Credit insurer Coface analyzes the risk of default on short-term trading transactions for companies operating in 160 different countries. These Country Risk assessments result in ratings on a seven-step scale: A1, A2, A3, A4, B, C, D, in order of increasing risk.

A country with an A1 rating has the following characteristics: very good macroeconomic and financial outlook; stable political context; good-quality business climate. This environment positively influences company payment behavior. The average probability of default is very low.

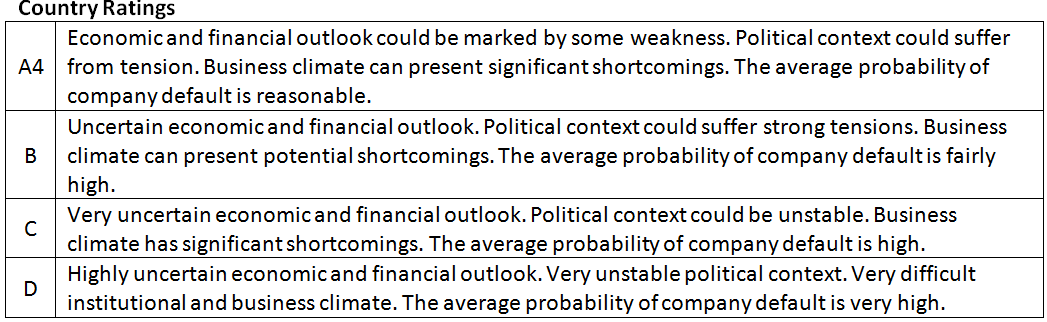

Risk environments for the high-growth countries identified in this article aren’t that low, with ratings of A4 to D. The definitions of these country ratings are set forth in the table below.

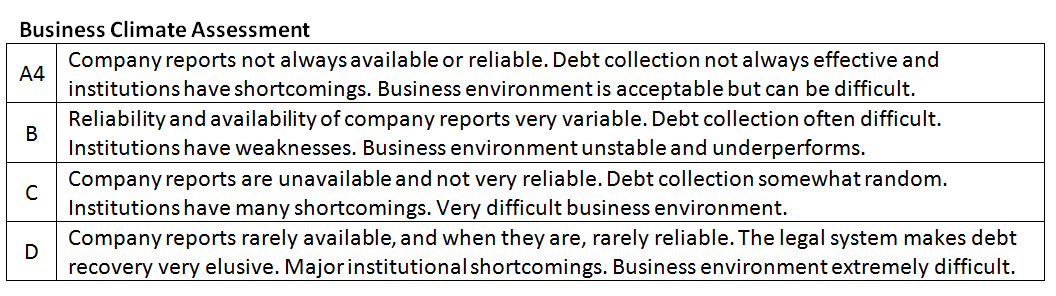

Coface also assesses business climate, looking at factors such as the legal system and the availability and reliability of company reports, using the same seven-step scale.

A country with an A1 business climate rating has the following characteristics: company reports (generally) available and reliable; effective debt collection; high-quality institutions; very satisfactory business environment.

The definitions associated with the business climate ratings referenced in the accompanying article are set forth below.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec