With two of three groups of expert hurricane researchers split on whether the 2016 Atlantic hurricane season will be above average or normal, a tie-breaking vote could come on Tuesday.

But even a higher level of storms might not boost property insurance prices to levels seen in prior market cycles, Fitch Ratings said Monday.

“A large catastrophic hurricane in 2016 would likely promote a shift towards positive pricing movement following years of property insurance pricing declines in the U.S. property/casualty market,” Fitch said in a statement about its 2016 annual hurricane season reference report, “U.S. Hurricane Season 2016 (A Desk Reference for Insurance Investors).”

“However, abundant available underwriting capacity for primary and reinsurance property coverage is also likely to diminish the magnitude of any upward price movement compared with past market cycles,” Fitch’s statement said, alluding to meteorologists’ predictions of an average hurricane season.

But not everyone sees the upcoming season shaping up to be an average one. On Friday, May 27, the National Oceanic and Atmospheric Administration and researchers at Tropical Storm Risk separately published forecasts, with TSR raising its numbers significantly from an earlier forecast in April.

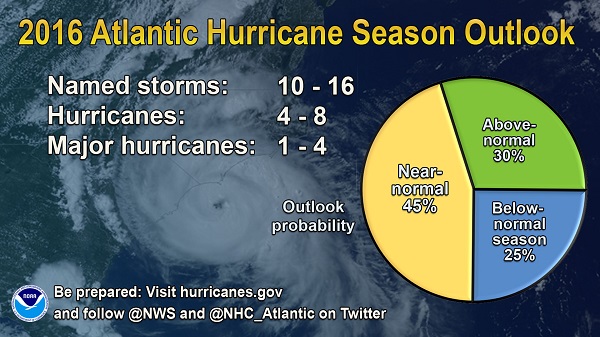

- NOAA predicted a 70 percent likelihood of 10 to 16 named storms (winds of 39 mph or higher), of which 4 to 8 could become hurricanes (winds of 74 mph or higher), including 1 to 4 major hurricanes (Category 3, 4 or 5; winds of 111 mph or higher).

- These expected ranges are centered near the 1981-2010 seasonal averages of 12 named storms, 6 hurricanes, and 3 major hurricanes, NOAA said.

- TSR predicted 17 named storms, 9 hurricanes and 4 major hurricanes—up from an April 5 forecast of 12 named storms, 6 hurricanes and 2 major ones.

- The forecast anticipates 2016 hurricane activity that is 30 percent above the 1950-2015 long-term norm and about 40 percent above the recent 2006-2015 10-year norm, TSR said.

“Sizeable uncertainties remain but there is an 80 percent likelihood that 2016 will be the most active hurricane season since 2012,” TSR said.

Among the sources of uncertainty surrounding its forecast of an active hurricane season is the strength of a predicted season La Niña, also cited by NOAA.

Colorado State University, which issued a forecast for 13 named storms, 6 hurricanes and 2 major hurricanes on April 14 (including Hurricane Alex in April), is expected to update the forecast today (June 1), Meteorologist Philip Klotzbach said on this Twitter page.

But even a jolt in the aggregate counts for all three won’t lift insurance prices to the levels of past hard markets. And if storm levels actually line up with higher forecasts, the weather activity won’t prompt a change in Fitch’s sector outlook to negative, the rating agency said, noting that such a move in the rating agency outlook would likely only come if storm losses equal to 15 percent or more of industry aggregate surplus.

Still, the potential ratings impact of a major catastrophe or series of events on individual insurers and reinsurers will vary by company exposure in loss-affected areas, Fitch said. “Meteorologists predict an average hurricane season and insurers and reinsurers in 18 major U.S. coastal states are well positioned to manage losses; however, insurers could face torrential blowback if there is a record breaking storm or battery of storms in succession,” said Christopher Grimes, Director, Fitch Ratings.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll