Analysis of a 2022 survey, conducted by McKinsey, finds that while new insurance business avenues can have significant impact on enterprise value, many insurers struggle to build and scale them.

According to the survey, 24 percent of insurers named business building as their top priority, and 65 percent named it as one of their top three priorities, up from 27 percent in 2017.

Though more than half of those surveyed launched four or more new businesses in the past decade, analysis indicates only 19 percent of newly launched insurance businesses become viable large-scale enterprises.

McKinsey examines why insurers are struggling to get new businesses off the ground in its survey analysis, Building new businesses: How insurers can leap ahead.

Facing slow growth across the globe, insurers are putting their efforts into new businesses, “whether to respond to changing customer expectations (cited by 47 percent of respondents), create new revenue streams (43 percent) or protect against disruption (30 percent).”

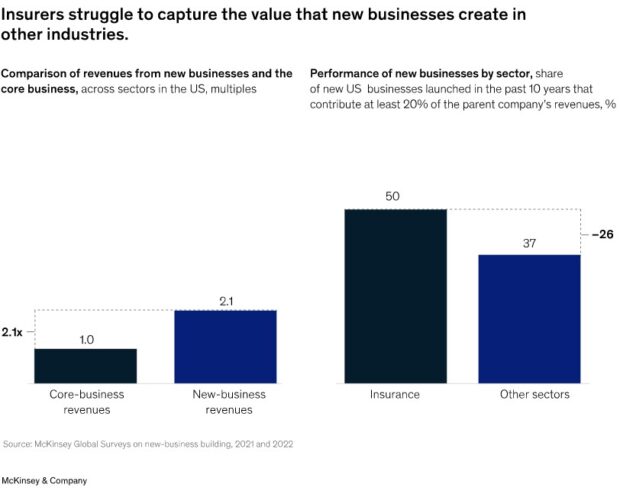

The survey findings indicate limited success with these new ventures, noting insurers aren’t as successful as other sectors in scaling new businesses.

Across other industries, “50 percent of new businesses contributed at least 20 percent to their parent company’s total revenues, but in insurance just 37 percent of new businesses did so,” the analysis stated.

With an average capital expenditure of $42 million per business, insurers spend more than other types of organizations on their new business ventures, compared with $31 million across sectors.

A third of new insurance businesses have yet to break even, compared with 18 percent in all industries, the analysis noted.

If insurers focus on two areas, the McKinsey researchers say they can tip the odds in their favor. First, insurers need to focus “on the existential challenges facing the industry—challenges that offer disproportionate rewards for insurers that crack them (why and where to build).” Second, insurers need to “derisk their new ventures by committing the right talent, technology and CEO involvement (how to build).”

An important insight highlighted by the survey findings is that insurers focused their attention mainly on launching digital platforms of already existing analog businesses.

Though e-commerce penetration doubled in the United States in the first quarter of 2020, commensurate growth in the insurance market was not seen, according to McKinsey, likely due to the complex nature of insurance products.

“Insurance products are complex, purchases are infrequent, and many policies, especially in life and commercial insurance, are discretionary—attributes that limit the advantages digital channels can provide,” stated the analysis report.

The report recommends insurers tackle neglected areas that could pose an existential challenge to the industry:

- New and rising risks

- Underserved segments

- Lagging customer experience

- Fee-based complementary services

The McKinsey analysis also found that new business success rises “if organizations commit to rigorous testing, invest in talent and technology and make the venture a CEO priority.”

The above summary is based on a collaborative effort by Ari Libarikian, Selwyn Peters, Jason Ralph, Ido Segev, and Selim Sulos, representing views from Leap by McKinsey and McKinsey’s Insurance Practice.

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops

Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Hackers Used AI to Breach 600 Firewalls in Weeks, Amazon Says

Hackers Used AI to Breach 600 Firewalls in Weeks, Amazon Says