A slide in reinsurance rates under competition from catastrophe bonds is starting to weigh on prices that companies like Zurich Insurance Group AG charge their own customers.

The decline in the cost of reinsurance is “more of a problem than not” because of the need to pass along the cuts to consumers to stay competitive, Mike Kerner, the company’s head of general insurance, said in an interview in Zurich this week. “Particularly in the property line business, we are already beginning to see some pressure on pricing that is coming into the direct space.”

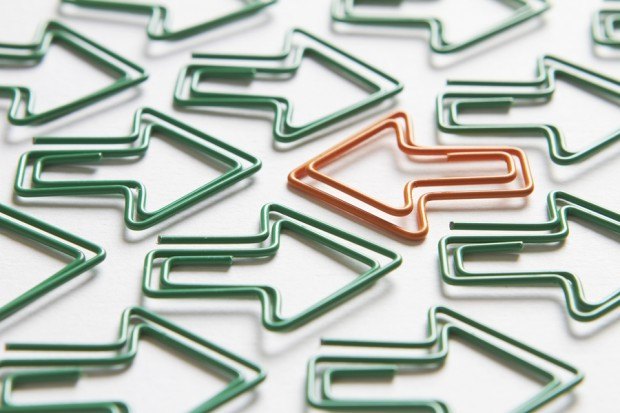

Reinsurers, who help insurers like Zurich shoulder risks for their clients, have seen prices fall as a growing number of institutional investors, including pension funds, snap up rival catastrophe bonds, or cat bonds in the industry jargon. This price decline is now also feeding through to the direct pricing primary insurers charge.

“If you’re on the primary side, part of the input of your cost is the cost of reinsurance,” Kerner said. “If that cost goes down, some competitors will let that flow through to their direct pricing and the end customer will benefit from that.”

Global insurance rates dropped in the first three months of the year under pressure from a continued softening in property rates, according to Marsh & McLennan Cos., the world’s largest insurance broker by market value. The company’s Risk Management Global Insurance Index hit its lowest level since the third quarter of 2012, showing the fourth consecutive quarterly decline.

Catastrophe Bonds

Issuance of cat bonds surged to a near-record $7.09 billion last year as investors seek higher returns, Swiss Re, the world’s second-biggest reinsurer, said in January. The market had $20.2 billion of outstanding catastrophe bonds at the end of 2013, almost 20 percent greater than the previous year-end record set in 2007.

“Cat bonds return about 5 percent before costs and there is a diversification benefit for pension funds as cat bonds aren’t correlated with other asset classes,” Urs Ramseier, the chairman of Twelve Capital, a Zurich-based specialist insurance investment manager, said in an interview on May 27. His company helps pension funds buy insurance-linked securities such as catastrophe bonds.

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market