Strategic implementation of generative AI can be a significant differentiator for stakeholders in the insurance industry, according to new research by Info-Tech Research Group.

Without a comprehensive deployment strategy, many insurers have yet to fully harness Gen AI’s capabilities.

According to Info-Tech’s report, “Generative AI Use Case Library for the Insurance Industry,” when appropriately adopted and implemented, Gen AI can significantly elevate a company’s standing in the market.

The report indicates a critical need for insurance companies to closely align IT capabilities and business innovation.

“IT must evolve from a traditional support role to a proactive business partner,” the report noted, indicating the process requires a deeper “understanding of client needs and a commitment to developing innovative products and services that meet those demands.”

Insurers will need to add specialized roles like data scientists, AI experts, client experience professionals, and process designers to their workforce.

Carriers can do this by prioritizing talent acquisition, upskilling, and cross-training, with the implementation of effective retention strategies.

Info-Tech suggests IT leaders must evolve their core competencies.

The first step is to establish responsible AI principle that can serve as the foundation for policy development. Policies “should emphasize accountability, transparency, data privacy and security, IT governance, and detecting fairness and bias in AI models.”

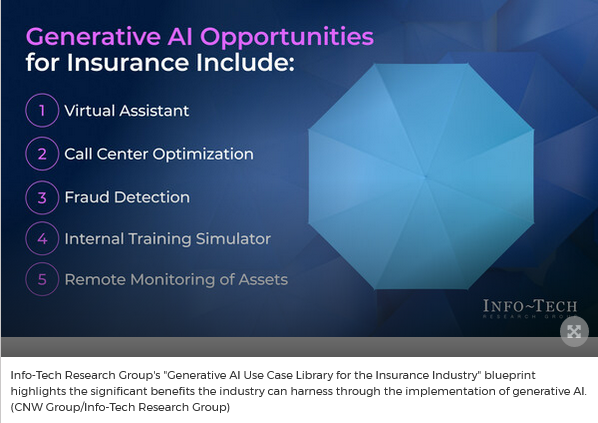

Several benefits can arise when insurers utilize generative AI responsibly within their operations. These include:

Virtual Assistant: Gen AI can significantly streamline operations by organizing and sorting underwriting and claims data for thorough investigation. It can also enhance job efficiency by acting as a facilitator and assisting in risk assessments, claims evaluations and fraud analysis.

Call Center Optimization: By deploying Gen AI, insurers can provide automated answers to common customer questions, effectively reducing call volume and call-handling times and offering 24/7 service with escalation to live agents for complex requests, leading to improved customer service.

Fraud Detection: The application of Gen AI and machine learning in claims processing offers insurers the ability to proactively detect suspicious claims and fraudulent behavior.

Internal Training Simulator: By using predictive analytics and GenlAI, insurers can create training simulators that can prepare employees to handle complex customer queries related to policy, claims and underwriting, enhancing service quality and efficiency.

Remote Monitoring of Assets: Gen AI can facilitate remote management of insured assets, assisting in loss prevention and contributing to a reduction in claims.

While larger insurers have already begun to adopt aspects of Gen AI, smaller carriers are partnering with vendors to tailor AI to meet their specific needs, the report noted.

Gen AI is expected to redefine “operational efficiency, enhancing customer experiences, and ultimately securing a pivotal position in the rapidly evolving digital insurance market,” the researchers added.

“Generative AI represents a pivotal shift in the insurance industry, enabling companies not only to streamline operations and enhance risk mitigation but also to innovate and personalize customer experiences like never before,” says David Tomljenovic, head of financial services industry research at Info-Tech Research Group. “Embracing Gen AI proactively is important for insurers to stay ahead of the curve, satisfy the ever-evolving demands of their customers, and safeguard their position in an increasingly competitive landscape.”

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage