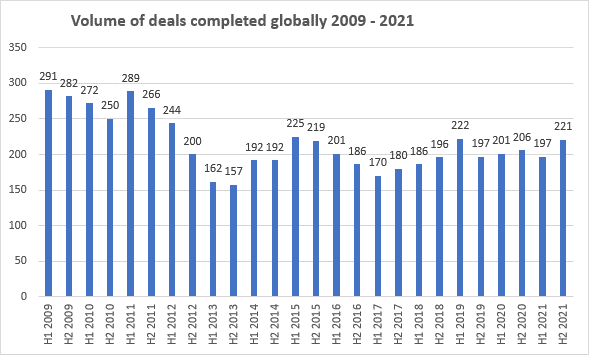

There were 418 completed mergers and acquisitions (M&A) worldwide in the insurance sector in 2021, up from 407 the previous year, according to a report published by law firm Clyde & Co.

Activity was driven by a particularly strong second half of the year, which saw 221 deals, up from 197 in the first six months, according to the report titled “Insurance Growth Report 2022; Navigating increasing complexity.”

The Americas remained the most active region for M&A—accounting for over half of the global annual total—with 224 deals, an annual increase of 17 percent. Activity was led by the U.S., where the number of completed transactions reached 180 for the year—the highest total for the country since 2015, said the report.

Deal activity in Europe was up 21 percent year-on-year, buoyed by a stand-out second half, which saw 74 transactions, up from 51 in H1 2021. Following a relatively buoyant two years, Asia Pacific saw a 44 percent drop in activity from 75 deals in 2020, down to 42 in 2021. The Middle East and Africa also experienced a similar trend, with a 2021 total of 17 deals, representing a 47 percent decrease from 2020, which was a bumper year for the region with 32 transactions.

“As anticipated, the volume of insurance M&A activity worldwide picked up notably in 2021. Despite the pandemic continuing to shape the economic and political landscape, investor sentiment strengthened in most regions as re/insurers rode the wave of rising prices across all product lines to generate healthy top-line growth,” commented Ivor Edwards, head of Clyde & Co.’s European Corporate Insurance Group, who was quoted in the report.

“Signs that market hardening is slowing down in certain classes combined with the pressure of rising costs means that for those businesses looking to expand, the decision on whether to grow through acquisition or by building out existing operations has never been more relevant,” Edwards added.

Innovation Drives M&A

The pandemic has accelerated innovation in the industry with re/insurers prepared to buy, fund or partner with the technology companies that can help provide product innovation and greater agility to deliver a competitive advantage, said the Clyde & Co. report, which noted that InsurTech companies are coming into their own as engines of growth for the insurance sector.

“The U.S. remains the most developed market for InsurTechs, with a number of firms having reached a mature phase of growth where they are now looking to acquire existing insurance operations to become ‘full stack’ carriers, rather than becoming agencies that sell policies on behalf of other carriers,” the report continued.

“These companies want to grow further, go on to develop products and control their destiny,” explained Vikram Sidhu, Clyde & Co. partner in New York, in the report.

Deals of All Sizes in Scope

In 2021, there was a rebound in the number of large transactions with 25 mega-deals in excess of $1 billion compared to 20 in 2020, including the year’s largest, Regent Bidco Ltd.’s takeover of RSA Insurance Group PLC for $9.2 billion. (Regent Bidco is a subsidiary of Canada’s Intact Financial Corp.)

However, re/insurers are also looking at smaller niche acquisitions that strengthen their core offerings, while the runoff market remains active in the U.S., Europe and increasingly in the Middle East.

“The legacy market remains a popular choice for the divestment of non-core assets, whether from P/C carriers and banks selling off life insurance divisions, or the spin-off of underperforming classes of business or subsidiaries due to market conditions,” the report went on to say.

New Business Models Emerge

Beyond M&A as a route to growth, new business models are emerging that will allow re/insurers to not only expand their operations but also improve the customer journey.

“While the insurance sector is firmly on the path to digitalization following the move to remote working during the pandemic, those who don’t take full advantage of digital platforms and access to innovations such as automation, data analytics and modeling are likely to be left behind,” added the report.

“Developing ecosystems will be an important growth strategy for insurers in the year ahead: identifying key services that dovetail with their insurance products and integrating those into their customer journey,” the report said.

“Any insurer who finds the right partners and builds up ecosystems that can be seamlessly connected with a bank or another distribution partner will, in five years, be in a much better position than those who just experiment in this area,” said Eva-Maria Barbosa, Clyde & Co. partner in Munich, who was quoted in the report.

M&A to Remain Buoyant in 2022

The sentiment for the next 12 months is likely to remain positive as the world moves beyond the pandemic, indicated the report. “We expect that M&A activity will remain buoyant and that completed deals will exceed 200 worldwide in the first half of 2022, rising above 220 for the second half of the year.”

“Re/insurers have remained resilient in the face of global economic pressures, having come out the pandemic very strongly in both underwriting and investment terms, and are positioning themselves for a more growth-oriented environment in the next year and beyond,” the report said.

However, it warned that there are some clouds on the horizon with signs that market hardening is slowing down in certain classes, “which will have an inevitable impact on re/insurers’ balance sheets.”

“Regulatory complexity is increasing, as too is the cost of compliance. In addition, the increasing possibility of interest rate rises is a double-edged sword that will lift investment returns but restrict the availability of capital to fund acquisitions. Those positioning themselves for M&A activity may seek to accelerate their plans as a result.”

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  The Future of HR Is AI

The Future of HR Is AI  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec