Though customers may report being very satisfied or satisfied with their overall auto claims experience (94 percent), one-third may still consider switching carriers, according to a newly released study by LexisNexis Risk Solutions.

“We know consumers leave their insurance carriers following the auto claims experience, and we wanted to look at dissatisfaction from multiple angles to root out its causes,” said Tanner Sheehan, vice president and general manager, U.S. Claims, LexisNexis Risk Solutions. “First, we found that one-third of a carrier’s business is at risk following an auto insurance claim, and then we dove deeper to pinpoint which factors are triggering switching behavior.”

The new white paper, Exceeding Expectations or Falling Short? U.S. Auto Claims Trends, Insights and Impacts Revealed, outlines how even the slightest customer dissatisfaction can negatively impact an auto insurer’s bottom line.

The claims data and analytics provider to the insurance industry conducted the study — comprised of consumer feedback from more than 1,400 insureds who experienced a claim within the past 12 months along with analysis of a customer’s propensity to switch auto insurance carriers post-claim — to analyze the customer claims experience to understand where dissatisfaction occurs and the correlation between policyholder satisfaction and retention.

The study reviewed 16.5 million policies with a claim and 150 million without a claim. Bodily Injury, Property Damage and Collision coverage were carried on each auto policy.

Switching carriers was defined as policyholders who left their carriers within 180 days (about 6 months) of filing the claim.

Factors influencing the decision to switch carriers include increased rates, claim settlement took too long and the claim wasn’t properly handled.

Though policyholder age is correlated with switching policies — younger policyholders tend to switch at higher rates than older policyholders — the study found that switching policies after a claim was uniform across all age groups.

Policyholders who filed a claim switched at a rate 35 times more than those policyholders who did not experience a claim.

Looking at the overall claims experience, the total number of customers who were either Very Satisfied or Somewhat Satisfied reached 94 percent, the white paper noted. Despite the high satisfaction rate, 33 percent still considered switching carriers based on some form of dissatisfaction with claims handling and/or the ease of their experience.

“What we found fascinating was that consumers who self-identify as either Satisfied or Somewhat Satisfied with the claims experience don’t necessarily behave that way,” said Sheehan. “That third of your business which could be at-risk does include customers who report some level of satisfaction, which insurers may find counter intuitive.”

Respondents were divided into two groups:

- Loyalists: customers who were not planning to leave their insurance carrier, 67 percent of respondents

- Flight Risks: customers that switched or considered switching insurers post-claim, 33 percent of respondents

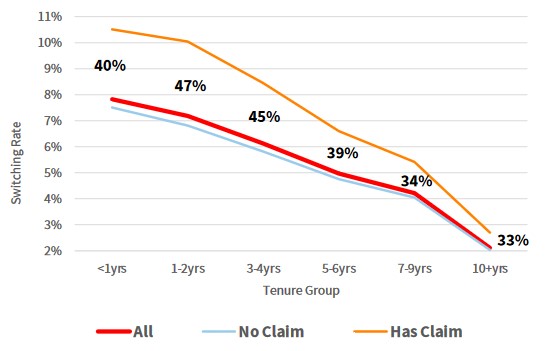

Though longer tenured customers are less likely to switch carriers than shorter ones, if one experiences a claim, the increase in switching behaviors becomes similar to the Flight Risks. The study found Loyalists switched at a rate that is 33 percent higher than less tenured ones.

In extreme examples, policies with a claim and one to two years of tenure switch 47 percent more often than their cohort counterparts without one, the analysis found.

Forty percent of Loyalists spoke to one person to settle a claim, whereas only 17 percent of Flight Risks reported the same experience. Forty-five percent of Flight Risk respondents reported speaking to three or more representatives to settle their claim, whereas only 19 percent of Loyalists reported the same.

“When customers speak to multiple adjusters, have to wait on responses or are forced to decipher confusing instructions on a website, customer satisfaction, and by extension loyalty, suffers,” said Sheehan. “Insurers who can better align the claims experience to customer expectations are not only delivering the quick and easy interactions customers seek, but they are also better positioning themselves to retain policyholders.”

Technology produces a wide discrepancy between loyalists and flight risks.

The study found that Flight Risks were four times more likely to experience slow response times after submitting a first notice of loss (FNOL). Only half of Flight Risks felt submitting a claim was Very Easy compared with three-fourths of Loyalists reporting the same.

During settlement, Loyalists and Flight Risks engaged with adjusters on similar tasks, but Loyalists were more likely to use an equal mix of self-service and carrier interaction throughout their claim while Flight Risks were 74 percent more likely to lean more heavily on self-service than Loyalists.

Flight Risks want additional assistance when reporting a claim and receiving a repair estimate, the research found, while opting for self-service channels for photo and document submission, checking the claim approval status and receiving payment.

Suggested ways to improve the auto claim experience include:

- Enabling Automated Claims Processes – offer critical claim data easily to adjusters rather than making them source it, offering them time to assist customers throughout the claims process.

- Strategically Infuse Data in the Workflow – expedites claims by eliminating unnecessary questions, conversations or uploads.

- Accelerate the Claims Process -Prefill contact data or inject key vehicle ownership data directly into the workflow to speed claims resolution.

Omni-channel service is the primary driver to delivering an optimal experience on your customers’ terms, the report suggested, adding “Customers may not always want digital interactions where you’d think, and the same goes for human interactions. Being good at electronic and adjuster-facilitated channels is a must, and letting customers flex between them is equally important.”

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage