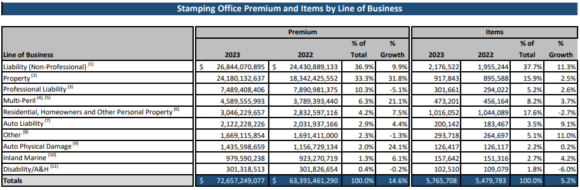

The excess and surplus lines market continued to grow in 2023, with premium reaching nearly $73 billion, according to data from 15 state surplus lines offices released by the Wholesale & Specialty Insurance Association (WSIA).

2023 premiums reflected a 14.6 percent increase over the record-breaking numbers of 2022 when premiums grew more than 24 percent to $63 billion.

Transactions were up 5.2 percent to 5.8 million in 2023, with commercial liability and commercial property making up the bulk of the market. Premiums in these lines increased nearly 10 percent and 32 percent to about $26.8 billion and $24.2 billion, respectively, in 2023.

Combined, E&S premiums for personal property grew 7.5 percent in 2023 to about $3 billion but transactions decreased 2.7 percent. However, the report breaks down data by state, revealing where risk is flowing to the E&S market. For instance, personal property transactions increased the most (26.3 percent) in California and premiums grew more than 20 percent to nearly $746 million (though personal property is still just 4.5 percent of the E&S market in California).

“This was to be expected, given the decisions by numerous admitted carriers to stop writing new homeowners business in California,” said Ben McKay, CEO and executive director of the Surplus Lines Association of California.

The largest premium market share of E&S personal property belongs to Florida at nearly 9 percent, but personal property transactions decreased 7.6 percent in 2023. Overall E&S premiums in Florida grew 27.8 percent in 2023 to $15.4 billion.

“We continue to see the commercial property market’s premiums exhibit a noteworthy surge in response to current market conditions,” said Mark Shealy, executive director of the Florida Surplus Lines Service Office. Commercial property premiums increased 41.7 percent to about $7.2 billion to now account for 46.5 percent of the market.

In another large surplus lines state, premiums grew 25.8 percent in Texas to about $14.6 billion — led by 45.9 percent growth in commercial property.

Janet Pane, executive director of the Excess Line Association of New York, said premiums increases in 2023 were primarily driven by commercial liability and property, excess liability and umbrella, errors and omissions, and directors and officers. Overall E&S premiums grew 5.2 percent to about $8.1 billion in New York, and transactions were up 8.6 percent.

10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits