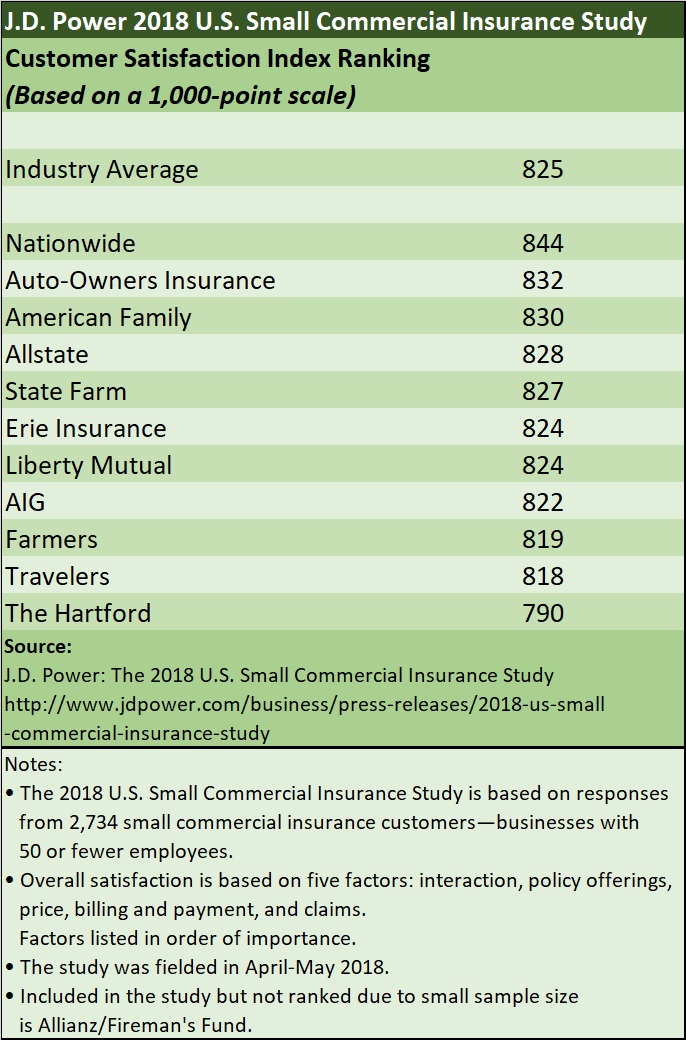

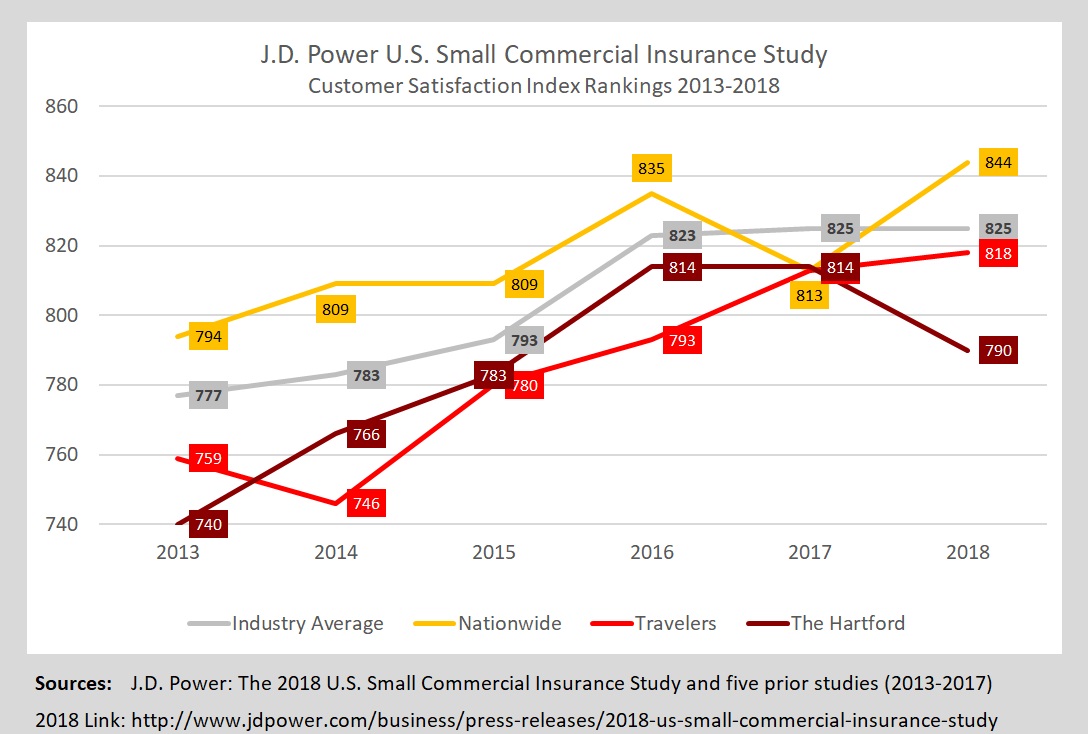

Nationwide Insurance came up on top of J.D. Power’s 2018 customer ranking of small commercial insurers, vaulting up from the middle of the carrier pack in 2017, while overall satisfaction scores for the industry as whole remained virtually unchanged.

Overall customer satisfaction remained stagnant with a Customer Satisfaction Index (CSI) of 825 on a 1,000-point scale for both 2017 and 2018, the J.D. Power 2018 U.S. Small Commercial Insurance Study revealed early this month.

Nationwide’s CSI score topped the industry, coming in at 844.

“To remain competitive, insurers must accelerate their customer experience efforts, especially with respect to service interaction and price,” said David Pieffer, Practice Lead, Property & Casualty Insurance Practice, commenting on the overall results in media statement.

“Specifically, we found that if agents or insurer representatives explain rate increases to customers in person, satisfaction is 100 points higher than those who were informed via email, as they better understood the reasons why.

“Those simple personal touches and attention will go a long way with small commercial customers,” Pieffer said.

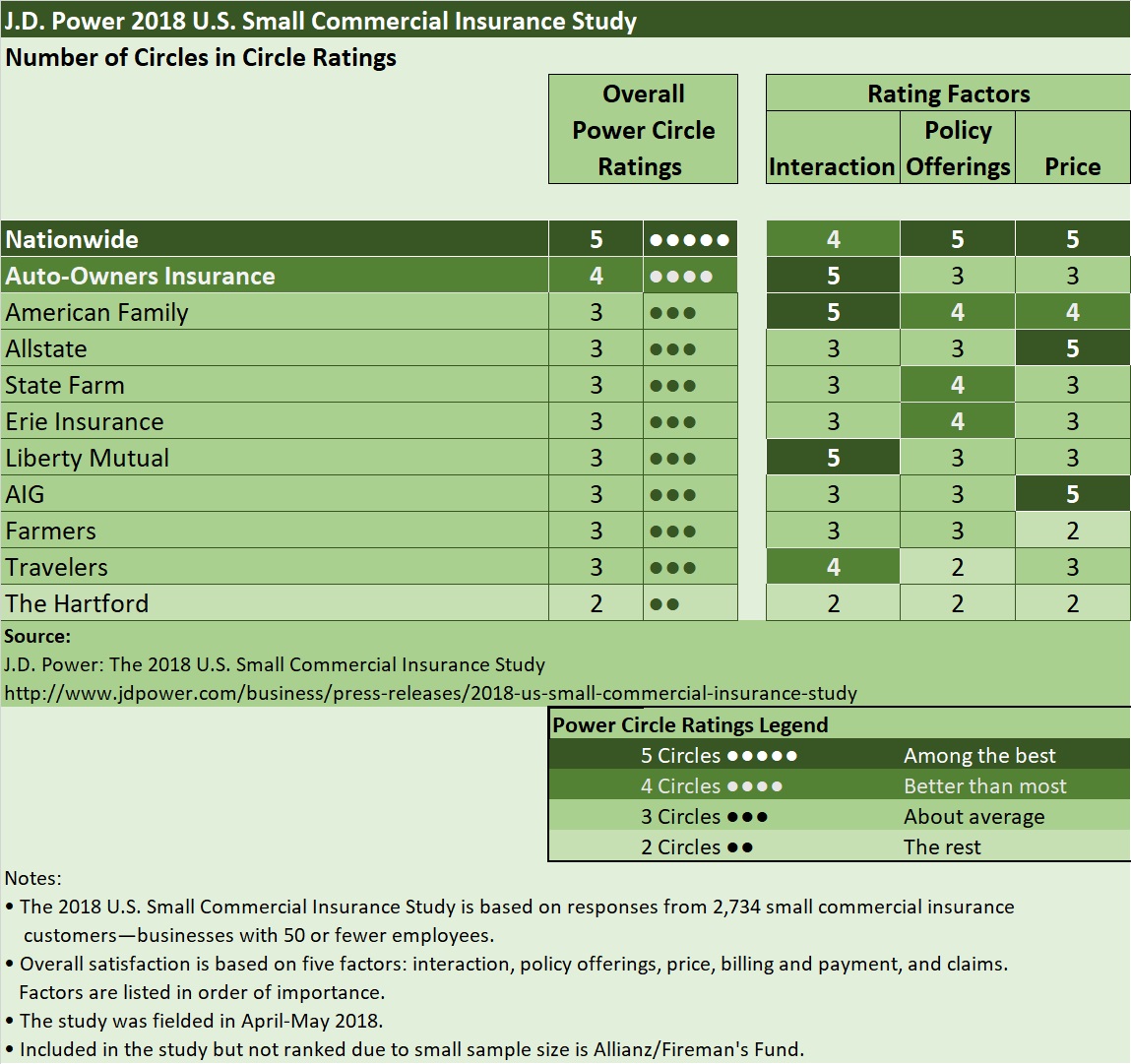

But top marks on service interaction alone won’t satisfy customers, a deeper analysis of the rankings reveals. Neither will price breaks without attention to other customer pain points. In fact, J.D. Power’s overall CSI is comprised of five factors (in order of importance): interaction; policy offerings; price; billing and payment; and claims, the report says. An analysis of where carriers rank on the these components shows that Travelers came up “better than most” carriers on the service interaction part of the ranking but garnered the second worst overall satisfaction score (CSI of 818).

Travelers’ rating for the price, billing and claims components of the score were “average.” And in the area of policy offerings customers found Travelers worse than average—as indicated by a 2-Circle Power Circle J.D. Power rating out of 5.

American International Group rated “among the best”—snagging a 5-Circle rating—on only the price factor. But AIG ranks slightly below the rest of the industry in overall satisfaction (822) with the other four component factors—interaction, policy offerings, billing and claims—registering just “average.”

The Top and Bottom

Nationwide is the only carrier among the 11 whose CSIs are shown in the 2018 J.D. Power study that had 5-Circle ratings for the claims and policy offerings components of the score. Actually achieving a 5-Circle rating on four of the five underlying components, Nationwide’s only Circle rating below the highest rating of “5” was a 4-Circle rating for “interaction.”

At the other end of scale, The Hartford came up below average—with 2-Circle ratings—on every satisfaction component this year. While the Connecticut-based insurer also wound up with the worst overall satisfaction score of 790 in 2018, The Hartford showed a marked improvement between 2013 and 2017. In the first year of the J.D. Power study, The Hartford’s overall satisfaction score was just 740. In 2017, it was 74 points higher, coming in at 814.

Among the 11 insurers included in this year’s report, The Hartford and Farmers were the only two that saw their scores fall by double digits between 2017 and 2018—The Hartford by 24 points and Farmers by 19 points.

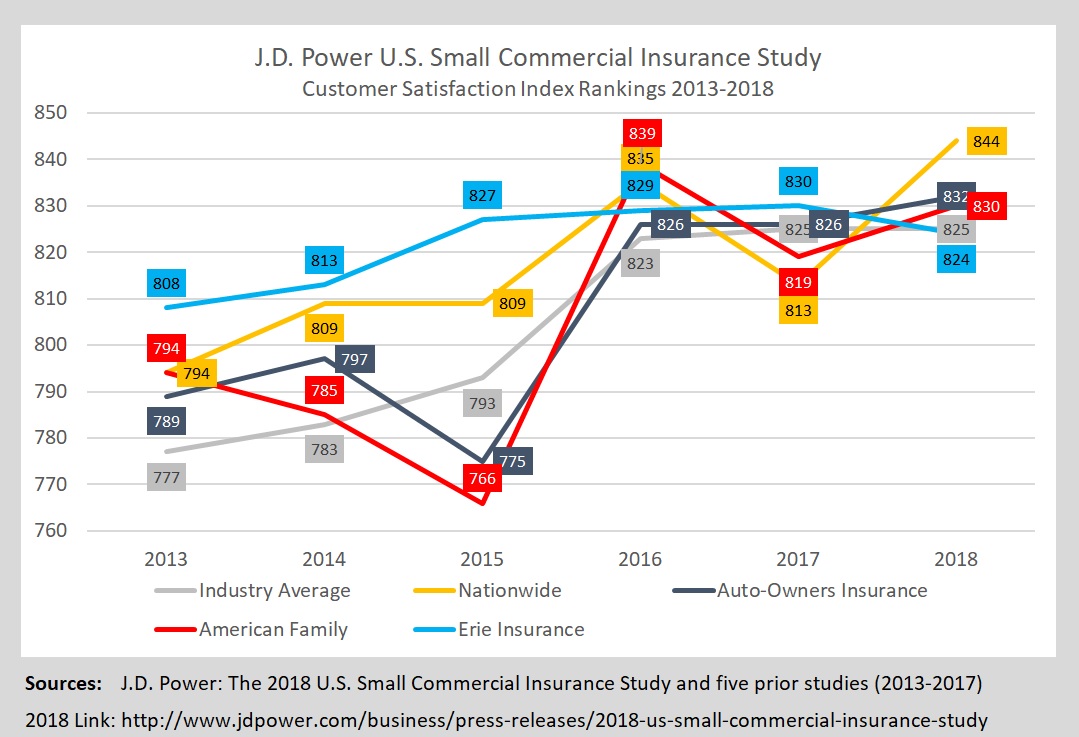

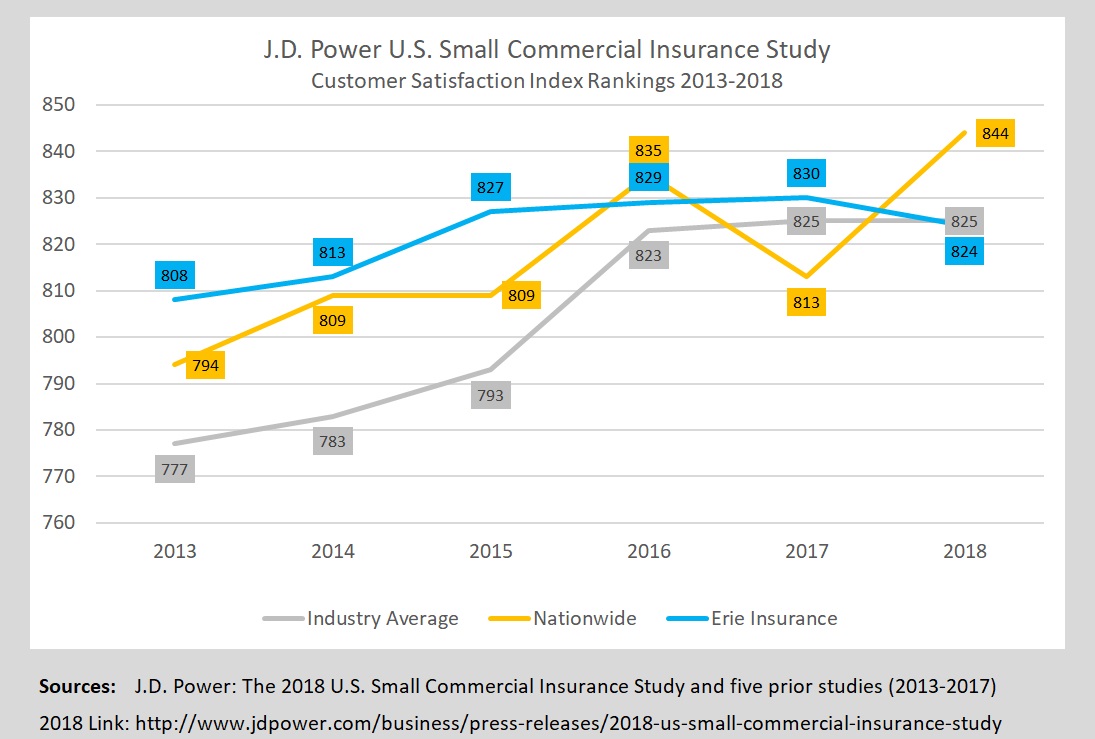

Industry Satisfaction Scores Trend Up, Then Plateau

Comparing the most recent report to all six years of small commercial insurance customer rankings available from J.D. Power reveals that the industry CSI increased by 48 points since 2013—the first year that J.D. Power studied customer sentiments about small commercial insurers. The year 2016 turned out to be a pivotal year for the industry, with 30 points of the 48-point gain over the six years coming between 2015 and 2016.

“Three consecutive years of steadily declining insurance rates have carriers looking at other ways to differentiate themselves in a competitive market,” J.D. Power said, explaining the 2016 jump. In 2016, “interaction” grew more than any other study factors, and carriers also had turned their attention to policy offerings, J.D. Power’s 2016 report said.

Interestingly, Erie Insurance, which had outranked all other small commercial carriers in 2013, 2014 and 2015, lost it’s No. 1 ranking to American Family in 2016. Still, Erie’s CSIs have stayed in a narrow band between a low of 808 in 2013 to a high of 830 in 2017 throughout the six-year period, dipping only slightly to 824 in 2018.

In contrast, the historical CSIs for this year’s top insurer, Nationwide, have been volatile, moving up more than 40-points between 2013 and 2016, and then dropping more than 20 points in 2017 before achieving its highest CSI of the six years in 2018.

At the bottom of the pack, industry giants The Hartford and Travelers have both seen big gains in CSIs since 2013, but Travelers annual steps on its path to its 2018 score of 818 have all been increases. In spite of the steady gains, Travelers CSI remains 7 points below the industry and 21 points below Nationwide.

The 2018 Small Commercial Insurance Study is based on responses from 2,734 small commercial insurance customers. The study examines overall customer satisfaction among small commercial insurance customers with 50 or fewer employees. The study was fielded in April-May 2018.

For more information about the J.D. Power U.S. Small Commercial Insurance Study, visit http://www.jdpower.com/business/resource/jd-power-us-small-business-commercial-insurance-satisfaction-study

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark