A record level of property-catastrophe reinsurance prices at June 1 followed a record level of hurricane losses last year, but a change in conditions may be on the horizon on both fronts, forecasters suggested recently.

In fact, the word “optimism” appeared in two reports on midyear conditions published late last week—one from reinsurance broker Howden Tiger and one from Fitch Ratings.

First the bad news from a cedents’ perspective from Howden Tiger: Risk-adjusted property-cat reinsurance pricing soared 33 percent on average at June 1, within a typical range of 25-40 percent.

The increase, following a 25 percent jump in 2022, brought Howden’s pricing index to its highest level since inception.

The index dates back to the mid-1990s, with the last peak occurring in 2006.

“There may be some reason for optimism around the end of cycle, although no one has taking this for granted,” said Michelle To, head of business intelligence, concluding a short video presentation that accompanied the publication of the Howden Tiger report. (The video was posted on Howden Broking’s LinkedIn page on Thursday.)

A slide with the heading “Is the inflection point approaching?” appeared on the screen as she spoke. The first bullet point gave one reason that the inflection just might be near: “A moderate capital rebound driven by mark-to-market movements and some new capital raising.”

David Flandro, head of industry analysis and strategic advisory, began the video digest also noting that the reinsurance sector “is coming up on an inflection point.” He stressed, however, that low capital levels to risk are still supporting price hikes at midyear.

“While capacity was largely impaired last year, we’re starting to see early signs of a recovery. It still hasn’t happened yet, but we can see capital constraints like elevated cost of capital, limited capacity and macro uncertainty, while persisting, starting to be offset by some new capital inflows, a clear growth in appetite on the part of some carriers and possibly early signs of inflation easing.

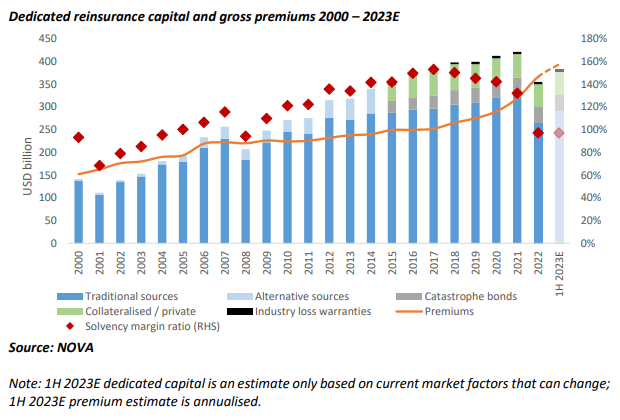

Flandro provided an analysis of dedicated reinsurance capital for each year since the turn of the century, displaying a sharp drop in 2022.

The decline—driven by mark-to-market investment losses and lower capital inflows—is recovering in 2023. “And we anticipate that by the end of the first half, it will [have] gone up significantly,” Flandro said.

“Still, risk and premiums have gone up significantly as well, meaning that the solvency margin ratio—that’s capital divided by premiums—remains below 100 percent. But this is changing,” he said.

(Howden Tiger’s To followed Flandro with an analysis of premium growth rates and price changes, reporting slower non-life premium growth in 2023 vs. 2022 for both insurers and reinsurers across lines including casualty lines, and rates hikes highest for property lines.)

Fitch Ratings, in its latest annual “U.S. Hurricane Season” report, stated that U.S. property/casualty and reinsurers have capital ample enough to absorb losses should a large storm make landfall in 2023.

Reviewing capital gyrations for the overall U.S. P/C industry in recent years, Fitch noted that after policyholder surplus jumped 37 percent from 2018 to 2021 to over $1 trillion, it fell roughly 6 percent in 2022. Without specifically quantifying the 2022 drop in capital for the global reinsurance market, which supports a substantial portion of Florida property exposure, Fitch said reinsurers have demonstrated “the resilience of their balance sheets,” with capital remaining “robust despite significant catastrophe events in recent years.”

“Fitch believes that reinsurers will continue to maintain very strong capitalization as they prudently manage capital, balancing capacity deployment for growth opportunities with the return of capital to shareholders,” the report says.

Honing in on deployment, Fitch noted that recent changes in pricing and terms have “moved the property-catastrophe reinsurance business into a more attractive phase of the underwriting cycle.”

“While losses from Hurricane Ian did not initially lead to substantive reinsurer formations or new capital entering the market, recent actions by several established market participants indicate revived broader market optimism,” the report said.

Fitch pointed to three specific examples:

- With RenaissanceRe’s plans to acquire Validus Re Holdings from AIG, RenRe recently reduced other property business to make room in its capital allocation for higher returning property-catastrophe business.

- Berkshire Hathaway publicly discussed its increased exposure to property-cat reinsurance—and Florida, in particular—as the pricing environment improved after Jan. 1.

- Everest Re, which the Fitch report characterizes as “a very consistent provider of capacity to the Florida market,” raised roughly $1.3 billion of new company equity in May 2023 to support future growth.

“Fitch expects a broader set of reinsurers will be willing to offer Florida market capacity if the recently enacted legislative changes demonstrate a meaningful reduction in loss-cost trends over time,” the report said.

The Fitch report also includes a summary of various hurricane forecasts pointing to a below-average hurricane season. And both Howden Tiger and Fitch offer graphs of catastrophe event counts for 10 years or more.

“One thing that obviously loomed very large during the renewal was Hurricane Ian and the specter of heightened catastrophe losses which the sector has experienced over the last six years,” Flandro said,

Howden Tiger’s graph, which included both loss dollars and counts for all types of catastrophe events (separately shown for North American and International losses) illustrates that even in year when catastrophe numbers dipped, one hurricane lifted the loss totals above other years displayed (back to 2013).

Driving home the point, Fitch’s graphic focuses on landfalling U.S. hurricanes, showing 2022 counts below any of the last six years.

Fitch reports that the probability of a storm hitting the U.S. Atlantic coast remains comparable with long-term historical averages in 2023. The report references a Colorado State University forecast putting the probability of a major hurricane making landfall along the U.S. coastline in 2023 at 43 percent, compared with the 71 percent predicted during 2022 and an average of 43 percent over the last 140 years.

The Fitch report also notes that Accuweather forecasters predict two to four direct U.S. landfalls of named storms in 2023, compared with four in 2022 and a 30-year average of four U.S. coastal landfalls.

“Heighted catastrophe activity, driven by Hurricane Ian, contributed to surplus deterioration for a number of Florida specialists in 2022. However, reinsurers remain broadly well positioned to absorb the loss costs of a large event in 2023,” commented Fitch analyst Christopher Grimes, in an introduction to the report.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Preparing for an AI Native Future

Preparing for an AI Native Future