Executives of Zurich Insurance Group and American International Group separately updated shareholders on transformation initiatives reshaping their businesses in November—with each saying they plan to build on strong customer relationship models within their commercial insurance businesses.

While neither Zurich nor AIG executives said they plan to grow the commercial lines business overall, Zurich Group Chief Executive Officer Mario Greco noted that his company has an increasing appetite for short-tail and specialty business. At AIG, Commercial Insurance CEO Rob Schimek puts E&S property and U.S. excess casualty in the “reduce” category, while looking to grow large limit property and international primary casualty.

And both companies are keen on specialties like financial lines, with Schimek highlighting M&A and cyber as potentially double-digit growth opportunities and Greco offering surety as a potential avenue of growth.

The two men provided more details of their appetites, joining other executives during their Investor Day events to also review progress on activities to reshape their insurance portfolios, cut costs, and building for the future. Below are some highlights of what key executives said on various topics.

Zurich Eyes ‘Tactical’ Specialty Lines Growth

Beyond the headline financial goals that include plans to slash Zurich’s costs some $1.5 billion by 2019 (compared to 2015) and a targeted business operating profit return on equity (after tax) in excess of 12 percent from 2017 onwards, Greco said that clarifying the appetite was one of several specific goals for Zurich’s commercial business. “We haven’t been clear in the market over the past years on what is our risk appetite. I heard that many times from brokers. I heard it from customers. We have changed risk appetite.

“We have to fix that and then work with a clear risk appetite message in the industry, and go and get the business that we like,” he said, going on to say that Zurich also aims to fix and overweight position in long-tail lines.

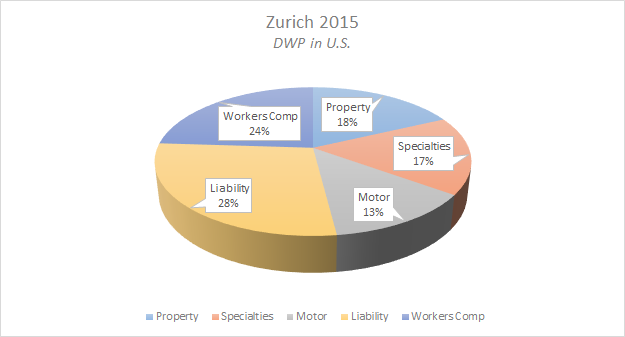

Characterizing the existing commercial insurance portfolios as “quite unbalanced,” and using Zurich’s $12 billon U.S. commercial book as an example, he compared the mix of Zurich’s direct written premiums by line to the overall industry book of nearly $300 billion (using 2015 figures).

“In specialties, we have a fair share,” he said, grouping the accident and health, credit and surety, financial, marine and aviation, and professional lines together in his definition of “specialties” and revealing that together they make up 17 percent of Zurich’s portfolio. While specialty lines also make up 17 percent of the overall industry commercial lines portfolio, “where we have a bigger share is in the long-tail business”—workers compensation and liability. For the market, these lines are 50 percent of the industry’s commercial lines total; for Zurich, they’re 52 percent.

That 2 percent makes a big difference, Greco asserted. “We are overexposed to long-tail, and consequently relatively less exposed to the short-tail business,” he said. A slide shown as he spoke revealed that short-tail lines—defined as property and motor—account for 34 percent of the industry U.S. commercial lines book and 31 percent of Zurich’s. “We think it is important over time to rebalance this and grow more short tail, which doesn’t mean we will shrink the long-tail but rather that we want grow the short-tail” and specialties, he said, noting a big difference in Zurich’s combined ratios for the businesses —a 12-point differential between long-tail and specialties, according to the slide.

In addition to better combined ratios, “it is completely different business,” he said characterizing long-tail business as “more strategic,” and short-tail and specialties as “more tactical.” To write long-tail business, “you work with customers,” while short-tail and specialty lines are “product specific.”

“There is no reason not to grow tactical businesses if it is profitable and if it can help reduce the volatility of our businesses,” he said, reiterating an overriding theme of the Investor Day presentation. “We will run the business with less volatility. We will take less risks on assets and less risks on the business itself,” he had said earlier during his opening remarks.

“A company like Zurich doesn’t have to chase top-line growth ever.”

Mario Greco, Zurich Group CEO

Greco affirmed: “We need to go back to technical excellence. I honestly think it was a mistake to target growth. We need to target quality. We need to target the returns of the portfolios; we shouldn’t target top line.”

Responding to an analyst who heard mixed messages in the statements about not focusing on growth but pursuing growth in short-tail commercial lines, which the analyst characterized as “challenged in terms of pricing,” Greco repeated his main message.

“A company like Zurich doesn’t have to chase top-line growth ever. We need the growth of Farmers. We need the growth of Life [business]. But GI should never never have a target of growth. It should have a target of profits, a target of loss ratio.”

“The Specialty business that we’re particularly interested in nurturing and growing over the next years is a very tactical one. It’s a business where you don’t serve clients. You sell products. It’s a business where you enter and you might leave,” he said, giving aviation business as an example. “Would you like to enter in 2014? Likely not. It was loss-making already and in ’15 was even worse. Would you consider entering in 2016? You might because this year it’s a profitable business.

“This is the nature of this beast here. It’s a tactical business where you have to have the capacity to go in and out,” he said, noting that James Shea, a former executive for AIG’s Global Specialty Lines and Global Financial Lines teams who took over as Zurich’s CEO of Commercial Insurance—the combination of what were separate Commercial and Global Corporate businesses—in September, knows the business well..

“I think it’s interesting to have some short-tail growing businesses like this one. It doesn’t mean we will grow it [immediately]. It just means we need to be in condition whenever we are interested to grow it if we want. But in some years, we will shrink it, depending on the market conditions.”

Beyond creating a global specialties team, within the commercial segment, Zurich will seek to increase its penetration of international clients, building on key strengths of the overall group—being globally diversified and having a strong customer brand.

“Global Corporate developed a ‘relationship model,’ which is unique in the market. This is something that is a Zurich attribute. It’s unique at Zurich,” Greco said. “We have more than 1,000 ‘Relationship Customers’ today,” he said. “These are named customers. For those customers, we have account managers. I am involved in a number of these, as are a number of other executive committee members and as the board itself will be ….”We need to use [this model] more and better. We need to extend it. We need to bring it down,” he said, suggesting that the model will be applied to customers who are not as large as those formerly handled by the Global Corporate division.

Separately, Terryn described Zurich’s Risk Advisor digital platform, developed for multinational customers and offering a suite of self-service risk assessments and risk prevention insights on a mobile app, noting that this will be rolled out to all customers going forward. In addition to benefiting customers directly, the tool helps Zurich with efficiency goals as well. In the past, risk engineers might only focus on visiting high-risk locations to make on-site risk assessments to inform underwriting decisions due to natural cost and resource capacity limits.

‘One Client at a Time’ Still the Focus in AIG’s Renaissance

Highlighting Zurich’s strengths in the global market, Greco said that the number of international programs the group writes “is far above anyone else” at 7,600. Chubb has the next largest number—4,200, according to a slide presented at the session, which noted that AIG data was not available.

Filling in the blank at AIG’s Investor Day, Schimek said that AIG serves 6,700 multinational clients and issues over 40,000 local policies. “This is something that absolutely sets AIG apart,” Schimek said, pointing to a map covered with colored dots to highlight the number of client operations AIG has in different areas of the world. “In our view, this is the best combination of owned operations and network partners operating anywhere in the insurance marketplace….We’re serving clients in over 200 countries and jurisdictions, he said, referring to AIG’s Commercial and Consumer divisions partnering together to bring seamless services to clients in these geographies.

The business remains attractive for AIG because it is profitable and it has good growth, Schimek said, noting that AIG multinational clients have grown 8 percent per year, on average, between 2012 and 2016. “It’s very hard to unseat us as an incumbent. It’s very sticky business for us,” he said, noting high entry barriers in the multinational market.

“What you should be very interested in is who’s picking up the business that we’re letting go of. We let go of $2.6 billion worth of business.”

“What you should be very interested in is who’s picking up the business that we’re letting go of. We let go of $2.6 billion worth of business.”

Rob Schimek, AIG Commercial CEO

Schimek also highlighted the “market-leading capacity” AIG provides in commercial property ($2.5 billion in limits), terrorism ($1 billion terror), and property-catastrophe ($500 million). “Those kinds of limits separate AIG from the rest of the pack. We’re able to take a position that otherwise would be shared by many carriers in the marketplace, and have that position owned and controlled by AIG.”

The Commercial CEO’s comments dovetailed with those of group CEO Peter Hancock, who reiterated a vision he first spelled out 18 months ago: “We have a humble objective to be our client’s most valued insurer, one client at a time,” Hancock said.

Like Greco at Zurich, Hancock discussed financial targets and AIG’s progress in meeting them, and spoke about work begun earlier this year to “reshape AIG into a simpler and more focused company.” Less humbly, Hancock likened the reshaping activities to the work of a sculptor and quoted words he attributed to Renaissance artist Michelangelo: “I saw the angel in the marble and I carved until I set him free.” Hancock maintains that AIG’s business leaders—its sculptors—”are not only transforming AIG but [also] shaping the insurance industry of the future.”

Hancock and Schimek delivered bold assertions about future-shaping discoveries that will be borne of innovation partnerships—like one with Two Sigma and Hamilton Insurance, for example, aiming to disrupt the $80 billion SME market, or another with Clemson University, tapping into its modeling and “supercomputing power” to educate AIG and its clients about risks.

A science team within AIG uses “client centric analytics” to benchmark individual customer claims results against those of the rest of AIG’s clients. “We’re able to share with them where they are better and worse than others in their class, [and therefore] what they should change to bend the loss curve [to] improve results,” Schimek said.

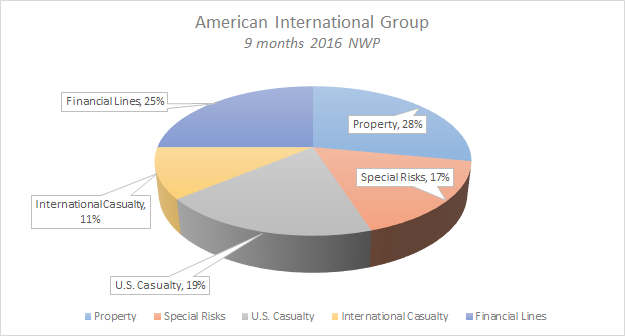

Between those descriptions, Schimek painstakingly detailed how AIG is carving through the commercial lines book, shedding unwanted business and growing profitable accounts to move toward one of the group’s targeted financial goals—a six-point reduction in the commercial lines (adjusted) accident year loss ratio (from the 66.2 level of full year 2015) by 2017.

Casualty business exits and business mix changes has shaved off two points so far, he reported. But an analyst questioned how AIG can hope to select the best risks in a competitive market going forward in 2017. “It’s difficult for us to see loss ratio improvement coming without loss of premium,” the analyst said.

“It’s not helping me by selling those three entities. But we didn’t not sell them because it was going to make my adjusted accident year loss ratio not look good. We focused on Peter’s hierarchy of goals,” he said, noting that the deals “will ultimately be accretive to AIG.”

Addressing the premise of the question head-on—the idea that a competitive market will deter AIG’s progress on improving the commercial lines loss ratio further—Schimek asserted that “it has been far easier” for AIG to change its mix of business precisely because it’s competitive environment.

“What you should be very interested in is who’s picking up the business that we’re letting go of. We let go of $2.6 billion worth of business” already, referring to buckets of business slated to “improve” or “remediate.” That’s translated into a 33 percent drop in net premiums for the first nine months of 2016 compared to the same period in 2015, with a corresponding 6 point drop in the overall loss ratio for those two buckets. “Rest assured it went somewhere. And what’s fabulous is that our clients were not upset with us …because the rate environment allowed them to find another place to put the business and still retain their valuable relationship with AIG,” Schimek said.

“We worked with them and said, ‘We love you as a client but you think you’re doing us a favor by giving us all your premium when in reality, we have 10 lines [but] we’d be better off with eight.’ So we still have eight [and] the client’s more valuable to us….

They had no problem being able to place it somewhere else ….I’d actually argue that rate environment has been an advantage for us,” he said.

Schimek also noted because AIG’s transformation was officially launched on Jan. 26 this year, the commercial team has not yet worked on combing through risks that renew in the fourth quarter or a full first quarter to determine whether they fall in buckets earmarked to maintain or to improve and remediate. With the heaviest renewals in Europe occurring on Jan. 1, “using the exact tools that delivered improvement [so far], we’re confident that we will be able to deliver the remainder through risk selection,” he said.

Schimek went on to list areas where AIG sees good opportunities to grow. “We’re growing double-digits in some really attractive places—for example, large limits property where we can use our engineering capability to drive a different answer. We’re seeing great opportunities in cyber, M&A and parts of financial lines that provides us with help notwithstanding an environment where otherwise rates have been against us.”

As he spoke, he showed a slide that depicted each of the lines in different-sized boxes, with the relative size indicating the relative amount of capital consumption for new business. He made the point that AIG is not just seeking to lower the accident year loss ratio in commercial lines. By considering capital, the team works towards achieving higher goals of the organization that Hancock outlined in the form of a hierarchical pyramid—specifically, growing intrinsic value and return on equity.

U.S. excess casualty, a much larger box (and capital consumer) than either cyber and M&A transactional liability insurance, will be shrinking. AIG will also reduce amount of capital and the amount of business written for a similarly sized box representing excess and surplus lines property. “I’d love for market conditions to be better and to be able to grow there. We have a leadership position there, but we can’t achieve an attractive rate of return there today at today’s market conditions. And so it’s shrinking,” Schimek said.

The same is true for aerospace—a tiny box on the chart. “We love it, we’re very capable in it but it’s highly competitive. We will hold our space but we’re not going to deploy a significant amount capital if we can’t get an appropriate return.”

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Preparing for an AI Native Future

Preparing for an AI Native Future  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages