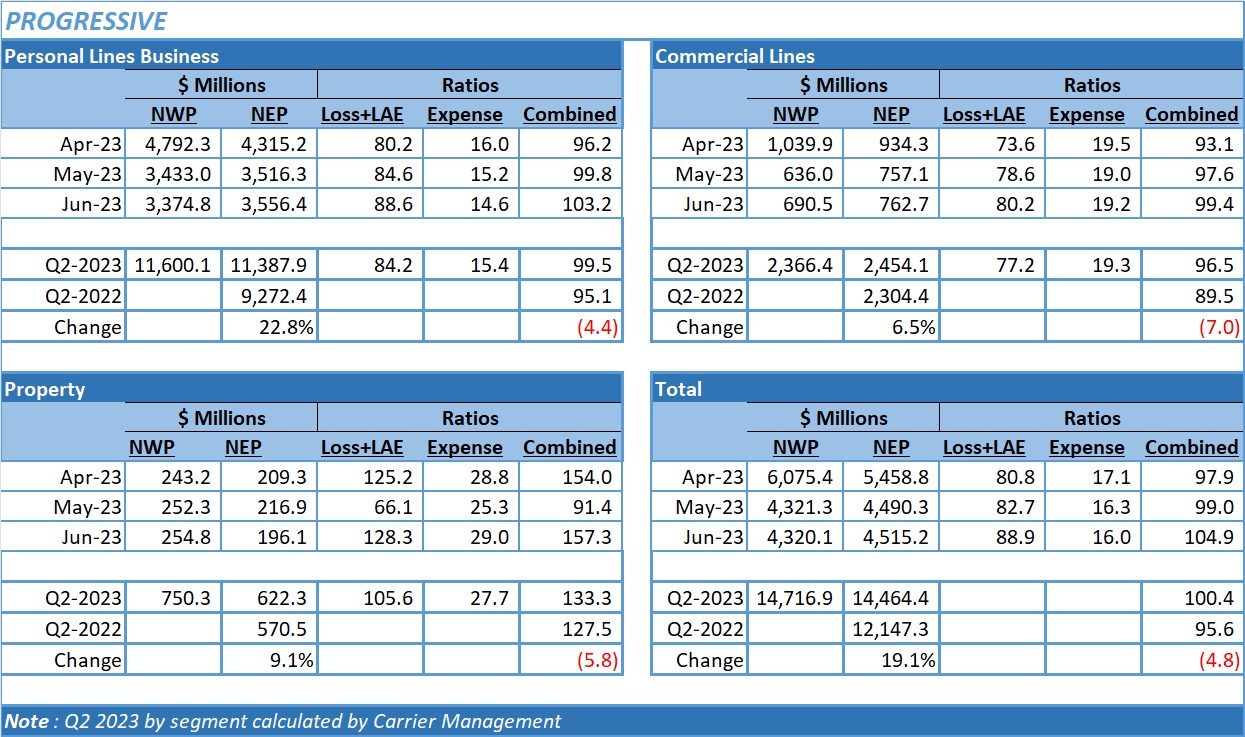

Progressive’s combined ratio came in just above breakeven for the second quarter of 2023, in spite of personal lines earned premium growth of more than 22 percent.

The company second-quarter combined ratio of 100.4 is four points above the company’s target of 96—a goal that Progressive achieved for full-year 2022. It is also 4.8 points over last year’s second-quarter 95.6 figure.

Year-to-date, the combined ratio ended up at 99.7, compared to 95.0 for the first six months of 2022.

Although earned premiums across all lines jumped more than 19 percent in the quarter, and 20 percent for the latest month of the quarter, Progressive’s underwriting results for June 2023 were marred by $137.8 million of unfavorable prior-year reserve development primarily in auto lines, and by catastrophe losses of almost $200 million in the property segment. The reserve development added 3.1 points to the companywide loss and combined ratios for the month of June, and the cat losses added 3.9 points.

Overall, the June 2023 combined ratio came in at 104.9—the worst combined ratio recorded for any month this quarter. Excluding property, however, the June combined ratio was under breakeven.

The company attributed the prior-year loss development predominately to personal auto products. The $137.8 million June total follows higher boosts in April and May—adding up to almost a $0.5 billion of unfavorable reserve adjustments for the quarter.

The June hit to loss reserve is comparable in dollar terms to the reserve boost Progressive recorded in 2022 for the entire first half. In this year’s first half, unfavorable loss reserve development for prior years so far totals over $1.1 billion. In all three months of the quarter, Progressive noted the impact of higher-than-anticipated severity on previously closed auto property damage claims contributing to the reserve development. In April and May, Progressive’s explanation of reserve charges also highlighted developments in the state of Florida, where the company noted that more claims are being litigated—a phenomenon that the carrier first reported on in its March 2023 results summary.

In spite of the underwriting losses, Progressive reported bottom-line net income of $345.4 million for the second quarter and $793.3 million for the first six months, more than reversing net losses the carrier reported for the same periods in 2022. Realized losses (over $2 billion in second-quarter 2022) and lower investment income contributed to the red inked numbers on the carrier’s bottom line last year.

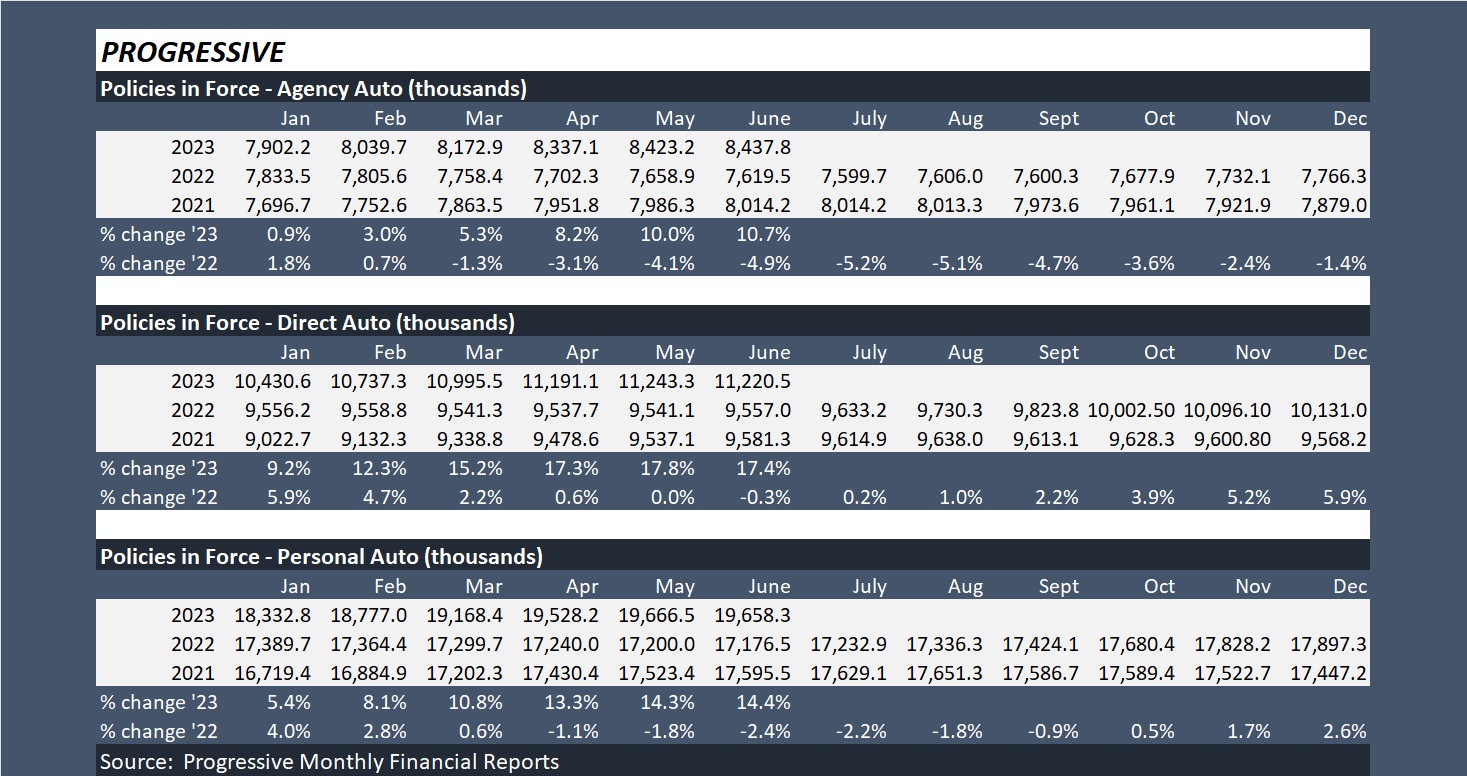

On the top line, Progressive continued to record growth in second quarter. Across all lines, net written premiums jumped 18 percent to $14.7 billion for the quarter. Even after executives stated on a first-quarter earnings call that the company expects to hike personal auto rates another 10 points this year on a countrywide basis, counts of personal auto policies in force have climbed, with PIF growth hitting double-digit levels in the last two months.

Agency personal auto PIF grew 10.7 percent in June. Last year, the segment experienced PIF declines.

On a direct basis, personal auto PIF growth hovered around 17 percent for April, May and June 2023, compared to flat PIF numbers in the same months of 2022.

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  The Future of HR Is AI

The Future of HR Is AI