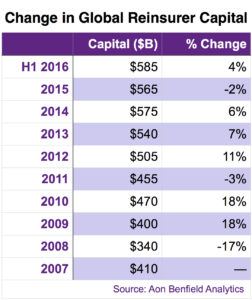

Reinsurance capital reached record levels in the first half of 2016, hitting a new high of $585 billion.

Aon Benfield’s latest Reinsurance Market Outlook report puts that number in perspective, noting that capital levels came in at $565 billion for all of 2015, and $575 billion for 2014.

Broken down, traditional capital rose to $510 billion as of June 30, a 3 percent increase. Aon Benfield said that this trend stems from unrealized gains on bond portfolios connected to interest rate dips, as well as a U.S. dollar that weakened versus other currencies.

Alternative capital enjoyed a 5 percent rise during H1, hitting the $75 billion mark. That increase stemmed from “additional deployment into collateralized reinsurance structures,” according to the Aon Benfield report. At the same time, catastrophe bond issuance came down from a record first quarter to $3 billion in issuance during the period.

Alternative capital enjoyed a 5 percent rise during H1, hitting the $75 billion mark. That increase stemmed from “additional deployment into collateralized reinsurance structures,” according to the Aon Benfield report. At the same time, catastrophe bond issuance came down from a record first quarter to $3 billion in issuance during the period.

Aon Benfield predicted the reinsurance sector would continue to have “ample capacity” to meet demand. But pricing competition and investment returns growing weaker continue to pose a problem, creating vulnerabilities for reinsurers, the report said.

“Price competition and weakening investment returns have eroded reinsurers’ expected profitability and earnings have become increasingly sensitive to catastrophe loss experience,” the Aon Benfield report noted. “In the absence of major events, retained earnings are not expected to be a significant driver of traditional capital growth going forward, given the amount of capital now being returned to investors.”

Aon Benfield said that that recent volatility in other asset classes and weaker interest rate outlooks has made insurance risk even more appealing to alternative investment managers.

“Expected returns have declined, but they remain attractive relative to opportunities seen elsewhere, and further growth is therefore expected going forward,” the Aon Benfield report noted. “The lack of correlation with broader capital markets (except in the most extreme scenarios) remains a key consideration.”

Moving ahead, Aon Benfield said it expects more M&A activity among reinsurers, considering the market conditions that spurred a number of deals in 2015 remain unchanged.

Source: Aon Benfield’s Reinsurance Market Outlook Report, September 2016

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers