Technology, artificial intelligence (AI) and the Internet of Things (IoT) offer new opportunities for insurance companies to be more cost-effective and innovative. However, in order to maximize these opportunities, it’s essential that insurers not straddle two business models for too long. One model centers on legacy processes and is heavy on administrative activities and work. The emerging one utilizes technology to predict, sense, model and administer services with increasing levels of connected data.

Executive Summary

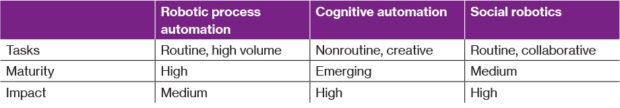

The enablers of work automation—RPA, cognitive automation and social robotics—are changing the work activities of claims professionals and agents working with carriers that have implemented them. Here, WTW’s Tracey Malcolm provides a glimpse at some of the changes and describes a new metric for examining the value of improved work performance, which may help carriers pinpoint activities where AI can play a role.The enablers of work automation may be considered in three ways: robotic process automation (RPA) that covers routine tasks; cognitive automation (think AlphaGo’s recent success in winning the Go match over Lee Sedol); and social robotics, where routine and collaborative physical tasks have both robots and human capital working side by side.

Let’s consider claim management and innovative customer service as examples of how work, talent and jobs are changing in insurance with these enablers.

Let’s consider claim management and innovative customer service as examples of how work, talent and jobs are changing in insurance with these enablers.

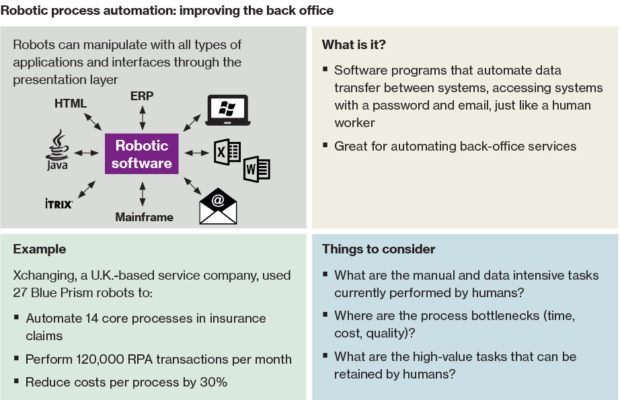

In the area of claim processing transactions, Xchanging implemented RPA to improve the back office and the efficiency of processing transactions, resulting in reduced costs in claim management. (See “Robotic Process Automation at Xchanging,” L. Willcocks, M. Lacity and A. Craig; Paper 15/03, June 2015.)

Insurers implementing RPA have democratized the work of claim processing, making substantial parts of the job obsolete and changing the talent needs for the area. Work activities related to reviewing and handling exceptions become the work of humans in the remaining jobs.

Insurers implementing RPA have democratized the work of claim processing, making substantial parts of the job obsolete and changing the talent needs for the area. Work activities related to reviewing and handling exceptions become the work of humans in the remaining jobs.

Fraud detection in claim management is an example of cognitive automation. AI can be used to automate pattern-spotting in fraudulent claims at a more rapid work pace than fraud analysts, creating new work capacity for strategic fraud prevention activities. Another example is the predictive modeling to support pricing, creating less latitude for field agent decision-making.

AI in the form of intelligent assistants—or “robo-advisers”—can also be used in customer care to support policy checking or claim initiation. For customer service representatives, the work changes from general inquiry management to active support across policy changes, billing, claims or when an interaction with a client is needed.

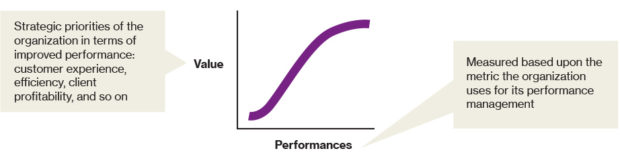

In the Fourth Industrial Revolution, with technology, digitalization and AI accelerating changes to jobs, understanding the nature of work with these accelerants is the source of value. In the three aforementioned examples, the value of jobs has changed with technology. To understand this in more detail, consider return on improved performance (ROIP). Similar to return on investment, ROIP measures the value of improved performance in a given position, not just the value of average performance in a job. (This measure is described in the book “Transformative HR: how great companies use evidence-based change for sustainable advantage,” by J. Boudreau and R. Jesuthasan; Jossey-Bass 2011.)

Let’s go back to our work automation examples and consider the impact on work and ROIP. In the case of claim processing jobs, the value-performance ROIP curve is likely long and flat—rising quickly to a threshold for defined administrative activities and then staying constant thereafter when the overall impact or value of increased performance is relatively consistent. Restated, better performance of administrative work does not add much value to customer experience, carrier efficiency or profitability. With technology, the efficiency work is now done through automation. The remaining jobs gain value as the work activity, once reconfigured, becomes exception handling and information management.

Let’s go back to our work automation examples and consider the impact on work and ROIP. In the case of claim processing jobs, the value-performance ROIP curve is likely long and flat—rising quickly to a threshold for defined administrative activities and then staying constant thereafter when the overall impact or value of increased performance is relatively consistent. Restated, better performance of administrative work does not add much value to customer experience, carrier efficiency or profitability. With technology, the efficiency work is now done through automation. The remaining jobs gain value as the work activity, once reconfigured, becomes exception handling and information management.

Similarly, in our contact center example, routine customer exchanges become the work of robo-advisers, establishing a greater impact for customer service roles. With human customer service representatives and robo-advisers combined, this may replicate what has been the interaction with the agent—stepping in when support is needed, pivoting to support changes in policy coverage, billing and claims.

For human agents, part of their work may be replaced by these cognitive automation and robo-adviser examples; simply put, clients will more directly access insurance information and support, and carriers will provide these channel options. While human agent roles have been pivotal, with a strong performance and value equation, the future of work and technology has this as a breaking point.

Insurance organizations need to understand and address the rapidly changing landscape of work, from the deconstruction of jobs, to the use of AI, to the transformation of the work experience and beyond.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality