The $1.9 billion cash-stock deal by RenaissanceRe Holdings Ltd. for Platinum Underwriters Holdings will create a $4 billion company with a bigger footprint in the U.S. casualty and specialty reinsurance markets, executives of RenRe said Monday.

During a conference call following the early morning release of written statements from each of the Bermuda-based reinsurers, RenRe’s chief executive officer Kevin O’Donnell outlined potential benefits, one of which is accelerating his company’s push to build a bigger onshore presence in the U.S. specialty and casualty reinsurance arenas.

During a conference call following the early morning release of written statements from each of the Bermuda-based reinsurers, RenRe’s chief executive officer Kevin O’Donnell outlined potential benefits, one of which is accelerating his company’s push to build a bigger onshore presence in the U.S. specialty and casualty reinsurance arenas.

The deal also gives RenRe more opportunity to put its expertise in managing third-party capital to work on a portion of Platinum Re’s book of business, he said. While this opportunity will likely be centered on property-catastrophe business in the near term, even Platinum’s specialty business could flow in the direction of outside capital providers in the future, O’Donnell suggested.

RenaissanceRe, launched in 1993 in Bermuda in the wake of Hurricane Andrew as a property-catastrophe reinsurer, remained heavily focused on this business in 2014, with roughly 60 percent of its gross premiums coming from that segment (for the 12 months ended Sept. 30). RenRe is also one of the pioneers in the area of managing capital through joint ventures (Top Layer Re, launched in 1999, DaVinci in 2001, and others later on.)

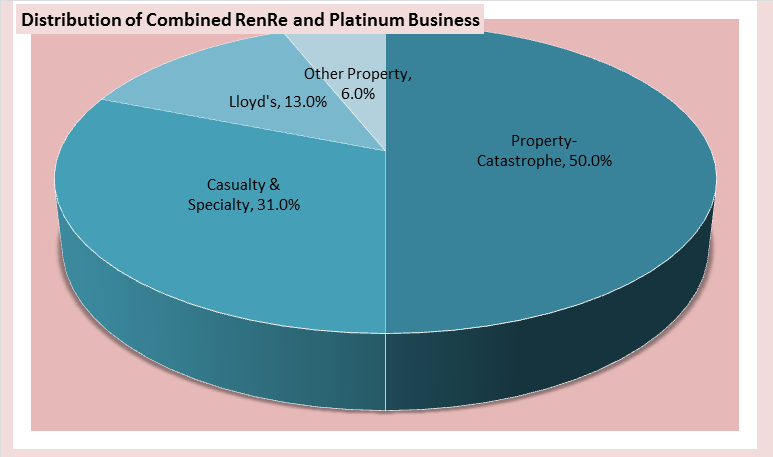

An expansion into proportional and excess-of-loss specialty reinsurance business over the last few years—through steps that included the June 2013 launch of reinsurer RenaissanceRe Specialty U.S. Ltd. and a related specialty reinsurance underwriting agency, as well the formation of a Lloyd’s syndicate in 2009—have reconfigured the business mix pie chart. According to a breakdown for the last three years in the 2013 annual report, specialty reinsurance and Lloyd’s business made up 18 percent of the book in 2011, 24 percent in 2012 and roughly 30 percent in 2013.

Platinum Re, created at the end of 2001, when The St. Paul Companies exited the reinsurance business and sponsored Platinum Underwriters, has historically been a multiline reinsurer. Starting with a book that was roughly 30 percent property and marine in 2003 and 70 percent casualty and finite reinsurance, the split was roughly 40 percent property and marine/60 percent casualty and finite in 2013 (based on net written premiums), according to the holding company’s latest annual filing.

“We feel confident that we can retain the portions of the book we want to retain,” O’Donnell said, responding to an analyst who asked how much of Platinum’s more than $500 million book RenRe plans to keep.

Referring specifically to the property-cat reinsurance portion, which represents 21 percent of Platinum’s portfolio, he said the determination of how much of that RenRe brings into its own underwriting portfolio and how much it shares with its third-party reinsurance partners “is going to be an evolving story.”

“In general, once it’s integrated it will be treated in exactly the same way as our book—where we’re writing it on both RenRe’s paper and then we’re taking companion lines on DaVinci paper,” he said, referring to a sidecar, adding that other sidecars and vehicles for transfer to third parties could potentially be introduced “as we look more carefully at what the customers need.”

Putting the companies together, O’Donnell said the property-cat reinsurance portion of the overall pie will be 50 percent, down from 60 percent at RenRe today.

“We believe the reinsurance market is shifting [and] companies that can deliver broader solutions to their clients will have an advantage,” O’Donnell said. “This transaction positions us well in terms of enhancing our strong client and broker relationships,” as he started to list deal benefits.

Accelerating the growth of RenRe’s U.S. specialty platform was next on his list, although the executive didn’t indicate how much U.S. business either company writes. According to year-end 2013 breakdowns in their respective SEC filings, 11.2 percent of RenRe’s $1.6 billion book was U.S. specialty written in the U.S. or at Lloyd’s, while 46 percent of Platinum’s nearly $600 million book was U.S. casualty business.

As part of the deal, RenRe will take on Platinum’s U.S. operations, located primarily in New York City, along with a smaller regional office in Chicago, O’Donnell said. According to presentation materials published in conjunction with the conference call, 86 of Platinum’s 123 employees are in the U.S. In contrast, only eight members of RenRe’s 285-member workforce are located onshore.

“We’re not buying just a book of business. We’re buying Platinum,” O’Donnell said, responding to a question about which members of the management team would stay on and adding that Liz Mitchell, who he identified as CEO of Platinum’s U.S. operations, has agreed to stay on. “Over the period of integration, we’ll get to know the rest of her team in more detail. We hope that many of them will become part of the RenRe franchise going forward,” he said.

O’Donnell later revealed that Michael Price, CEO of Platinum Underwriting Holdings, would not be joining the combined company.

Both O’Donnell and RenRe’s Chief Financial Officer Jeffrey Kelly spoke about operating and capital efficiencies being additional deal benefits. On the operating side, Kelly said that annual cost savings of roughly $30 million would come from lower facilities costs and reduced infrastructure as well as the elimination of duplicative positions around the company, identifying the redundant roles as being “heavily focused in areas in effectively running a public company.”

On the capital side, the executives noted that introduction of Platinum’s diversifying books of business will reduce required capital overall.

Relative to RenRe’s historical strength in the property-cat world, O’Donnell said: “The deal allows us to optimize the combined property reinsurance portfolio. We have the expertise and technology to make the portfolio more efficient while utilizing our own and third-party balance sheets to improve overall returns.”

“For time being, I would expect that most of the risk for Platinum on the casualty and property side will reside on owned balance sheets,” he added.

Unlike Platinum, which has been exclusively involved in the reinsurance business since inception, RenRe has participated in the insurance market at times throughout its history (in the U.S. program business market during the prior decade, for example) and currently though a Lloyd’s syndicate (RenaissanceRe Syndicate 1458). During the conference call, an analyst asked whether RenRe might look to acquire a specialty primary insurer in the near future in order to get closer to end customers (insureds).

O’Donnell responded by reframing the question. “There has been a lot of conversation about getting close to the customer. That conversation is actually one that I would change slightly to be a conversation about disintermediation,” he said.

“People are seeing capital come in at different parts of the chain, and they’re seeing risk being matched with capital differently—both in property-cat and in other lines of business …

“It’s our belief that as long as we’re adding value between risk and capital, there’s a role for us in any market. And as this market changes, we are constantly focused on providing value in that.”

He concluded: “As far as thinking about the move to primary, our view of that is really one of playing a valuable role in the changing capital structures that are supporting different types of risk—making sure you have a role to play in that.”

The current deal for Platinum is still subject to regulatory approval and approval of Platinum shareholders.

S&P also put its “A-” financial strength rating for Platinum on CreditWatch with positive implications.

The Platinum CreditWatch “reflects the potential support it will receive as an important part of RenaissanceRe’s specialty strategy and the overall RenaissanceRe group,” S&P said, also adding that Platinum’s historically profitable casualty book could contribute meaningfully to RenaissanceRe’s profits. “Over time, Platinum may also benefit from enterprise risk and managerial resources at RenaissanceRe upon full integration of its risk systems and underwriting platforms,” S&P said. S&P’s assessment of RenRe’s ERM is “very strong,” while Platinum has “adequate” ERM practices in S&P’s view.

S&P also said that “the affiliation to the RenaissanceRe brand and a larger balance sheet” could work to solidify Platinum’s competitive position.

Casting some doubts about the deal, a handful of law firms announced investigations into whether Platinum’s board of directors breached their fiduciary duties to stockholders by failing to adequately shop the company before agreeing to the deal, and into whether RenaissanceRe is underpaying for Platinum Underwriters shares.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk