Commercial insurance was a bright spot on the third-quarter earnings picture for The Travelers Companies, with strong pricing fueling a record top line and a “best-ever” underlying combined ratio in spite of a hefty asbestos reserve charge and catastrophe losses.

With catastrophe losses absolutely slamming the carrier’s personal lines results, however, Travelers reported an overall drop in third-quarter net income of 11 percent across the entire company, the carrier reported yesterday.

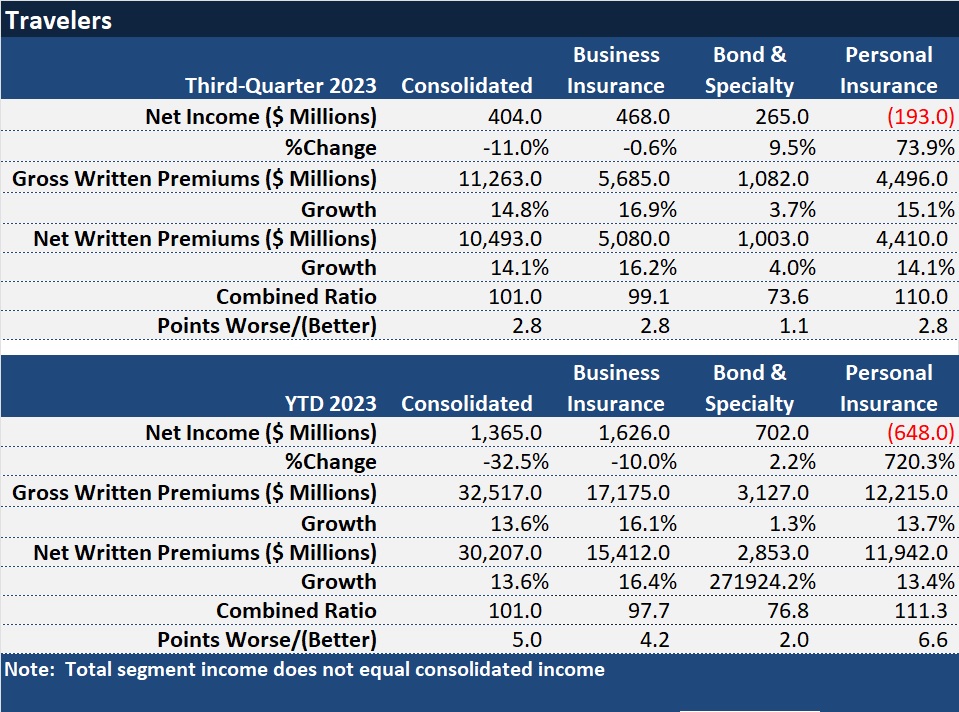

For standard commercial Business Insurance segment alone, income remained roughly even with last year’s third-quarter ($468 million vs. $471 million), helped by a boost in investment income and strong underlying underwriting income (excluding catastrophes and prior-year loss reserve development). Unfavorable prior-year loss reserve development of $263 million pretax and over $200 million in pretax catastrophe losses added nearly 10 points to the reported combined ratio, which still came in under breakeven at 99.1.

“As a result of strong pricing in recent years and higher fixed income NII [net investment income], returns to the segment are currently attractive,” said Travelers Chair and Chief Executive Officer Alan Schnitzer, during a third-quarter earnings conference call. “Nonetheless, given the uncertainty generally in terms of weather volatility, economic and social inflation, a hardening reinsurance market and the geopolitical landscape, we plan to continue pursuing strong price increases in both the property and casualty lines to achieve our…return objectives.

Quantifying the “strong pricing” in the quarter, Schnitzer and Greg Toczydlowski, president of Business Insurance reported that renewal rate changes reached 7.9 percent, and renewal premium change (including exposure changes) was 12.9 percent. “Renewal rate change was higher sequentially in every line other than workers’ comp, where overall renewal premium change remains positive and appropriate given returns in the line.”

The weather wildcard added 4.1 points to the segment’s reported third-quarter combined ratio. Unfavorable prior-year reserve development, including a $284 million boost to asbestos reserves along with additions to reserves for childhood molestation and environmental claims in Travelers runoff business, added another 5.3 points to the reported combined ratio for the segment.

Excluding the reserve charges and the hit from catastrophe losses, the underlying combined ratio for the quarter was 89.7, a best-ever underlying ratio for the company, executives said.

With more than $600 million of catastrophe losses adding 16.8 points to the combined ratio for the Personal Insurance segment, the reported combined ratio sits well above breakeven—at 110 for third-quarter 2023, compared to 107.2 in last year’s third-quarter.

Personal Lines President Michael Klein noted that there were 19 designated PCS events specifically related to wind, hail and tornado activity in the quarter, nearly twice the 10-year average and also marking the highest number for a third quarter in more than a decade.

Chief Financial Officer Dan Frey gave additional detail noting that there were 92 days in the third quarter, and on 91 of those 92 days, there was a PCS event occurring.

On a more positive note, Klein noted that the underlying (ex-cat) combined ratio for Personal Insurance 94.2 improved 5.1 points compared to third-quarter 2022, with both the auto and homeowners lines showing improvement, and written premiums growing 14 percent to $4.4 billion for the segment overall.

Details for the auto line alone, available on Travelers website, indicate underlying personal auto combined ratios of 100.6 for the quarter and 102.5 year to date. Reported auto combined ratios, including cat losses were 103.5 for the quarter and 105.5 through nine months.

“Underlying results in auto are headed in the right direction as the benefit of earned pricing continues to accelerate and as vehicle repair and replacement trends are moderating,” Klein said, flagging, however, that fourth-quarter ratios are historically 6-7 points worse than the rest of the year because of winter weather and holiday driving.

Noting that personal auto insurance renewal premium change averaged 18.2 percent in the third-quarter, Klein noted that he expects that to move down going forward “as more of the book reaches rate adequacy on a written basis.”

For homeowners, the third-quarter and year-to-date reported combined ratios were similar—116.2 for the quarter and 116.9 for the nine-month period, with cat losses adding over 30 points to both figures.

Generally, Schnitzer and the segment executives spoke during the conference call about the beneficial income effects of moderating levels of the components of core goods inflation that impact insurer loss costs. Social inflation, however, is another matter.

Responding to an analyst who asked about commentary he’d heard from executives of some large, unnamed reinsurance companies indicating a cautious stance on U.S. casualty tied to concerns about social inflation trends, Schnitzer said, “We think that commentary is well placed.”

“Frankly, we’ve been on that bandwagon since, I don’t know, 2018…We think we rang that bell very, very early,” he said, noting that Travelers dismissed data that said trends were improving during the pandemic.

“We’ve said consistently, we don’t believe it. We think it’s here, we think it’s at higher levels, we think it’s inflating faster,” he said, noting that Travelers sees this inside the combined ratios in the Business Insurance segment, even though they remain strong. “We do think that it continues to be an important issue to watch. We’ve taken a lot of price–in part in response to that. It’s an issue and we think we’re on top of it,” he said.

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash