Despite proclamations by some observers that the reinsurance cycle is dead, JLT Re says, reports of its demise are greatly exaggerated – and now is the time for buyers to use the cycle, and reinsurance, to their advantage.

Despite proclamations by some observers that the reinsurance cycle is dead, JLT Re says, reports of its demise are greatly exaggerated – and now is the time for buyers to use the cycle, and reinsurance, to their advantage.

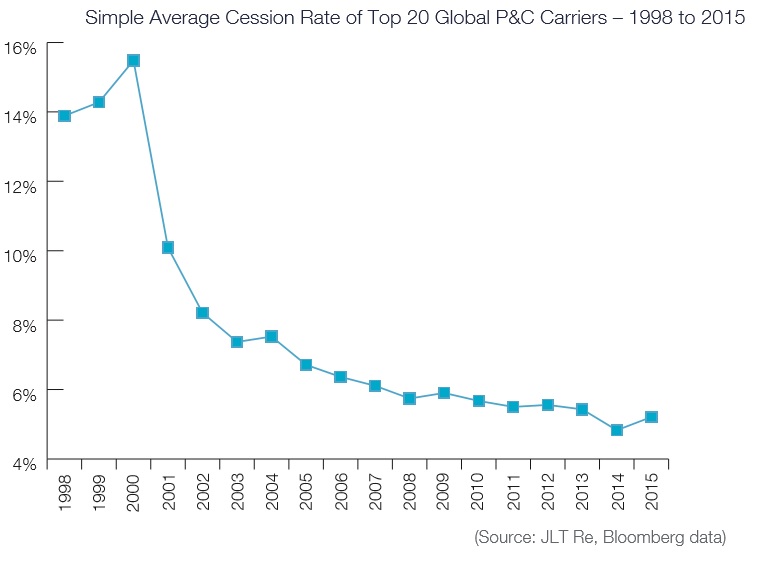

Rates are competitive, but reinsurance cessions are historically low, which perhaps isn’t the best use of capital, indicated the report which underscores the value and efficiency of reinsurance capital in the current marketplace.

“The bottom of the pricing cycle represents the optimal time to buy reinsurance, and with rates for certain business lines showing early signs of nearing a floor, current market conditions offer cedents attractive buying opportunities,” said the JLT Re* report titled “Reinsurance: The Price Is Right.”

Further, the report affirmed, there are still massive property catastrophe exposures despite the current low level of catastrophe activity.

Global property-catastrophe reinsurance pricing has dropped 30 percent in the last three years, partly the result of below average loss activity, JLT Re said, noting, however, the potential for insured catastrophe losses has risen at an exponential rate since the 1970s.

“Comparing the most expensive insured catastrophe loss year of the 1970s of $16 billion in 1979 to this decade’s high of $133 billion in 2011 suggests a compound annual growth rate of approximately 6 percent in terms of the largest loss experiences…,” JLT Re added.

This implies a real possibility of a $200 billion loss year before the end of the decade, the report warned.

Counterintuitive Buying Behavior

“Some buying behaviors could, at the moment, be described as counter-intuitive. Cedents’ recent purchases have not, on average, reflected a presumption of higher expected loss experience,” said David Flandro, global head of Analytics, JLT Re, in a statement issued with the report.

He said an analysis of the simple average of cession rates of the top 20 global property and casualty carriers starting in 1998 (and ending in 2015) “shows that the insurance sector is at a long-term cyclical low in terms of reinsurance buying.”

“The peaks and troughs of the underwriting cycle have long been core features of the reinsurance market. No two cycles are the same and market developments over the last five years have seemingly transformed the sector’s capital structure, potentially influencing the duration and volatility of future cycles. But the cycle is not dead,” continued Flandro.

“The peaks and troughs of the underwriting cycle have long been core features of the reinsurance market. No two cycles are the same and market developments over the last five years have seemingly transformed the sector’s capital structure, potentially influencing the duration and volatility of future cycles. But the cycle is not dead,” continued Flandro.

Seizing Buying Opportunities

“By deploying reinsurance strategically, cedents can increase franchise value, support new growth initiatives and pursue more profitable business in order to navigate successfully today’s challenging operating environment,” the report said, noting that reinsurance at current prices is “increasingly a more efficient form of contingent capital than debt, equity and carriers’ own capital.”

JLT Re noted that cedents have an opportunity to “seize the moment and utilize highly competitive reinsurance as a capital optimization tool.”

“Reinsurance is now potentially the best-priced source of capital for most carriers. But market dynamics will not stand still forever and there are already emerging trends around reserving, capital inflows and the macroeconomic environment that could prove to be catalysts for future change,” said Mike Reynolds, Global CEO, JLT Re, noting that reinsurance buyers can secure competitive advantages by anticipating cyclical change.

“We are encouraging clients to carefully re-examine strategic reinsurance purchases, not only in regard to earnings protection but also for value creation,” he added.

“Carriers with the foresight to exploit today’s cost effective reinsurance can help secure future profitability by preparing for the next unforeseen event(s) which could precipitate or accompany a turn in the market,” Reynolds said.

Reynolds noted that increased reinsurance spending “can minimize volatility and protect cedents’ balance sheets in the event of major natural catastrophe losses, large man-made disasters, sudden macroeconomic changes and adverse reserve development issues, or a combination of all four.”

* JLT Re is part of the Jardine Lloyd Thompson Group plc.

*This story appeared previously in our sister publication Insurance Journal.

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Preparing for an AI Native Future

Preparing for an AI Native Future  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs