A new survey highlights the demand for humanized insurance purchasing, increased digital purchasing and payment options and improved communication throughout the policy term.

The 2023 Global Consumer Insurance Insights survey, conducted by Duck Creek Technologies, found that younger consumers are driving demand for debit and digital payment, such as Apple Pay. In addition, younger consumers expressed considerable interest in purchasing insurance via a mobile app.

The second annual survey of more than 2,000 policyholders, spanning 13 countries, offers insights for insurers on consumer preferences, innovation opportunities and purchasing and communication desires. The survey also offers the opportunity for insurers to compare responses across different global audiences to inform their commercial strategies.

Homeowners and auto insurance were the most common coverage purchased with 84 percent of consumers purchasing homeowners insurance and 87 percent purchasing auto insurance.

Most surveyed felt confident (93 percent) with the amount of insurance purchased, no matter the method purchased.

Of those surveyed, 44 percent of consumers prefer to interact with a human (up from 35 percent in 2022); yet interest in app/WhatsApp usage for buying and switching insurance also increased year-over-year.

Noteworthy highlights of the survey include:

Buying preferences

72 percent buy insurance directly from a provider.

67 percent see the provider’s website as the easiest method for buying insurance (this is up considerably from 2022’s 40 percent).

52 percent of those surveyed felt buying insurance through an app was the most secure method to do so.

Respondents’ views on switching insurance

86 percent indicated there was a good range of choices when it comes to switching insurance providers.

92 percent rated their experience switching insurers as positive overall.

50 percent felt that bundled insurance packages provide value.

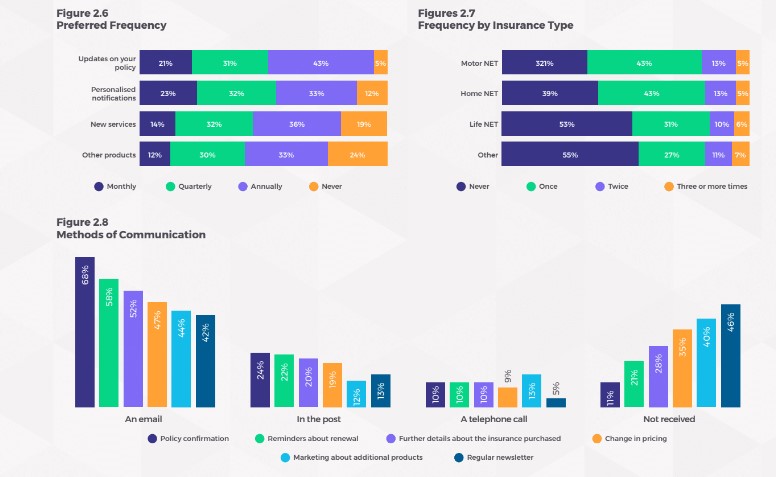

Communication preferences

82 percent wish to hear about news services.

75 percent want to hear about new product offerings.

45 percent of respondents didn’t hear from their insurer at all during their policy term.

Innovation perspective

43 percent of respondents are interested in the potential of add-on insurance options.

54 percent find on-demand insurance appealing.

The survey offered key takeaways for each country represented.

Of those surveyed in the U.S., 90 percent believe there is a good range of choice when it comes to purchasing different types of insurance and 36 percent are happy to switch insurance online.

As far as premium and claims payment options go, nine in 10 consumers believe their insurer offers enough premium payment options, while three-quarters believe there are enough methods to receive claim payments.

Nearly all respondents (96 percent) globally want to know the status and progress of their claim.

Though consumers rate the purchase of insurance via digital channels secure, there is still a significant number of customers who prefer purchasing policies via paper applications or in person, for security reasons. Additionally, telephone purchasing options and/or the use of chatbots were not rated highly for any stage of insurance purchases.

A range of communication options to meet the diverse needs and preferences of customers was recommended.

“It is vitally important, therefore, for insurers to strike the right balance between self-service features and live agent assistance to the online policy shopper,” the report stated.

Suggested ways to achieve this include insurers exploring cloud-based digital communication integrated with their core systems. Options such as screen sharing, co-browsing, digital audio/video and chat offer an insurer the ability to provide humanized contextual help convenient to the consumer.

Another area of focus for insurers is the amount of communication with customers. According to the report, “the data also suggests that insurers must continue to be prudent about communicating with policyholders outside of purchase, loss and renewal events.”

Analysis of collected data from core insurance systems, coupled with AI and machine learning models, will assist insurers in determining optimal timing for communications to policyholders, the report added.

Finally, survey respondents indicated more improvement is necessary when it comes to transparently communicating policy terms and conditions to consumers.

“As the insurance industry continues to evolve, it is crucial for providers to listen to the needs and preferences of their customers,” said Jess Keeney, chief product & technology officer at Duck Creek.

AmFam Reports Underwriting Profit, Top-Line Decline for 2025

AmFam Reports Underwriting Profit, Top-Line Decline for 2025  Berkshire’s Abel Vows to Use All His Pay to Buy Firm’s Stock

Berkshire’s Abel Vows to Use All His Pay to Buy Firm’s Stock  Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud

Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud  Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict

Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict