Despite rising interest rates and less than desirable business conditions, small business insurance consumers are increasing satisfied with the products and services offered by their insurance providers, according to the newly released J.D. Power 2023 U.S. Small Commercial Insurance Study.

Based on responses from 2,472 small commercial insurance customers, the study, now in its 11th year, examines overall customer satisfaction among small businesses with 50 or fewer employees.

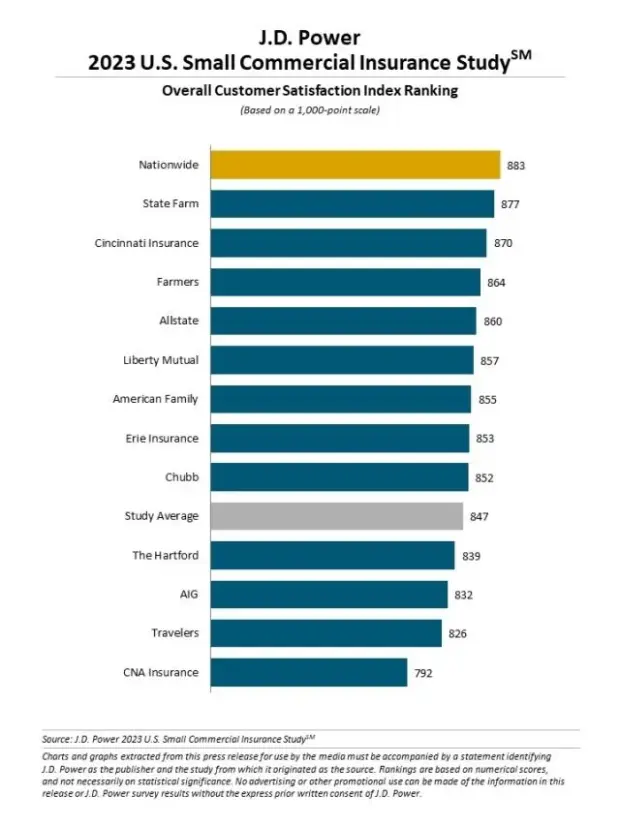

Overall satisfaction is 847, an increase of 5 points from last year on a 1000-point scale and up 70 points over the last decade, the study found.

Nationwide ranked highest in overall customer satisfaction with a score of 883. The last time Nationwide topped the list was back in 2019.

State Farm (877) ranked second and Cincinnati Insurance (870) ranked third.

Overall satisfaction is comprised of five factors (in alphabetical order): billing and payment; claims; interaction; policy offerings; and price.

Improvement was seen in all factors, said J.D. Power, led by claims, pricing and interaction.

Proactive communication aids customers in understanding why their premiums are increasing.

“When insurers proactively discuss price changes with small business customers and work with them to find ways to minimize that increase, overall customer satisfaction improves,” the report stated.

Of the 36 percent percent of customers who made changes to their coverage to minimize a price increase, satisfaction with the price of their policy increased 84 points.

The study found that of the 25 percent of customers who made changes to their business practices to reduce their risk, price satisfaction increased 135 points.

The report found that social media can assist with communication efforts.

Small businesses, in general, want tips on reducing costs, new product information and information on state and federal regulation changes via social media.

Overall satisfaction is 88 points higher among micro business customers who follow their insurer on social media than those who do not, the study found.

The smallest of small businesses feel less satisfied, noted J.D. Power, indicating insurers may want to consider targeted approaches to this customer base.

The micro category—businesses with fewer than five employees—had a lower overall satisfaction score (823) than medium-size (855) and larger (857) small businesses.

“Contrary to what we’ve seen in personal lines insurance, small business customer satisfaction keeps rising even as premiums have continued to climb,” said Stephen Crewdson, senior director of global insurance intelligence at J.D. Power. “While the overall satisfaction numbers are high, there are some important variations based on the size of the small business. The trend is really being driven by businesses in the ranges of five to 10 employees and 11-50 employees, as opposed to the micro businesses with fewer than five employees. That variation should inform more targeted small business strategies on the part of insurers.”

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid