees work in an SMB company. We need to take a step back to rethink how that market needs to be served, and how we can provide benefits to a vastly changed employee work environment and marketplace.

There’s a vast area of untapped opportunities in diversified plays beyond the traditional coverages offered. While the anchor propositions for employer plans are healthcare and retirement services and traditional group covers for protection and disability, expanding beyond this usual set is crucial to close the customer expectation gap and drive growth.

Most of these payoffs will be found under categories of new products and services (utilizing data in new ways), new relationships (using untapped partnerships and channels), and additional capabilities (providing employers with tools that save time and effort, along with giving greater insights.) Each of these areas needs to be approached holistically using a fresh approach to operations plus a tech transformation that includes the use of AI, machine learning, and intelligent core system design.

Majesco gives Group & Voluntary insurers a boost into new markets and channels by providing them with technologies that expertly fit the demands of the new, improvisational market landscape. To learn more about how Majesco is helping build a new framework for Group & Voluntary growth, visit Majesco’s Intelligent Core for L&AH, Intelligent Sales & Underwriting Workbench, Digital Enroll360 for L&AH, and Majesco ClaimVantage Enterprise Claims Management for L&AH. Be sure to also download Bridging the Customer Expectation Gap for Group and Voluntary Benefits.

By Denise Garth

[1] “Aflac Dental, Vision and Hearing Plans Now Available to Individuals Outside the Traditional Worksite,” PR Newswire, October 13, 2022, https://www.prnewswire.com/news-releases/aflac-dental-vision-and-hearing-plans-now-available-to-individuals-outside-the-traditional-worksite-301648479.html

[2] McGrath, Jenny, “Beam wants to give you a smart toothbrush, then use the data for your dental insurance,” Digital Trends, August 26, 2015, https://www.digitaltrends.com/home/beam-technologies-introduces-dental-insurance-with-its-smart-toothbrush/

[3] Shashoua, Michael, “Assured Allies partners with EquiTrust on long-term care insurance,” Digital Insurance, December 8, 2022, https://www.dig-in.com/news/assured-allies-equitrust-launch-ltc-wellness-program

[4] Macgregor, Jamie, McCoach, Dan, “Next-Gen Platforms in Group and Voluntary: Exploiting new opportunities across the worksite ecosystem,” Celent, August 26, 2021, https://www.majesco.com/white-papers/next-gen-platforms-in-group-and-voluntary/

[5] Collins, Barry, “Apple Will Launch Health Insurance In 2024, Says Analyst,” Forbes, October 18, 2022, https://www.forbes.com/sites/barrycollins/2022/10/18/apple-will-launch-health-insurance–in-2o24-says-analyst/amp/

[6] Small business employee benefits, ADP, https://www.adp.com/resources/articles-and-insights/articles/s/small-business-employee-benefits.aspx

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit