According to Swiss Re’s preliminary sigma estimates, total economic losses from natural and man-made disasters were $56 billion in the first half of 2013, down from $67 billion in first-half 2012.

The global insurance industry covered $20 billion of the losses—$17 billion of which stemmed from natural catastrophes, in large part due to widespread flood events. This was lower than the $21 billion in first-half 2012 and also below the average of the last 10 years.

Man-made disasters triggered an additional $3 billion in claims, unchanged from first-half 2012.

Disasters in the first half of 2013 claimed 7,000 lives.

Flooding caused an estimated $8 billion in insurance claims globally in the first half of the year, already making 2013 the second most expensive calendar year in terms of insured flood losses, according to Swiss Re.

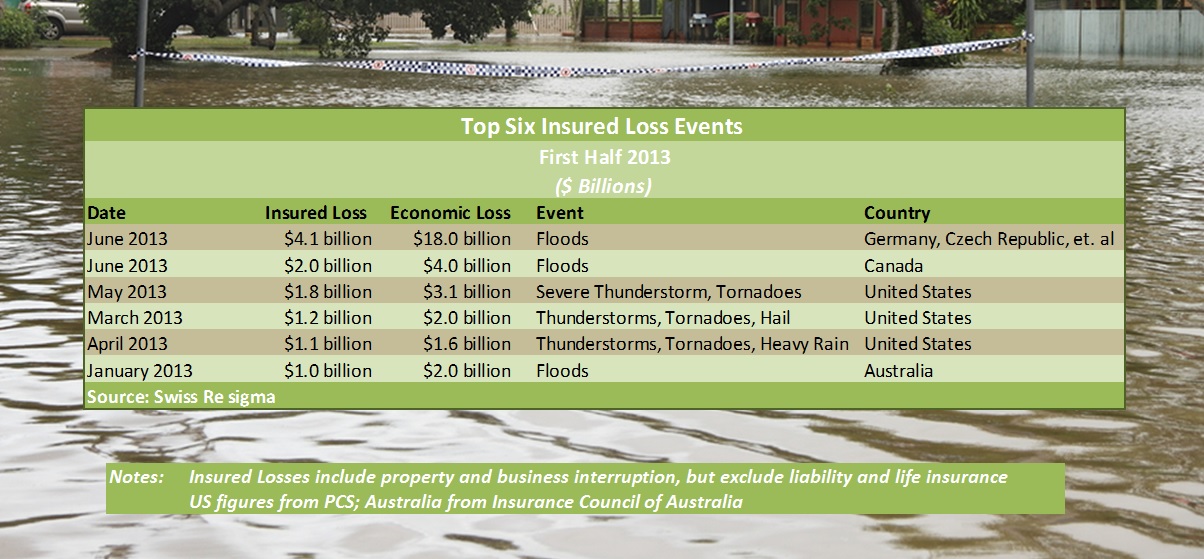

In January, Cyclone Oswald brought flood damage in Australia, amounting to $1 billion in insured losses.

Heavy rains in June caused massive floods in Central and Eastern Europe that resulted in economic losses of close to $18 billion and an estimated cost to the insurance industry of $4 billion.

Rains and subsequent flooding also hit Alberta, Canada in June, generating insured losses estimated at $2 billion—the highest insured loss ever recorded in the country.

Jens Mehlhorn, head of Flood Risk at Swiss Re, says: “Flooding continues to wreak havoc across all areas of the world. No one is immune from this ever-present disaster threat. Sadly, without insurance, the impact of these events is severe for many. While we cannot stop future floods, we believe that preventative actions can be taken to mitigate the overall impact of extreme weather events.”

Beyond floods, first-half 2013 also spawned deadly tornadoes in the U.S. Midwest. A tornado outbreak in May caused the loss of 28 lives and insured claims of $1.8 billion. The loss of life and property was mostly concentrated in Moore, Okla., which was hit by an EF5 tornado on May 20.

And the year is far from over. Kurt Karl, chief economist at Swiss Re, notes: “Though 2013 has so far been a below-average loss year, the severity of the ongoing North Atlantic hurricane season, and other disasters such as winter storms in Europe, could still increase insured losses for 2013 substantially.”

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation