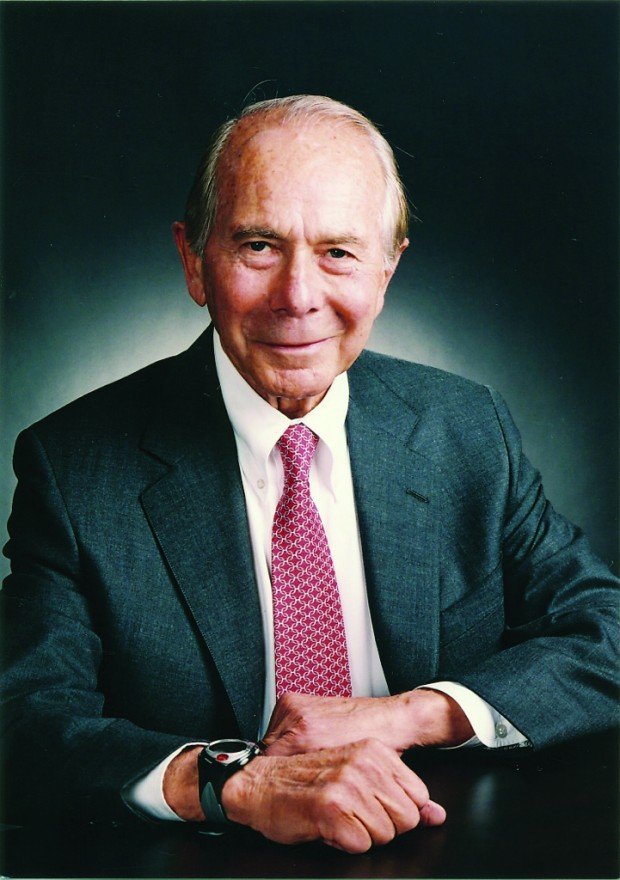

A New York state appeals court rejected former American International Group Inc Chairman Maurice “Hank” Greenberg’s bid to dismiss a lawsuit accusing him of orchestrating an accounting fraud at the insurer he ran for nearly four decades.

Thursday’s unanimous decision by the state Appellate Division suggests a trial may finally take place soon, after a decade of sometimes-vitriolic legal wrangling between Greenberg, who turns 90 next month, and three New York attorneys general.

The court said current Attorney General Eric Schneiderman can pursue his effort to ban Greenbergfrom the securities industry and from serving as an officer or director of a public company. It also called Schneiderman’s bid to recoup millions of dollars of allegedly ill-gotten bonuses “legally viable.”

Greenberg and co-defendant Howard Smith, a former AIG chief financial officer, are accused of having tried to hide losses at AIG through fraudulent transactions, including with a reinsurance unit of Warren Buffett’s Berkshire Hathaway Inc .

The court said the defendants failed to show no connection between the wrongdoing and the alleged bonuses, and did not show conclusively that an injunction was not warranted under the Martin Act,New York state’s powerful securities fraud law.

Greenberg may appeal, according to Stephen Aiello, a spokesman for insurance company C.V. Starr & Co Inc, where Greenberg is chairman and chief executive.

“This lawsuit has absolutely no merit,” Aiello said. “This case is a waste of taxpayer money.”

Vincent Sama, a lawyer for Smith, did not immediately respond to a request for comment.

Schneiderman inherited the lawsuit from predecessors Eliot Spitzer and Andrew Cuomo. He was forced to drop claims for as much as $6 billion in damages, in the wake of a class action settlement between AIG shareholders and the executives.

Critics, including former New York Governors Mario Cuomo and George Pataki, have questioned the need to pursue the case once damages could not be collected.

But Schneiderman has said executives who perpetrate fraud should be held publicly accountable.

“We look forward to presenting the people’s case at trial,” Liz DeBold, a spokeswoman for Schneiderman, said on Thursday.

The defendants were accused of orchestrating a $500 million transaction with Berkshire’s General Reunit to boost loss reserves without transferring risk, and a transaction with Capco Reinsurance Co to hide a $210 million underwriting loss.

Mario Cuomo, Andrew’s father, died in January. Buffett and Berkshire were not accused of wrongdoing.

The case is People v Greenberg, et al, New York State Supreme Court, New York County, No. 401720/2005. (Reporting by Karen Freifeld; Editing by Dan Grebler and Jonathan Oatis)

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered