Comparing recent conditions in the property/casualty insurance and reinsurance markets to a three-act play, the chief executive of Arch Capital Group predicted hard casualty pricing ahead in the final act.

Speaking on a third-quarter earnings conference call, during which executives reported a 25 percent annualized operating return on equity, Marc Grandisson said, “Today, market trends point to a reinsurance-driven GL [general liability] hard market, and we stand ready to act.”

Beginning his overview of market conditions, Grandisson told analysts and investors listening to the call that looking forward to 2024, he believes that although the dynamics may shift, “this hard market will continue to support profitable growth.”

Then, launching into the theater analogy, he recalled the first act of the current hard market starting in primary liability insurance in 2019, followed by “the unique circumstance of a two-year pause and claims activity due to a global pandemic.”

“The second act introduced Hurricane Ian as a main character,” forcing property reinsurers to adjust their pricing and their risk appetites.

“While property has been the most recent driver of this market, as we move into Act Three, we are faced with increasing evidence that casualty rates—widely underpriced and oversold during the last soft market—need to increase,” he continued, adding that Arch Capital expects this third act of one of the longest hard markets in memory “to persist until the industry’s reserving issues are resolved and until casualty rates generate positive results.”

At Arch, the plan is to capitalize on the emerging hard market underwriting opportunities on the reinsurance side of the business. “Our incredibly nimble reinsurance group allows us to grow more quickly and significantly than in our insurance group, and is therefore where we are most likely to deploy capital first,” Grandisson said.

Between Acts

Act Two—Hurricane Ian—figured into underwriting results for last year’s third quarter, with catastrophes (mainly Ian) adding 13.4 points to the third-quarter 2022 Insurance segment combined ratio and 42.8 points to the third-quarter 2022 Reinsurance segment combined ratio.

In this year’s third quarter, cat impacts were much lower—just 2.6 points for Insurance and 9.7 points for Reinsurance.

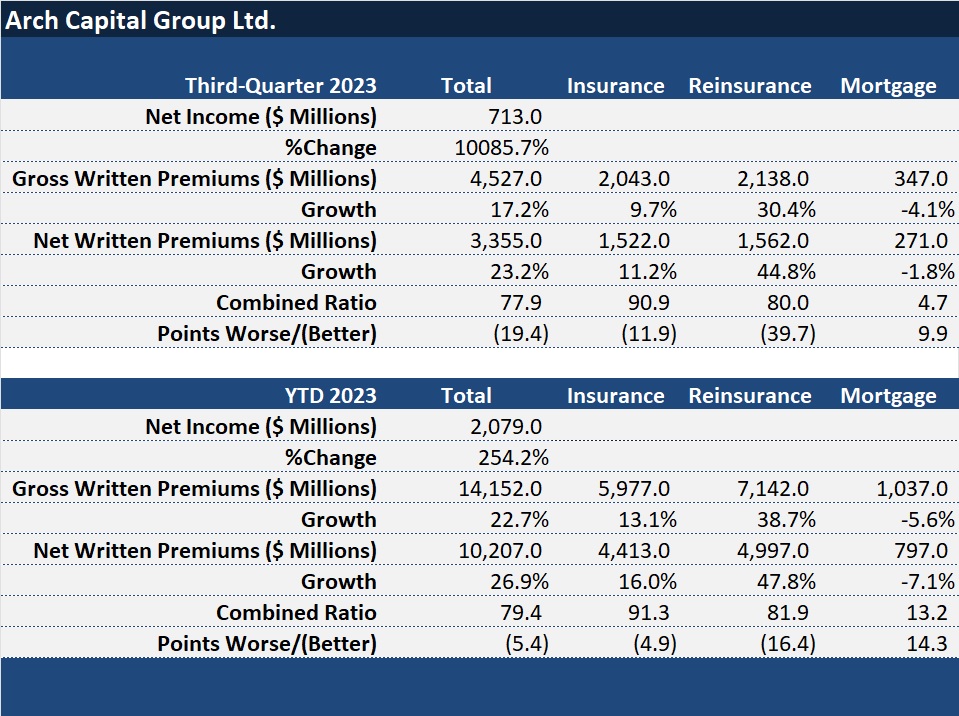

Lower cat impacts explained almost all of the improvement in Arch’s Insurance combined ratio, which fell 11.9 points to 90.9. The Reinsurance combined ratio improved nearly 40 points to 80.0, compared to 119.7 in last year’s third quarter, with net premium growth of 45 percent also driving more underwriting profit.

Chief Financial Officer Francois Morin noted that the growth in the Reinsurance segment was led by the property-other-than-catastrophe line, where premiums came in 73 percent higher than the same quarter last year. For Arch Capital’s property-catastrophe reinsurance, he noted that net written premium in third-quarter 2022 included roughly $34 million of reinstatement premiums resulting from Hurricane Ian. Adjusting for that reinstatement premium impact, he reported that net written premium growth for prop-cat reinsurance would have been 64 percent.

Chief Financial Officer Francois Morin noted that the growth in the Reinsurance segment was led by the property-other-than-catastrophe line, where premiums came in 73 percent higher than the same quarter last year. For Arch Capital’s property-catastrophe reinsurance, he noted that net written premium in third-quarter 2022 included roughly $34 million of reinstatement premiums resulting from Hurricane Ian. Adjusting for that reinstatement premium impact, he reported that net written premium growth for prop-cat reinsurance would have been 64 percent.

In the Insurance segment, net premiums grew 11 percent to a similar figure as the Reinsurance segment—roughly $1.5 billion—in third-quarter 2023. Here, Morin noted competitive conditions in professional liability lines, D&O in particular, reporting that ex-professional liability premium growth would have been 20 percent for the quarter.

“Overall, market conditions for our Insurance and Reinsurance segment remained attractive, and we expect the returns on the business underwritten this year to exceed our long-term targets by a solid margin for some business units,” Morin said, without specifying the units.

“Profitable growth during periods of favorable market conditions is one of the hallmarks of our cycle management strategy, and the current hard market is definitely giving us the opportunity to deploy meaningful capital in many areas,” he said.

With net realized losses nearly offsetting net investment income for the quarter, Arch’s bottom line of $713 million after taxes was nearly equal to pretax underwriting income of $721 million.

Let’s Play Ball

Grandisson, as he did during the second-quarter earnings call with a tennis analogy, offered another sports analogy to size up the market dynamics—this time to baseball given the timing of the call coinciding with the World Series. Noting that baseball differs from other sports in that there’s not a specified length of time to play the game, the CEO said that the current hard market feels like a baseball game. “We know there’s only nine innings to be played, but we have no idea how long those innings will take,” he said, suggesting that the key is to position your team with a “great lineup” that is “happy to keep hitting our singles, doubles and occasional home runs until the inning is over.”

Related article: “Hard Market Game Refuses to End: Arch Capital CEO“

Asked when Arch Capital would start playing more in the casualty reinsurance game—or more specifically, in the words of one analyst, the timing for when the reinsurance book would shift to casualty, Grandisson said that Arch is still very keen on property, referring to the 1/1/2024 renewal period as “the early innings” of a lengthy hard market in casualty.

“The one beautiful thing about GL, or the one bad thing depending on the side of the market you’re in, [is that] it’s a longer-term development. On a softening and on the hardening, the GL…will take a little bit longer to get to where it needs to get to because it takes time for you to get the losses, reflect them in the reserving, and [to] have a good sense of where the ultimate results are from the prior years to adjust and help inform the pricing…”

“So, this is going to be a lot much more protracted third act than the second act was,” he said.

Another analyst asked whether Grandisson could identify a particular reason that commentary about casualty concerns and reserve inadequacy has been bubbling up in recent months in commentary from European reinsurers and others. In response, the CEO suggested that a few things are simply going wrong at the same time.

While social inflation is not new, after a lull there was a spike in activity between 2021 to the middle of this year. “Right now, we have sort of a refresh, and are updating all the information about the losses—where we are and what could happen with the demands being updated and made more current.

“At the same time, we have priced that business, as an industry, in ’15, ’19 with inflation at 2 percent, Now inflation is north of 5, 6, 7, depending on where you look,” he said.

Taken together, this “is a classic case of having a couple of things going against you. [It’s] nothing that the industry did on its own. It’s just the economy and the environment and the riskiness in the environment. [And] we’re facing [this] all collectively as an industry,” he said.

He went on to praise the industry response that’s fueling a hard casualty market.

“What I like about the industry’s capability is [that] it’s reacting. That’s what you hear. That’s something that we should be very, very happy for, collectively, as an industry. The other calls that you heard this quarter recognize it, and once you recognize an issue and a problem, [underwriters] are very good and very adept at addressing it,” he said.

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market