A sub-100 combined ratio is what publicly traded property/casualty insurance carriers strive to report.

The sub-90s combined ratios that many carriers reported in 2021 are even better.

A sub-80? That sounds like one for the record books.

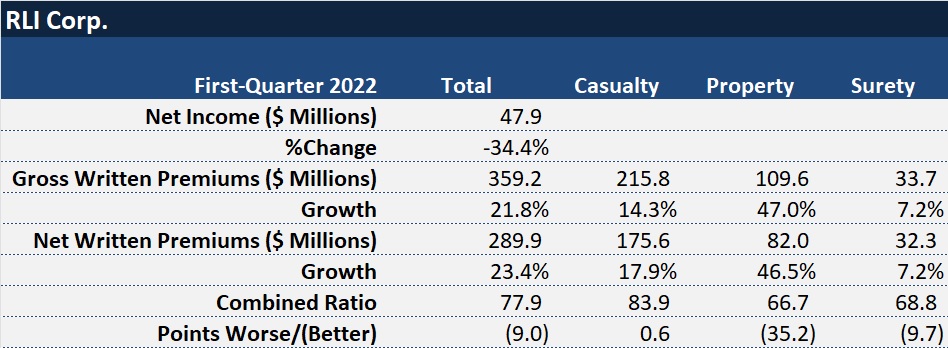

When RLI Corp. announced a 77.9 combined ratio across its entire book of business for the first quarter, the specialty insurer didn’t make note of the special figure in its media release.

“With just one quarter played so far, [it’s] still way too early to cut down the nets,” RLI’s President and Chief Executive Officer Craig Kliethermes said yesterday during an earnings conference call, referencing a basketball analogy. “Instead, we will keep our head down and stay focused on the underwriting fundamentals that we practice every day,” he said, after noting that the premium growth of over 20 percent accompanied the sub-80 combined ratio.

Caution aside, a combined ratio more than 20 points better than breakeven seems noteworthy, even for a carrier that achieved its 26th consecutive year of underwriting profitability in 2021, with an average combined ratio of 88.4 over that span of years. And, in fact, it was a record low first-quarter combined ratio for RLI, a media representative confirmed when Carrier Management asked the question.

Carrier Management looked over the company’s first-quarter reports for the last two decades to find the last comparable figure—a 78.8 combined ratio recorded way back in 2005.

Contributing to a 9-point improvement from RLI’s 2021 combined ratio of 86.9 were a loss ratio decline of 6.7 points, mainly due to low catastrophe activity during the first quarter of 2022, reported Todd Bryant, RLI’s chief financial officer. According to Bryant, storm losses added less than 1 point to this quarter’s loss ratio compared to 7 points of loss from winter storms last year.

Favorable prior-year loss development in each of RLI’s three business segments—property, casualty and surety—also helped explain the record combined ratio. Another factor was a 2.3 point drop in the company’s expense ratio, Bryant said.

In dollars, underwriting profit nearly doubled to $59.5 million from $29.9 million in first-quarter 2021. But investment results—a lower level of realized investment gains and $28 million of unrealized investment losses—pulled bottom-line net earnings down 34.4 percent to $47.9 million for first-quarter 2022.

Bryant noted that large movements in equity prices between periods can have a significant impact on net earnings. And Kliethermes said RLI remains vigilant on the underwriting side in spite of this quarter’s record combined ratio result.

“In aggregate, rate levels continue to be up enough to cover our loss cost inflation expectations. We remain cautious in regards to inflation both core and social, and we continue to manage our volatility with quality reinsurance partners who believe in our ownership culture and business model,” he said.

Growth by Segment

During the call, Chief Operating Officer Jennifer Klobnak described market conditions and rate changes achieved by segment, indicating that casualty rose 5 percent, while property and surety rates rose 7 percent.

Casualty gross written premiums jumped 14 percent on an 84 combined ratio, with personal umbrella, E&S primary and excess liability, and professional services all contributing, she said. She also reported a dip in premiums for one product in the casualty book: D&O insurance. “We have exited some minor products in [the Executive Products Group] over the last year, and competition has returned to the space,” she said, noting that D&O rates jumped 8 percent in the quarter, contrasting 20 percent rate increases of prior years.

“Another [casualty] area where competition has rebounded is within the transportation market,” she added. Still, RLI reported 36 percent premium growth in that market, “driven by a return of exposure in our public auto group with bus activity now back to pre-pandemic levels.”

“New business has been difficult to win as MGA markets with new backing have returned aggressively to the market,” she said.

In the property segment, Klobnak walked analysts through contributors to a 47 percent jump in gross premiums. While all products had double-digit premium growth, property rates were up just 7 percent overall. Hurricane-exposed business, however, was up 17 percent, and pricing is accelerating in a very hard Florida market.

“Much of the premium growth was driven by our E&S property portfolio, where new business submissions are up 22 percent,” she said.

Giving more details of the market situation, she said that RLI underwriters expected more capacity to enter the E&S property market, particularly in Florida, after 1/1 renewals, since catastrophe events in Southeast over the last couple of years had pushed pricing up to attractive levels. “We expected some competition, and really that competition hasn’t arrived. And, in fact, the MGAs that we compete against and other carriers have seemed to pull back their limits quite a bit,” she said.

Speculating that Lloyd’s accounted for some of the pullback, it’s not entirely clear why others aren’t showing up. “But generally speaking, people are putting up less capacity than they used to. So, where you have a building that might be worth $30 million, now that’s layered with multiple insurance policies adding up to $30 million versus one policy previously,” she said, giving one explanation as to why RLI’s submissions are up so much.

“Essentially, there’s just not enough capacity to cover it all. So, our brokers continue to call us back. Can we get more limit? What else can you do for us?”

She added, “We don’t see anything in sight that’s going to end this opportunity at the moment,” explaining that RLI is taking advantage but being more selective—tightening up underwriting guidelines each month, increasing deductibles, lowering limits, raising rates and increasing minimum premiums.

“We are actively managing our aggregates and finding opportunities to support growth while market conditions remain attractive.”

A $500M Boost

In addition to the first-quarter growth surge in RLI’s property book, several analysts had questions about an announcement RLI made last month about a non-insurance property, Maui Jim, the sunglass company, which RLI (once a contact lens insurer) has held for many years. On March 14, 2022, RLI Corp. announced that it agreed to sell that interest, with net after-tax purchase price proceeds from the sale amounting to roughly $500 million.

What will RLI do with that capital? Will there be a special dividend, analysts wanted to know.

“As always, our top priority is to ensure we have adequate capital to support our business. However, we have demonstrated discipline in returning capital to shareholders if it exceeds our near-term needs,” Kliethermes said in a media statement, repeating that general message during the earnings call.

“Our preference has always been to invest in our own products—ones that we know, with disciplined underwriters [that] share our values and our culture. And you can see, I think, we’re doing a pretty good job of that right now is putting that capital to work,” he said during the call.

The CEO promised that an announcement about the use of proceeds would come after the close of the deal in the second half of the year—”after a full evaluation of usage of our own portfolio and considering all other opportunities that make sense.”

“I would remind you that we do treat this as shareholder money. This is not our money…So, we’re going to take good care of it,” assuring investors that RLI would take continue take a disciplined approach to managing its capital position.

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit