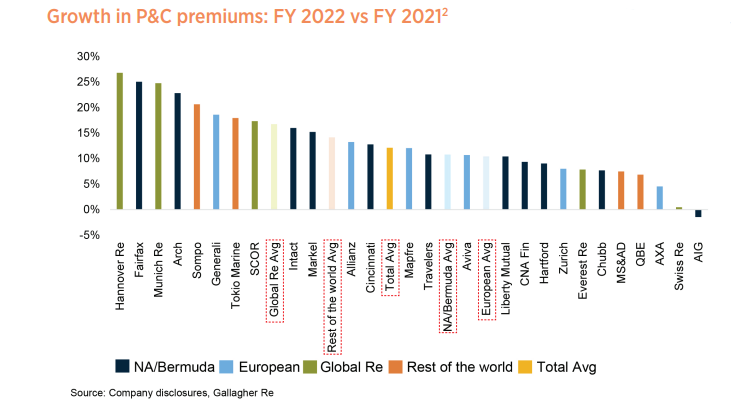

Reinsurers’ premium growth averaged 12.1 percent for full-year 2022 and 10.2 percent for the fourth quarter, which was driven by improved pricing for commercial lines and reinsurance business, according to Gallagher Re.

However, the strongest FY 2022 increase (16.7 percent) came from the global reinsurers analyzed by Gallagher Re – Hannover Re, Munich Re, SCOR, Everest Re and Swiss Re.

“The double-digit growth in premiums on both a quarterly and annual basis continues to be supported by not only price increases but also higher policy retention and organic growth,” said the Gallagher Re report, titled Global reinsurers’ financial results for full year 2022. (Editor’s note: Gallagher Re said it tracks the largest reinsurers globally that have meaningful commercial lines or reinsurance operations.)

Inflation hit a 40-year high in many global economies in 2022 and continues to have an impact on industry premium trends.

Apart from AIG, all companies Gallagher Re tracks reported a year-on-year increase in premium. “Sixteen of the 26 companies in our dataset reported double-digit premium growth, and of those, five reported increases over 20 percent.”

“Although rate increases continue to moderate, some management teams expect overall margin expansion for their commercial lines business in 2023,” the report said.

“Margin trends varied by commercial line of business, with workers compensation and professional liability lines (e.g., D&O) being viewed as challenged, while commercial property pricing has benefited from rising reinsurance costs,” it continued.

While personal lines profits continued to be challenged in 2022, management teams are optimistic about improvements in 2023 as a result of recent rate increases, Gallagher Re said, noting that insurers generally expect strong premium growth to continue throughout 2023.

Additional themes identified by Gallagher Re from full-year and Q4 reinsurance results include:

- The average combined ratio deteriorated marginally to 95.7 (FY 2021: 94.7), mainly due to an inflation-driven increase in the attritional loss ratio.

- Investment losses weighed on the average full-year ROE, which dropped to 10 percent (FY 2021: 12.6 percent).

- Shareholders’ equity decreased by an average of 27 percent in FY 2022, driven by unrealized losses on investments and to a lesser extent capital return (both dividends and buybacks).

- Despite declining shareholders’ equity, European solvency remained robust at 235 percent (FY 2021: 225 percent), supported by higher risk-free interest rates and retained profits.

- The total average consensus 2023 earnings per share estimate was virtually unchanged following FY 2022 results.

The report analyzed the following companies: AIG, Allianz, Arch, Aviva, AXA, Chubb, Cincinnati, CNA Financial, Everest Re, Fairfax, Generali, Hannover Re, Hartford, Intact, Liberty Mutual, Mapfre, Markel, MS&AD, Munich Re, QBE, SCOR, Sompo, Swiss Re, Tokio Marine, Travelers and Zurich.

Source: Gallagher Re

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford