Though most insurance companies feel their enterprise risk management (ERM) programs are operating at a robust level, rising economic risks and claims costs and the increasing severity and frequency of weather-related losses necessitate the need for ERM programs to continue to evolve along with an insurance company’s risk profile, according to a new report released by AM Best.

The U.S. insurer-focused credit rating agency reviews ERM, along with a company’s balance sheet strength, operating performance and business profile in its insurance rating process.

Enterprise risk management analysis focuses on an insurer’s risk management framework and its capability relative to its risk profile.

Though the ERM framework exists in many insurance companies, the lack of stress testing is cause for concern, stated the new Best’s Commentary, “Rising Economic Risks Highlight Importance of Enterprise Risk Management.”

According to AM Best, when insurers don’t understand their key risks, a weak ERM framework can add to potential failures that may occur. The result: a failure to maintain adequate protection against unexpected losses.

“The failures of Silicon Valley Bank and crypto firm FTX are two recent examples of insufficient risk management,” said Sridhar Manyem, senior director, industry research and analytics, AM Best. “Insurers may not be susceptible to a run-on-the-bank scenario, but SVB’s failure provides lessons pertaining to liquidity management and asset-liability risks. Strength and depth of management teams are also essential for an insurance company to execute its strategy, and at FTX, a lack of accountability of executives and board oversight led to poor management decision-making.”

Stress testing offers those in charge an opportunity to analyze events of concern to regulators and other company stakeholders, providing insights into a company’s risk profile.

AM Best offered the example of how an insurer, with exposure to catastrophes, might review cat losses sustained in an area where reinsurance rates increased following the event.

Not limited to underwriting or company size, stress testing is an invaluable tool to aid ERM adequacy.

“Despite the appropriate or very strong ERM assessment for a significant majority of AM Best-rated entities, many insurers lack robust stress testing and reverse stress testing processes,” the report stated.

Approximately one-third of insurers have stress testing assessments in the bottom three categories: evolving, nascent or unrecognizable.

Reverse stress testing allows companies the ability to review outcomes after failure, to better understand where corrections can be made in the future.

Evolving Risks

Heightened economic risk, the result of COVID-19 governmental fiscal policies put in place to alleviate financial stress, pushed inflation higher. Supply chain shortages and geopolitical concerns due to the Russia/Ukraine conflict only exacerbated the situation.

Indicative of growing credit risk, according to AM Best, insurers were met with widening credit spreads and a volatile equity market, as the Federal Reserve began raising interest rates to combat inflation.

Another reason for insurers to review their ERM processes comes down to weather-related losses. In recent years, AM Best noted companies’ operating results deteriorated largely due to weather-related events and an increase in fire losses.

“The frequency and severity of weather events in the recent past have deteriorated the results of P/C insurers and led to a record number of insolvencies of concentrated regional players in Florida, because their relatively smaller capital bases could not recover from the losses due to Hurricane Ian,” the report noted.

Typically relied on by smaller insurers, reinsurance became unaffordable.

“These companies often lack the capability to manage concentration risk effectively,” said Jason Hopper, associate director, industry research and analytics, AM Best. “Strengthening these ERM frameworks can further enhance understanding and management of risks.”

Adding to the mix is social inflation — the growing costs of claims because of changes to societies’ perceptions relating to insurance companies.

The report noted, “As society becomes more litigious and see corporations as less trustworthy, attitudes toward corporations have become more cynical and the punitive damages levied on corporations on cases involving injury (perceived or physical) have escalated.”

As litigation funding grows, social inflation is considered a top risk for property/casualty insurers.

Where to Focus

Components of a robust ERM program include governance/risk culture, risk management and controls, risk identification/reporting and non-modeled risks, risk appetite/tolerance, and processes for stress testing.

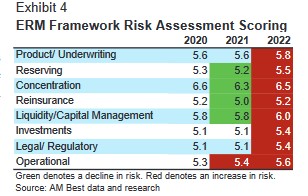

Having a dynamic ERM framework is key, the report stated. AM Best measured risks within several areas of an insurance company.

“The year 2022 brought uncertainty and change in the economic and operating environment, and we saw worsening risk profiles across each category compared to 2021,” the report stated.

Concentration and liquidity management topped the risks, while reserving, investments and legal/regulatory risks grew the most from 2021.

Risk tracking indicators to forewarn insurers of potential outlier events and dedicated ERM specialists will aid insurers in the future.

As new risks emerge and others evolve, the rating agency expects insurers with well-developed ERM programs will be better equipped to identify and react, build and preserve balance sheet strength and bolster operating performance over the long term.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut