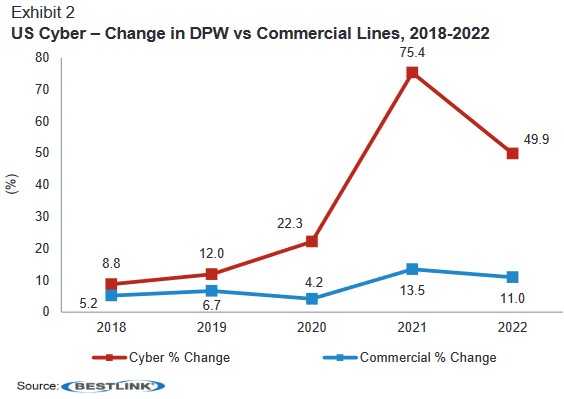

Last year marked robust growth in the U.S. cyber insurance market, with direct premiums increasing by 50 percent to $7.2 billion, brought on by better underwriting and improved loss ratios, according to Best’s Market Segment Report.

Direct premium written tripled in the past three years due to demand “outpacing broader commercial lines by a wide margin.”

Following two difficult years, major improvements were seen in 2022 with continued rate increases, better underwriting scrutiny and a slowdown in ransomware attacks. The loss ratio fell 23 percentage points to 43 percent on standalone policies, the report noted, and 18 percentage points to 48 percent on package policies.

“Underwriters have used every item in the proverbial toolbox to manage exposures. In addition to the rate increases, underwriters have cut limits, increased insureds’ own retention and improved risk selection,” said Christopher Graham, senior industry analyst, industry research and analytics, AM Best.

“With the cyber universe expanding and becoming more complex with artificial intelligence creating new exposures and ransomware attacks returning to prominence in 2023, the demand for cyber coverage will only increase,” he added.

Standalone policies are now the preferred policy among larger insurers as they step away from offering the coverage in package policies.

The report found that more than 70 percent of cyber premium is written on standalone policies, with the 2022 total standalone DPW exceeding all 2021 cyber insurance premium.

AM Best views this change in a positive light, suggesting it may reduce disputes and litigation costs.

Another interesting development relates to surplus writers’ share of the market.

From 2015, when the NAIC began tracking cyber insurance data, until about 2020, when the hard market began for this line of coverage, surplus lines companies held a relatively steady 25 percent share of the cyber market.

Cyber premium written by surplus lines insurers has increased by more than 500 percent, representing nearly 60 percent of total cyber market premium, the report found.

Despite a decline in ransomware claims in 2022, “first-party claims remain close to 75 percent of the nearly 27,000 reported claims as business email compromise claims increased.”

The number of third-party liability claims remains significant, the report noted, adding “the claims will have some tail in development.”

War risk exclusions vary by company, with some carriers sticking with traditional war exclusions and others accepting certain war exposures, the report added.

“Systemic risk is an ongoing concern. Property catastrophes typically affect a limited geographic area, but a cyber catastrophe, as we saw with NotPetya [cyber attacks that occurred in Ukraine in 2017], can go worldwide,” said Fred Eslami, associate director, AM Best.

“As the definition of war becomes broader, so may the exclusion as well, which could lead to insureds with less coverage, Eslami added. “Ultimately, the coverage provided to insureds may be decided by the risk appetite of the insurer, and to a certain extent, the coverage that reinsurers are willing to provide.”

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Preparing for an AI Native Future

Preparing for an AI Native Future